Nebraska Block Time Agreement

Description

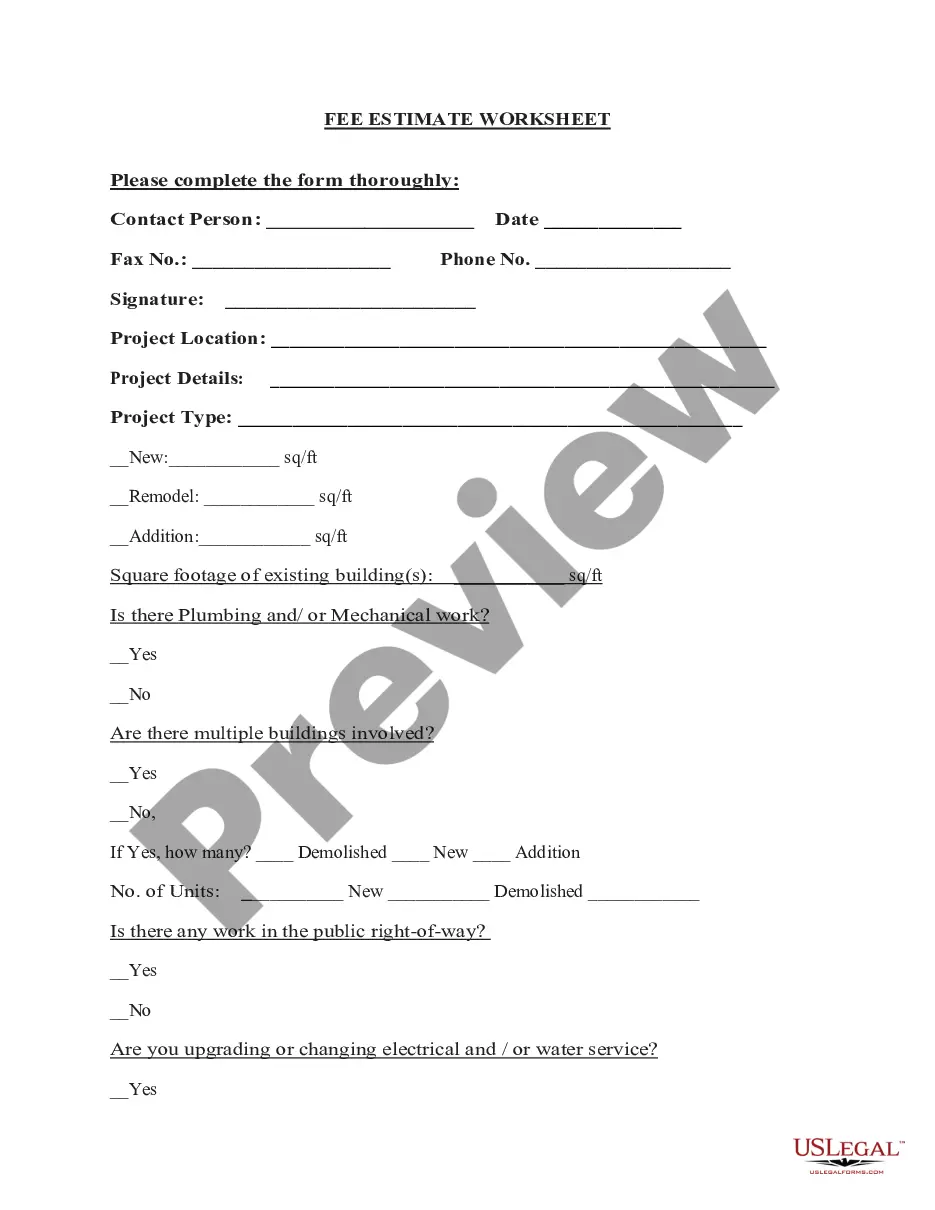

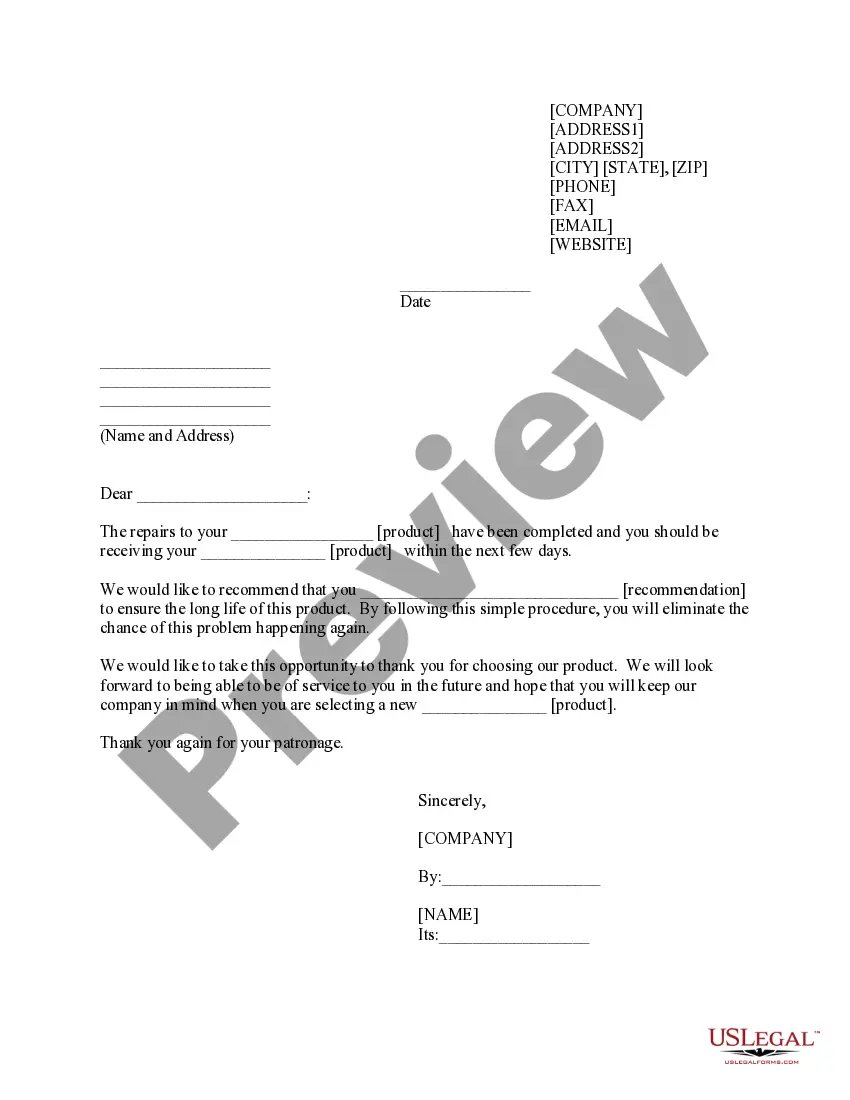

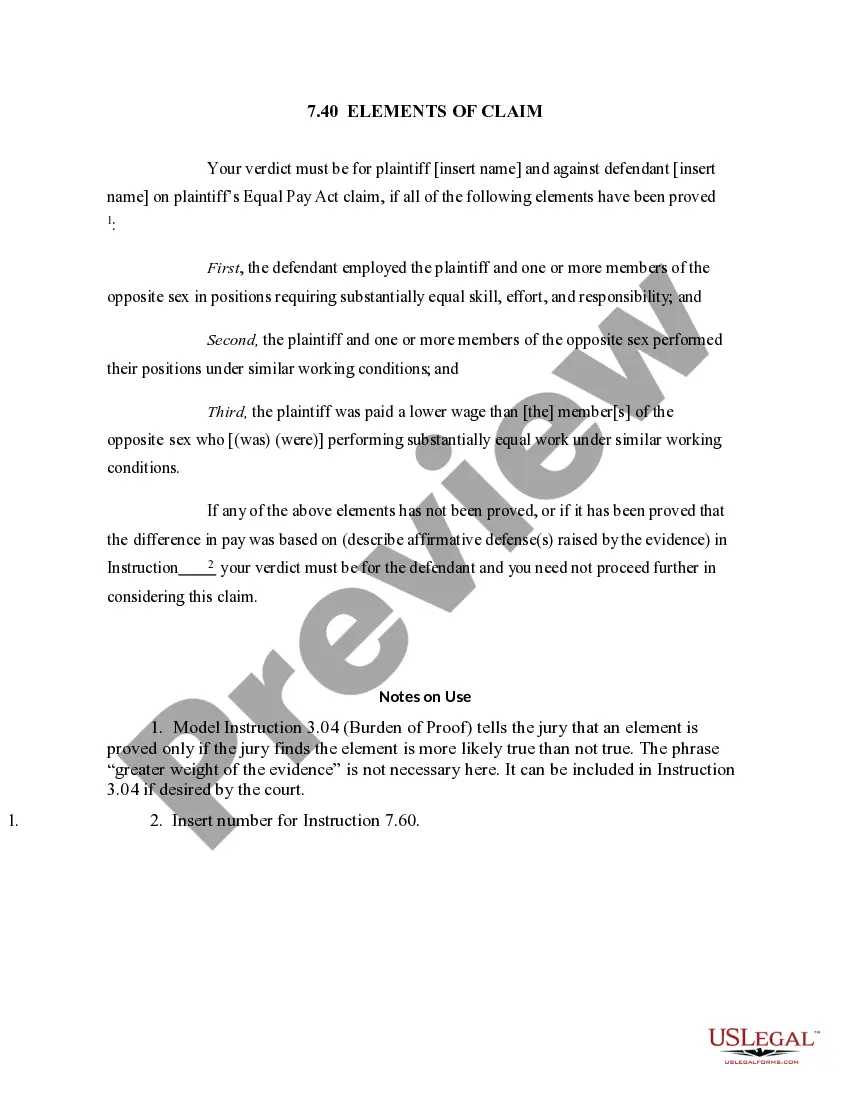

How to fill out Block Time Agreement?

If you want to comprehensive, acquire, or printing legal file templates, use US Legal Forms, the greatest variety of legal types, which can be found online. Use the site`s simple and easy convenient search to obtain the papers you will need. Different templates for business and person reasons are categorized by classes and says, or key phrases. Use US Legal Forms to obtain the Nebraska Block Time Agreement in just a couple of clicks.

In case you are currently a US Legal Forms buyer, log in to your profile and click on the Acquire key to obtain the Nebraska Block Time Agreement. You can even entry types you earlier saved in the My Forms tab of your own profile.

If you work with US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have selected the shape for your right metropolis/country.

- Step 2. Utilize the Review option to examine the form`s articles. Never forget about to read the outline.

- Step 3. In case you are unsatisfied together with the type, utilize the Look for industry at the top of the monitor to discover other types in the legal type design.

- Step 4. Upon having discovered the shape you will need, go through the Buy now key. Opt for the costs strategy you favor and put your qualifications to register for an profile.

- Step 5. Procedure the transaction. You can utilize your credit card or PayPal profile to perform the transaction.

- Step 6. Select the formatting in the legal type and acquire it on your own device.

- Step 7. Comprehensive, change and printing or signal the Nebraska Block Time Agreement.

Each and every legal file design you buy is the one you have eternally. You might have acces to each type you saved inside your acccount. Go through the My Forms section and select a type to printing or acquire once again.

Compete and acquire, and printing the Nebraska Block Time Agreement with US Legal Forms. There are millions of specialist and condition-certain types you can utilize for the business or person requirements.

Form popularity

FAQ

Taxable income not subject to withholding - Interest income, dividends, capital gains, self employment income, IRA (including certain Roth IRA) distributions. Adjustments to income - IRA deduction, student loan interest deduction, alimony expense.

Claiming more allowances will lower the amount of income tax that's taken out of your check. Conversely, if the total number of allowances you're claiming is zero, that means you'll have the most income tax withheld from your take-home pay.

Form 941N is filed whether or not there were payments made during the quarter that were subject to Nebraska income tax withholding. The Form 941N is due on or before the last day of the month following the end of the quarter. The Form 941N may be e-filed using DOR's free Form 941N filing program.

Payees that chose not to have federal income tax withheld on the federal Form W-4P may elect to be exempt from withholding income tax for Nebraska on the Nebraska Form W-4N. Payees completing the Nebraska Form W-4N may skip lines 1 and 2 and write ?exempt? on line 3 of the Nebraska Form W-4N.

Nebraska also offers no filing or withholding threshold for income taxes. That means taxes are owed after one day of earning income in the state. It doesn't matter if you are a contractor on a single job or you are visiting family in Nebraska while working remotely, you owe Nebraska income tax.

Yes. The wages paid to employees for work done in Nebraska is subject to Nebraska income tax withholding.

Exemption From Withholding If an employee qualifies, he or she can also use Form W-4 to tell you not to deduct any federal income tax from his or her wages. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.