Virgin Islands Notice to Debt Collector - Posing Lengthy Series of Questions or Comments

Description

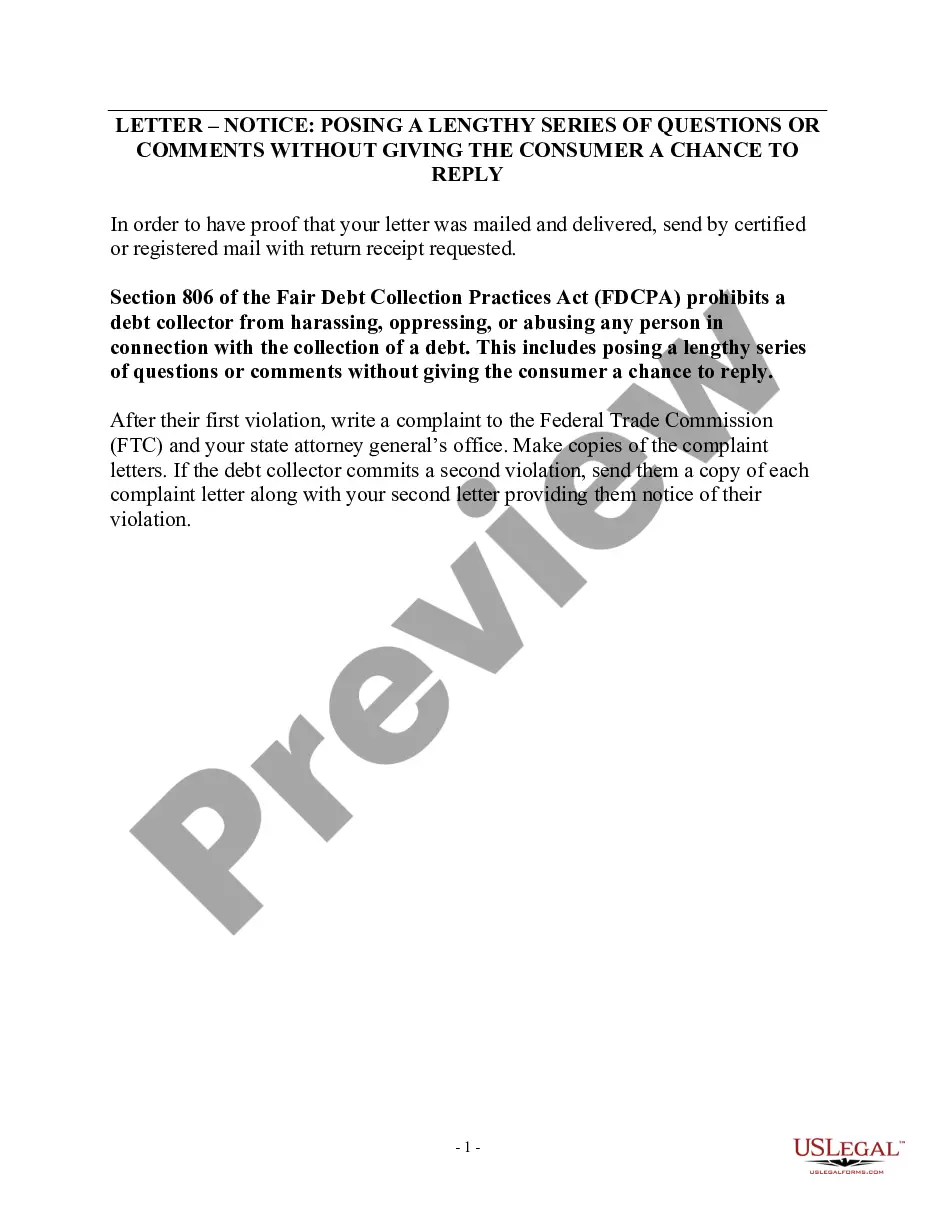

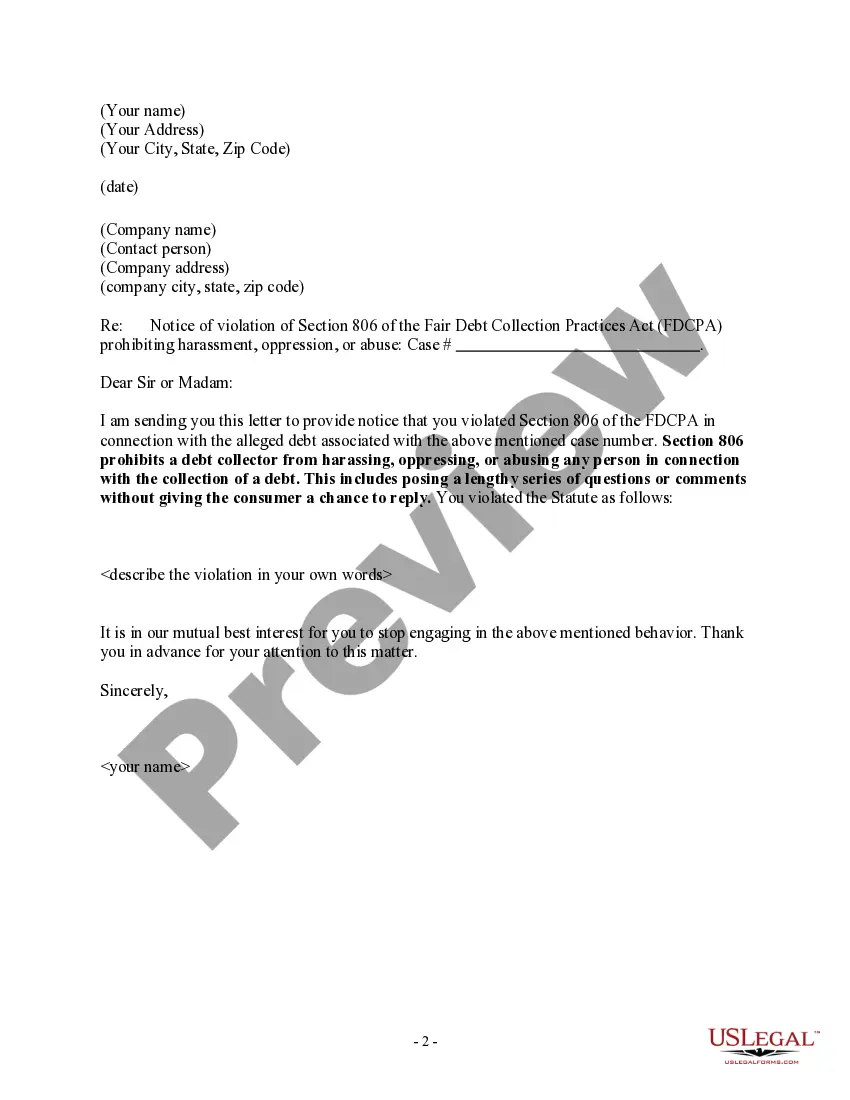

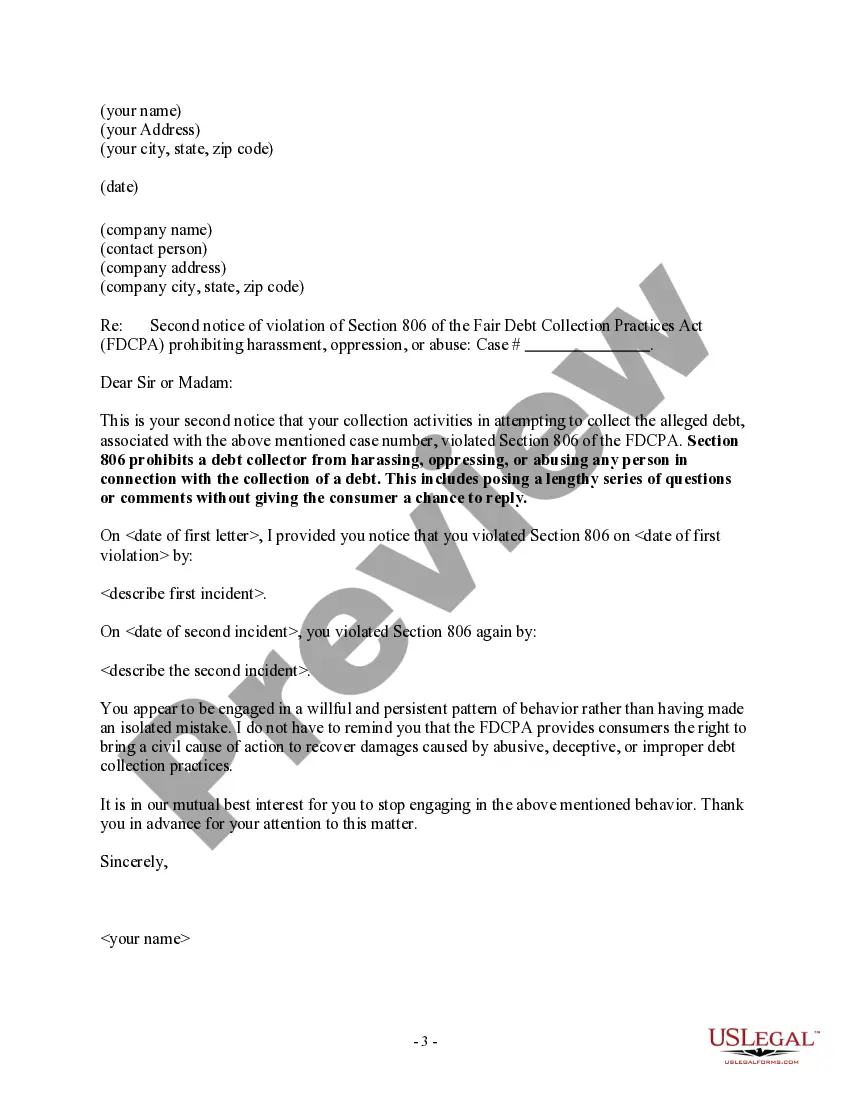

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes posing a lengthy series of questions or comments to the consumer without giving the consumer a chance to reply.

How to fill out Notice To Debt Collector - Posing Lengthy Series Of Questions Or Comments?

You can spend hours online searching for the suitable legal document template that meets the state and federal standards you need.

US Legal Forms offers thousands of legal documents evaluated by experts.

You can effortlessly download or print the Virgin Islands Notice to Debt Collector - Posing Lengthy Series of Questions or Comments through our services.

If you wish to find another version of the document, use the Search field to find the template that aligns with your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and hit the Download button.

- After that, you can complete, modify, print, or sign the Virgin Islands Notice to Debt Collector - Posing Lengthy Series of Questions or Comments.

- Each legal document template you obtain is yours to keep indefinitely.

- To get another copy of any purchased document, navigate to the My documents section and click the relevant button.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure that you have selected the correct document template for your chosen county/town.

- Check the document outline to confirm you have chosen the right document.

- If available, use the Preview button to review the document template as well.

Form popularity

FAQ

You should not ignore a debt collection letter as not responding to them in time (or at all) can lead to the collection agency filing a lawsuit against you. Not only will this result in you being responsible for additional fees, but it can allow them to take legal action to get the funds from you in other ways.

Ask CFPBWho you're talking to (get the person's name)The name of the debt collection company they work for.The company's address and phone number.The name of the original creditor.The amount owed.How you can dispute the debt or ensure that the debt is yours.

If you're dealing with a third-party debt collector, there are five things you can do to handle the situation.Don't ignore them. Debt collectors will continue to contact you until a debt is paid.Get information on the debt.Get it in writing.Don't give personal details over the phone.Try settling or negotiating.

Disputing a Debt Within five days after a debt collector first contacts you, it must send you a written notice, called a "validation notice," that tells you (1) the amount it thinks you owe, (2) the name of the creditor, and (3) how to dispute the debt in writing.

If you're wondering how to win a debt collection lawsuit against you, here are six steps you can take.Respond to the Lawsuit.Challenge the Collection Agency's Right to Sue You.Hire an Attorney.File a Countersuit.Attempt to Settle the Debt.File for Bankruptcy.The Bottom Line.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

Typical debt settlement offers range from 10% to 50% of what you owe. The longer you allow debt to go unpaid, the greater your risk of being sued. Creditors are under no obligation to reduce your debt, even if you are working with a reputable debt settlement company.

9 Ways to Outsmart Debt CollectorsDon't Get Emotional.Make Sure the Debt Is Really Yours.Ask for Proof.Resist the Scare Tactics.Be Wary of Fees.Negotiate.Call In Backup.Know the Time Limits.More items...?