Virgin Islands Stone Contractor Agreement - Self-Employed

Description

How to fill out Stone Contractor Agreement - Self-Employed?

You might spend numerous hours online looking for the valid document template that meets the state and federal standards you need. US Legal Forms provides an extensive collection of legal forms that can be reviewed by experts.

You can download or print the Virgin Islands Stone Contractor Agreement - Self-Employed from the service.

If you have an existing US Legal Forms account, you can Log In and click the Download button. After that, you can complete, modify, print, or sign the Virgin Islands Stone Contractor Agreement - Self-Employed. Every legal document template you purchase is yours indefinitely. To obtain an additional copy of any purchased form, go to the My documents tab and click the corresponding button.

Select the format of the document and download it to your device. Make adjustments to your document if necessary. You can complete, modify, sign, and print the Virgin Islands Stone Contractor Agreement - Self-Employed. Download and print a vast array of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the area/city you select. Check the form description to confirm you have selected the right form.

- If available, utilize the Review button to browse through the document template as well.

- If you need to find another version of the form, use the Search section to locate the template that suits your needs and requirements.

- Once you have found the template you desire, click on Purchase now to proceed.

- Select the pricing plan you wish, enter your details, and create your account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form.

Form popularity

FAQ

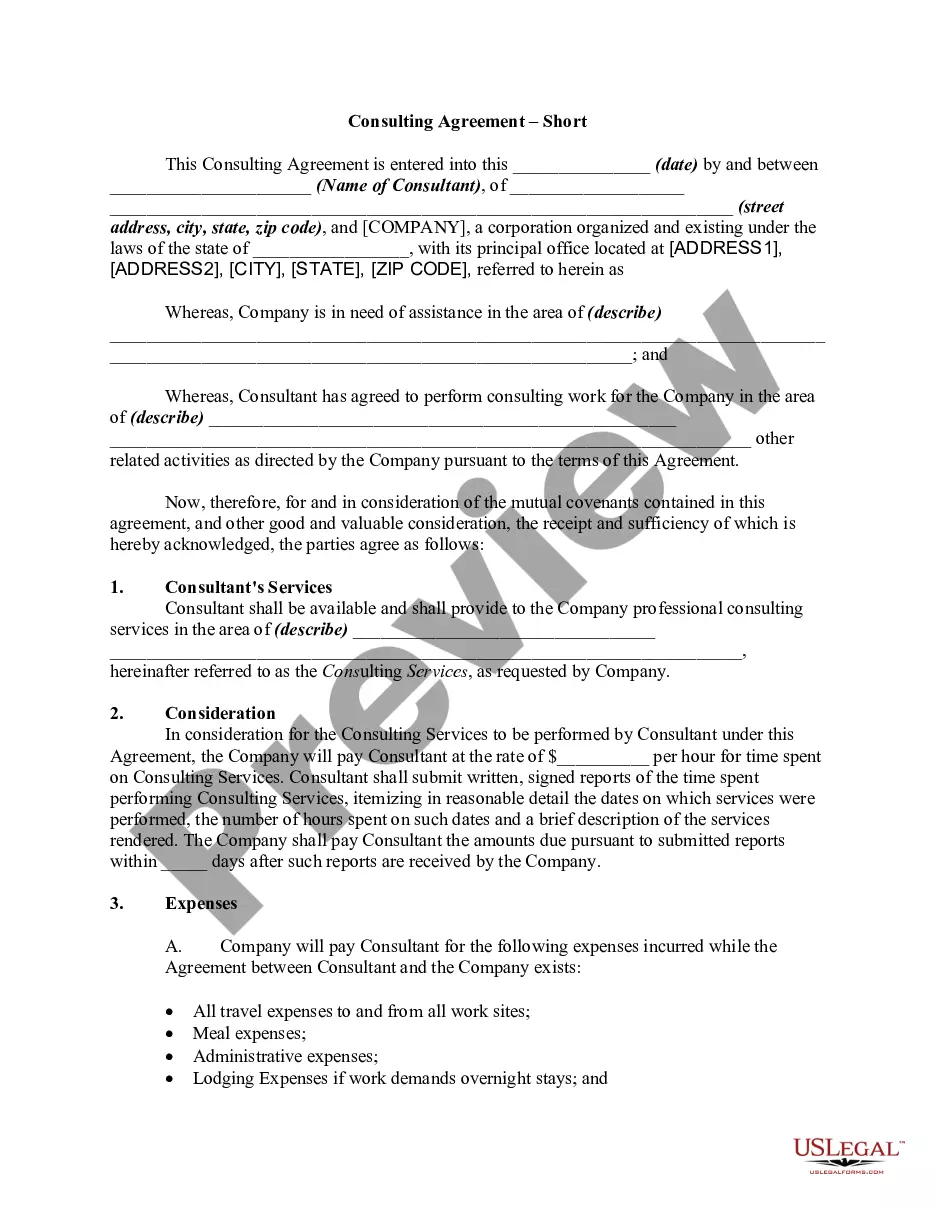

When drafting a construction contract, like the Virgin Islands Stone Contractor Agreement - Self-Employed, five essential elements should be present: the contract offer, acceptance, legal consideration, mutual consent, and lawful purpose. Each of these components helps create a solid foundation for your agreement, ensuring all parties understand their roles and obligations. A clear contract protects your rights and sets expectations for your project.

The new independent contractor law in Virginia aims to provide clarity on the classification of workers as independent contractors or employees. While this may not directly impact a Virgin Islands Stone Contractor Agreement - Self-Employed, understanding such laws is crucial for contractors operating across state lines. It ensures you maintain compliance and reinforces your contractor status, which can protect your business interests.

Recovering your deposit from a contractor can depend on the terms outlined in your Virgin Islands Stone Contractor Agreement - Self-Employed. Typically, agreements stipulate conditions under which deposits are refundable, such as cancellations made within a specific timeframe. Always review your contract carefully to understand your rights regarding deposits and consider using a platform like uslegalforms to secure a well-structured agreement.

A contractor remains responsible for their work for a specified duration, often identified in the Virgin Islands Stone Contractor Agreement - Self-Employed. Generally, this period includes the time it takes to complete the project and may extend to include warranty periods for any defects. Understanding this timeline in your agreement is essential, so you know when to address any potential issues that may arise.

Absolutely, a self-employed person can—and often should—have a contract. A contract protects both the contractor and the client by defining the scope of work, payment terms, and deadlines. Using a Virgin Islands Stone Contractor Agreement - Self-Employed can help ensure that both parties understand their rights and responsibilities in the collaboration.

Yes, independent contractors file taxes as self-employed individuals. This means you will report your income and expenses on your tax return, using forms designated for self-employed earnings. To simplify this process, consider using a Virgin Islands Stone Contractor Agreement - Self-Employed to keep organized financial records.

Being self-employed typically involves earning income through your own business endeavors rather than receiving a paycheck from an employer. This can include freelancers, consultants, or contractors in various fields. If you’re considering projects in the Virgin Islands, a Virgin Islands Stone Contractor Agreement - Self-Employed may help you outline your business responsibilities clearly.

To prove you are an independent contractor, keep clear records of your contracts, invoices, and payments. These documents demonstrate your relationship with clients and your independent business activity. Utilizing a Virgin Islands Stone Contractor Agreement - Self-Employed can strengthen your position and provide necessary details for tax and legal purposes.

Both terms describe a similar concept, but they can carry different implications. 'Self-employed' is a broader term that includes various types of business owners, while 'independent contractor' refers specifically to those who provide services on a contractual basis. Using the Virgin Islands Stone Contractor Agreement - Self-Employed can clarify your status as an independent contractor and enhance your professional image.

Yes, an independent contractor is indeed considered self-employed. This means they run their own business and provide services or goods to clients without being tied to a single employer. You can explore options like the Virgin Islands Stone Contractor Agreement - Self-Employed to formalize your working relationship with clients.