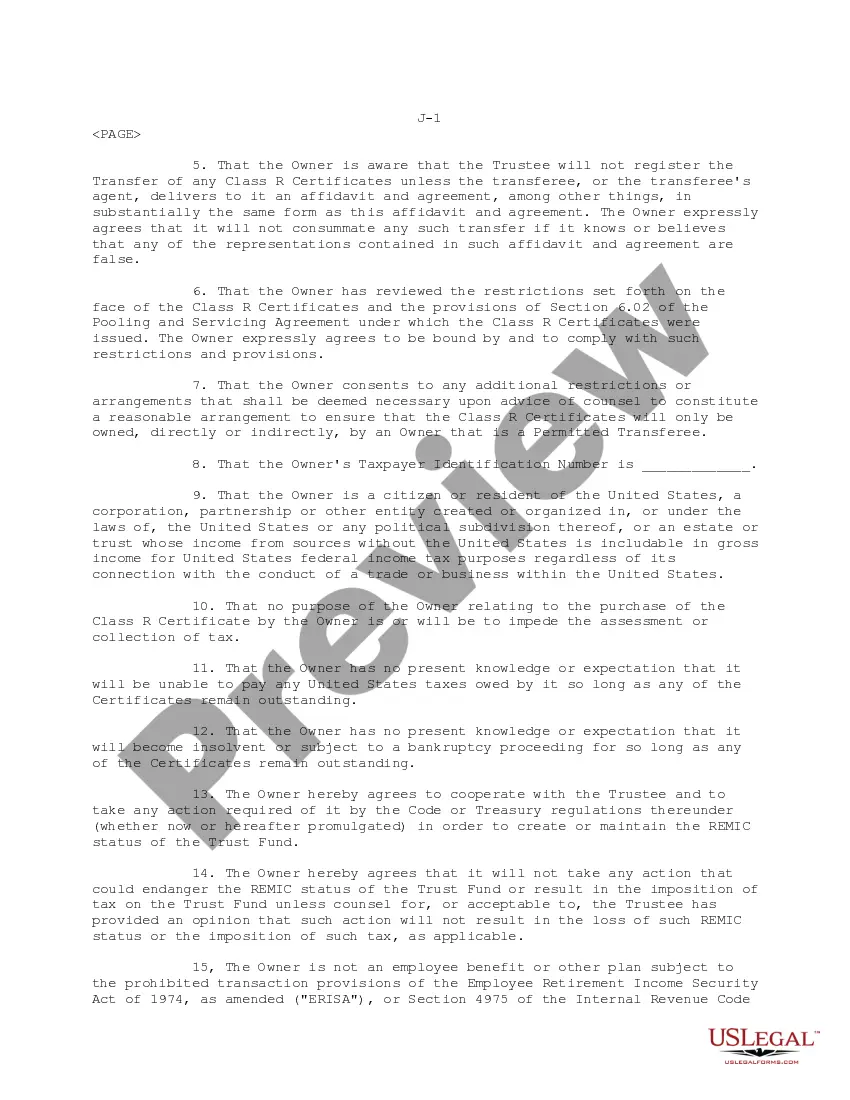

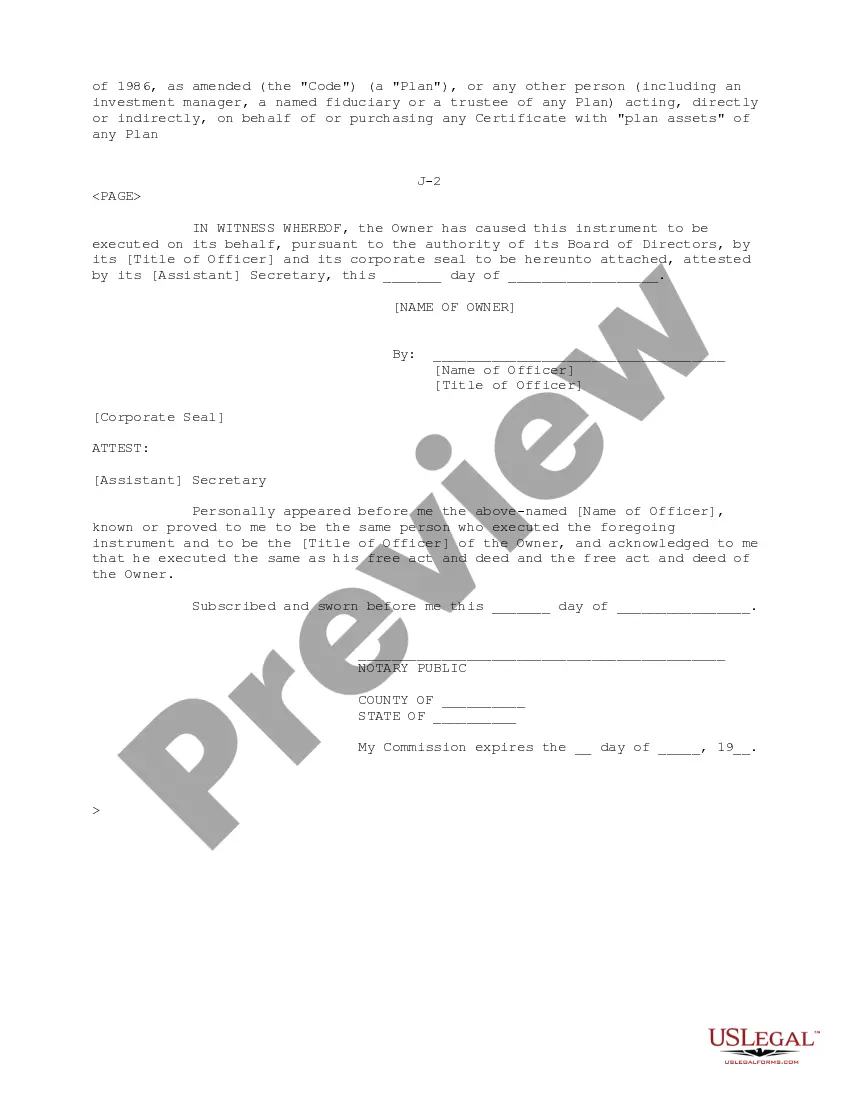

Virgin Islands Investment Transfer Affidavit and Agreement

Description

How to fill out Investment Transfer Affidavit And Agreement?

Have you been inside a situation where you require papers for either enterprise or specific uses virtually every day? There are a variety of legitimate papers templates available on the net, but discovering ones you can depend on isn`t straightforward. US Legal Forms offers 1000s of develop templates, much like the Virgin Islands Investment Transfer Affidavit and Agreement, which are published to meet state and federal needs.

If you are previously informed about US Legal Forms site and get a merchant account, just log in. Afterward, you are able to obtain the Virgin Islands Investment Transfer Affidavit and Agreement design.

If you do not offer an accounts and want to begin using US Legal Forms, follow these steps:

- Discover the develop you will need and make sure it is for your appropriate metropolis/county.

- Use the Preview button to examine the shape.

- Browse the outline to actually have chosen the proper develop.

- If the develop isn`t what you are seeking, utilize the Lookup area to get the develop that meets your requirements and needs.

- Once you discover the appropriate develop, just click Get now.

- Pick the prices prepare you want, complete the specified details to make your money, and purchase the transaction making use of your PayPal or Visa or Mastercard.

- Select a convenient paper structure and obtain your copy.

Find each of the papers templates you possess bought in the My Forms menus. You can aquire a extra copy of Virgin Islands Investment Transfer Affidavit and Agreement at any time, if necessary. Just go through the essential develop to obtain or print out the papers design.

Use US Legal Forms, the most comprehensive selection of legitimate types, to save lots of time as well as prevent blunders. The support offers appropriately made legitimate papers templates that you can use for a variety of uses. Generate a merchant account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

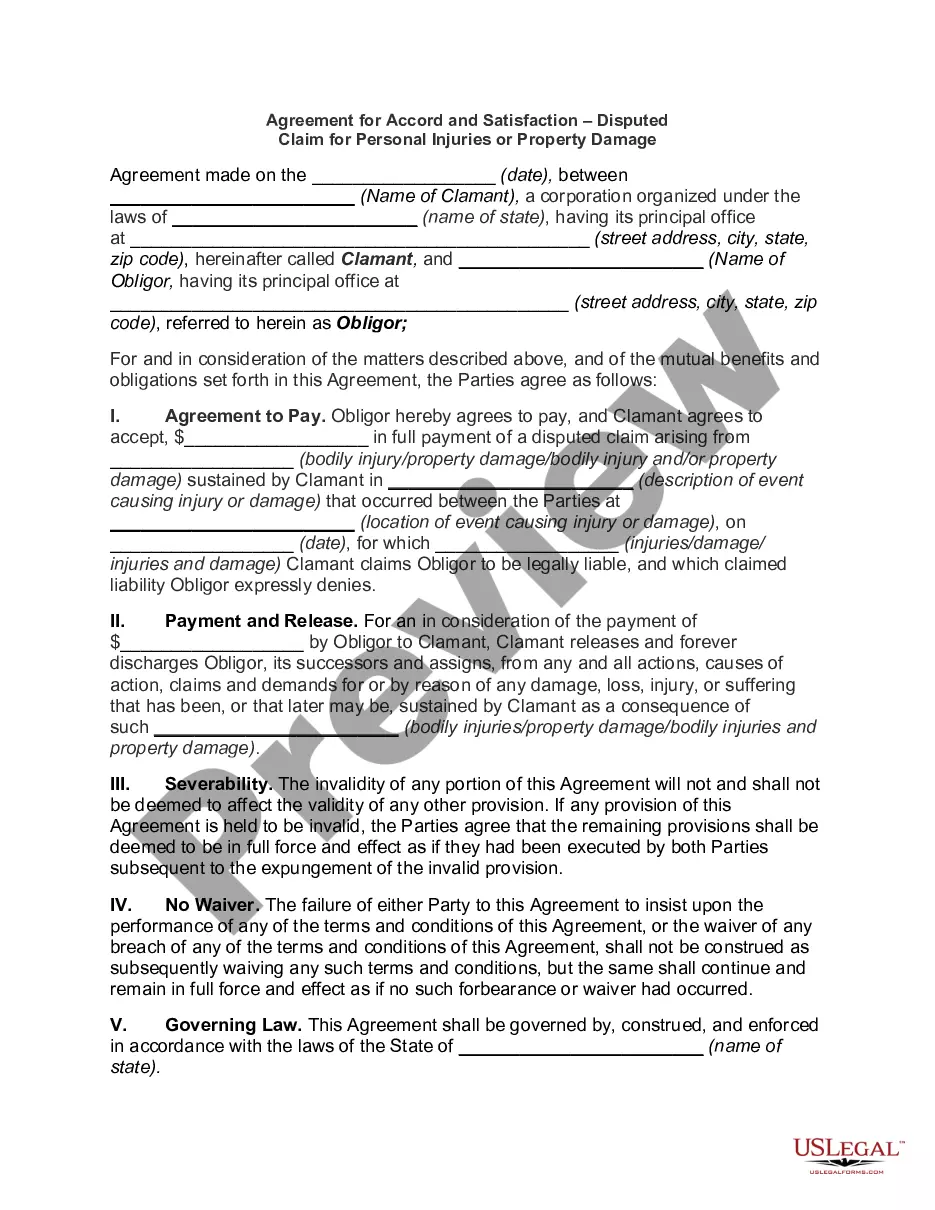

Filing Forms 843 and 8288-B to request an early refund of the withholding. Filing income tax returns (Form 1040NR) for the year of the sale to properly report the sale?and to report the withholdings or request the refund.

The transferee or a member of the transferee's family must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer.

To ensure collection of the FIRPTA tax, any transferee or buyer acquiring a U.S. property interest must deduct and withhold a tax equal to 15 percent of the amount realized on the disposition.

A taxpayer must file identical tax returns with the United States and the USVI. If they're not enclosing a check or money order, they should file the original Form 1040 (including Form 8689) with the Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301-0215 USA.

Possible reasons for the rejection include reporting the wrong amount on your tax return, inputting the wrong W-2 amounts when transferring the information electronically or just math errors.

TurboTax does not support the Form 8689, however you can enter the credit that you compute on the Form 8689 (line 40) in TurboTax Deluxe. You won't have to upgrade. Enter in the Other Credits section under Deductions and Credits.

Forms you can e-file for an individual: Form 540 , California Resident Income Tax Return. Form 540 2EZ , California Resident Income Tax Return. Form 540NR , California Nonresident or Part-Year Resident Income Tax Return. Form 592-B , Resident and Nonresident Withholding Tax Statement.

If you decide to electronically file the Federal return, Form 8689 will be sent with that submission. If you decide to paper file the return, the return will need to be sent to the IRS address as outlined in the Form 8689 instructions under the section titled Where to File.