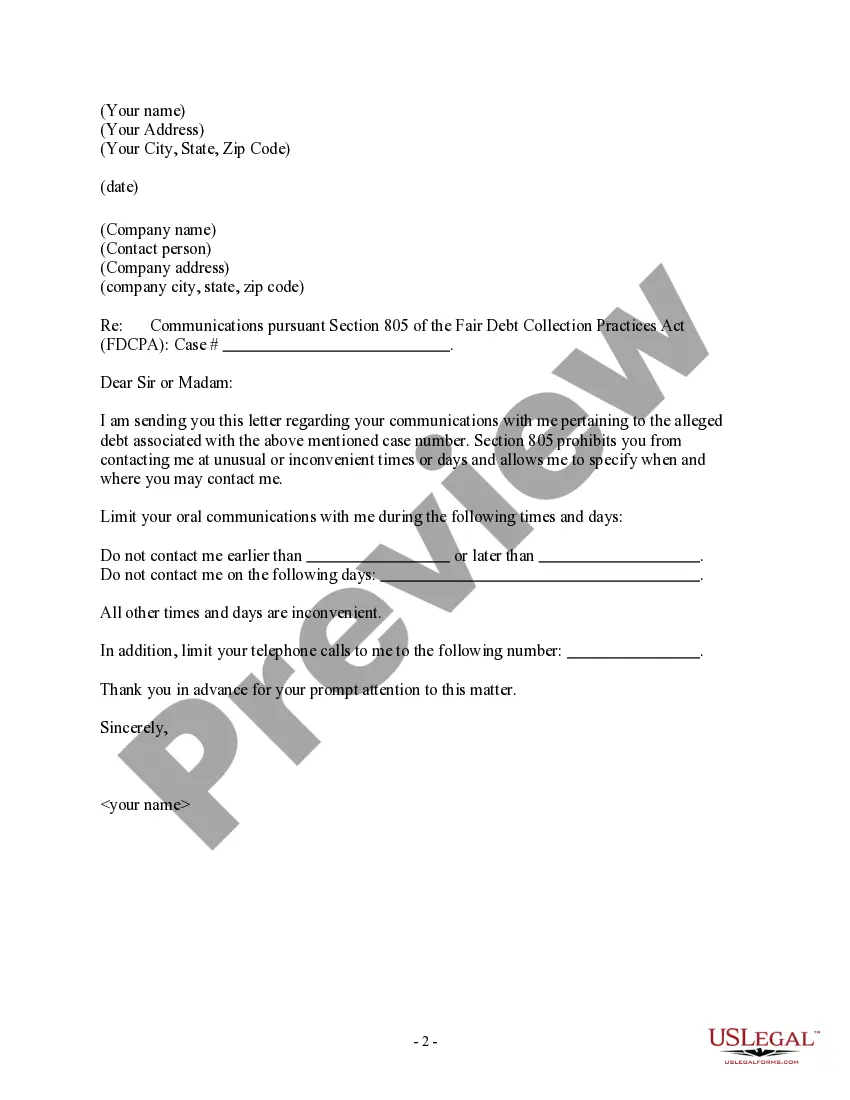

Virgin Islands Letter to Debt Collector - Only call me on the following days and times

Description

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

It is feasible to spend hours online searching for the legal document template that fulfills the state and federal requirements you need.

US Legal Forms offers countless legal documents that are assessed by professionals.

It is easy to download or print the Virgin Islands Letter to Debt Collector - Only contact me on the specified days and times from my services.

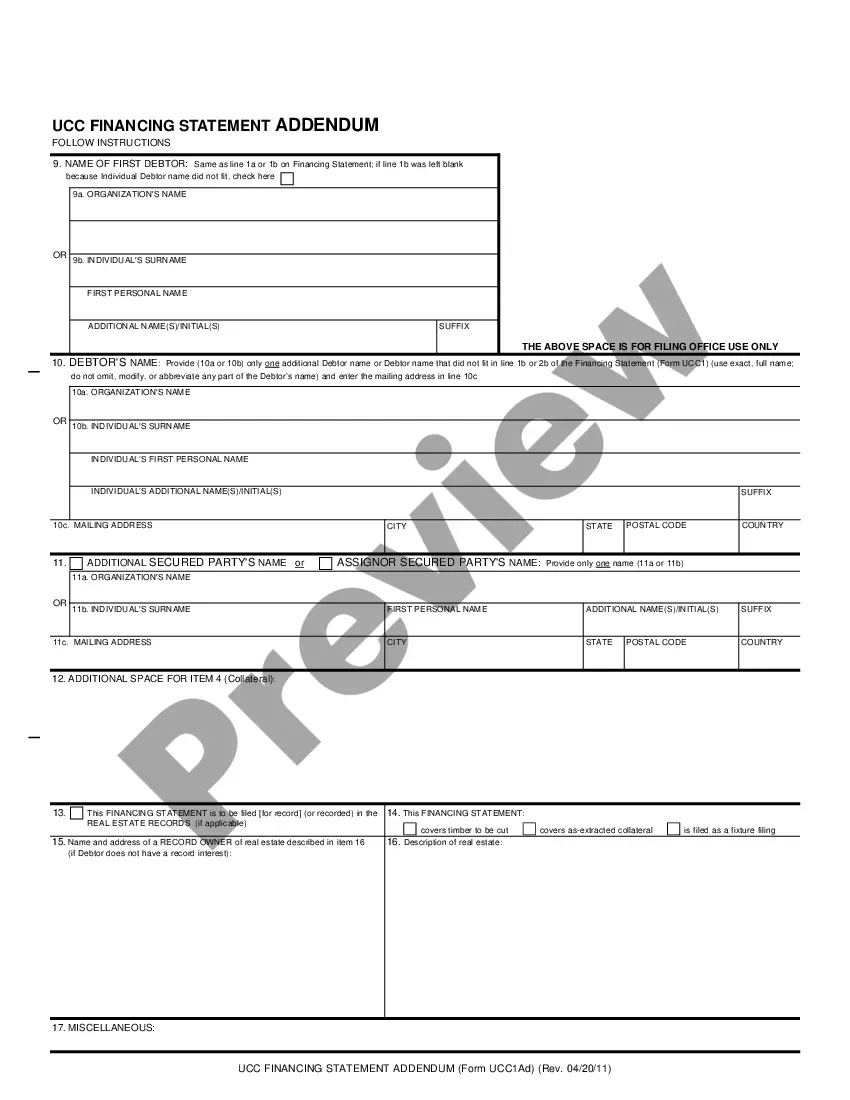

If available, make use of the Review option to examine the document template as well.

- If you possess a US Legal Forms account, you may Log In and select the Download option.

- Afterward, you can complete, edit, print, or sign the Virgin Islands Letter to Debt Collector - Only contact me on the specified days and times.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of the acquired form, navigate to the My documents tab and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for your area/city of choice.

- Review the form information to confirm you have selected the right form.

Form popularity

FAQ

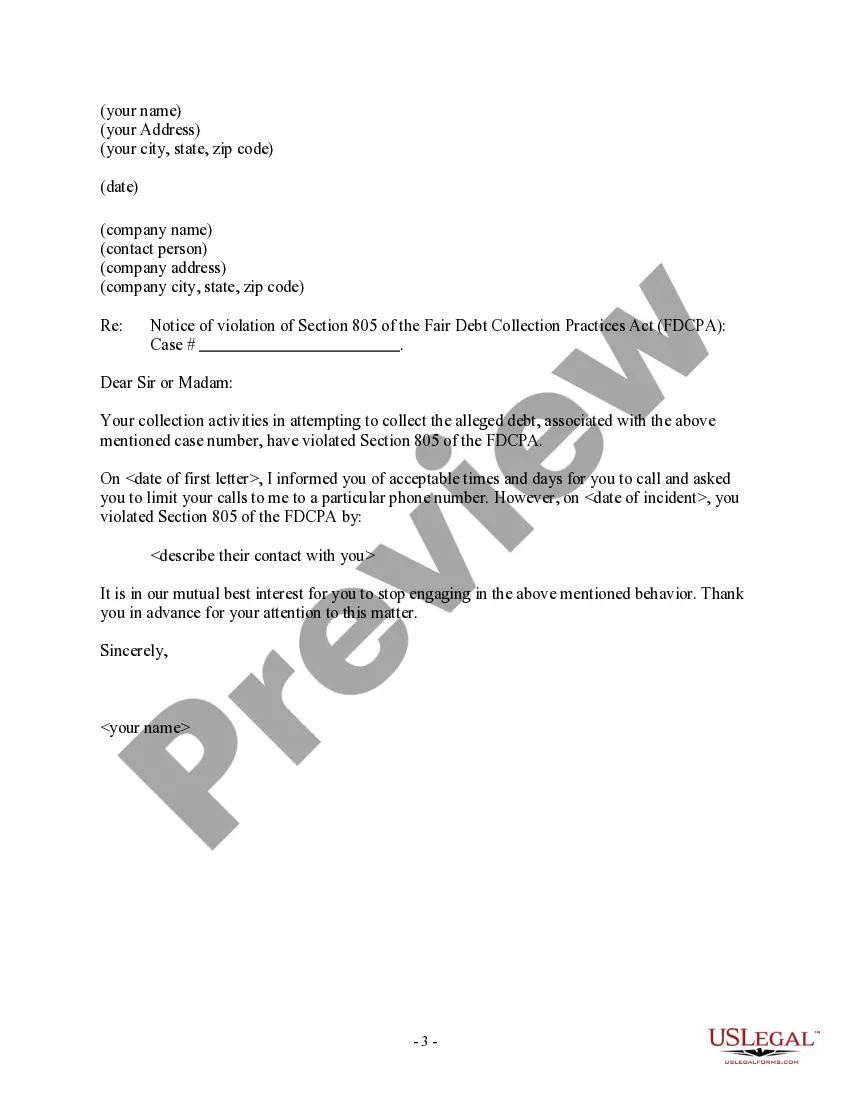

The 11-word phrase to stop debt collectors is, 'I do not wish to be contacted by your office.' This statement can be included in your correspondence to cease unwanted communication. Including this in your Virgin Islands Letter to Debt Collector - Only call me on the following days and times can be an effective measure.

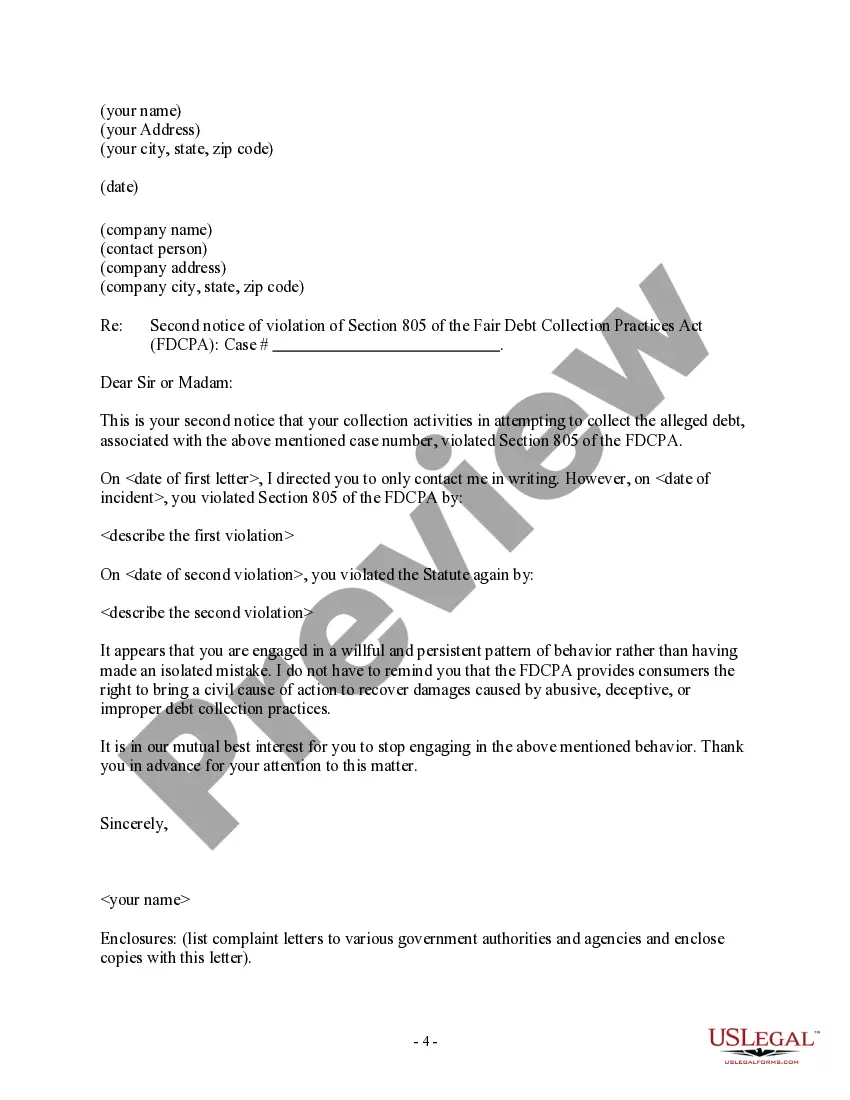

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

You may ask a debt collector to contact you only by mail, or through your attorney, or set other limitations. Make sure you send your request in writing, send it by certified mail with a return receipt, and keep a copy of the letter and receipt.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L.

While an account in collection can have a significant negative impact on your credit, it won't stay on your credit reports forever. Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.

If you continue to ignore communicating with the debt collector, they will likely file a collections lawsuit against you in court. If you are served with a lawsuit and ignore this court filing, the debt collection company will then be able to get a default judgment against you.

Although debt collectors can leave a message on your machine, they cannot necessarily do it legally. The FDCPA exists in order to protect your privacy and prohibits debt collectors from disclosing your information to third parties. Third parties include your family, friends, boss, or anyone other than your spouse.