Virgin Islands Notice of Violation of Fair Debt Act - Improper Document Appearance

Description

How to fill out Notice Of Violation Of Fair Debt Act - Improper Document Appearance?

Are you in the place the place you need paperwork for either enterprise or personal reasons almost every day? There are a lot of legitimate document web templates available on the net, but locating types you can depend on isn`t easy. US Legal Forms offers 1000s of type web templates, much like the Virgin Islands Notice of Violation of Fair Debt Act - Improper Document Appearance, which are published to fulfill state and federal demands.

If you are previously informed about US Legal Forms website and also have a free account, just log in. Afterward, you can obtain the Virgin Islands Notice of Violation of Fair Debt Act - Improper Document Appearance web template.

If you do not have an account and need to begin to use US Legal Forms, follow these steps:

- Discover the type you require and make sure it is for the right metropolis/state.

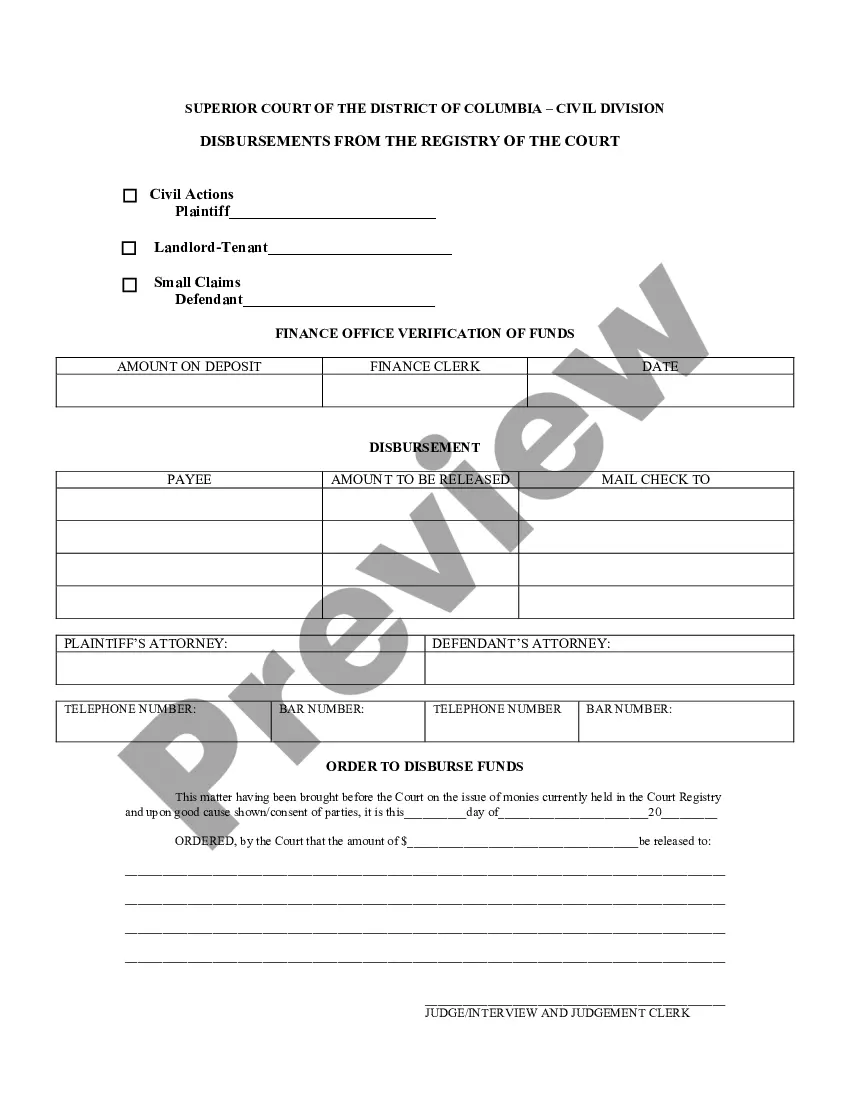

- Take advantage of the Review button to examine the form.

- Browse the outline to ensure that you have chosen the proper type.

- If the type isn`t what you`re seeking, make use of the Research field to obtain the type that fits your needs and demands.

- Whenever you get the right type, click Acquire now.

- Opt for the pricing program you desire, submit the desired information to create your bank account, and pay money for the transaction using your PayPal or Visa or Mastercard.

- Choose a convenient file structure and obtain your version.

Get every one of the document web templates you might have bought in the My Forms food selection. You can get a further version of Virgin Islands Notice of Violation of Fair Debt Act - Improper Document Appearance whenever, if required. Just click the essential type to obtain or print out the document web template.

Use US Legal Forms, probably the most extensive selection of legitimate varieties, to save efforts and stay away from mistakes. The services offers professionally manufactured legitimate document web templates that you can use for a range of reasons. Make a free account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take.

§ 807. (1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

A debt collector who fails to comply with any provision of the FDCPA or Regulation F is liable for: Any actual damages sustained as a result of that failure.

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

If a CA lets another person know who the debtor is, and why they're calling you then they have violated the FDCPA and, if they cannot provide adequate validation, then they have essentially told a lie about you! i.e., they have defamed your character.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

Your rights. Whether you owe money or not, a collection agency cannot harass you and must follow strict rules under the law. If they break the rules, you can file a complaint with the ministry.