Virgin Islands Complex Will - Max. Credit Shelter Marital Trust to Children

Description

How to fill out Complex Will - Max. Credit Shelter Marital Trust To Children?

Choosing the best legitimate file template could be a have difficulties. Needless to say, there are a lot of web templates available on the Internet, but how will you get the legitimate develop you require? Use the US Legal Forms internet site. The assistance offers a large number of web templates, like the Virgin Islands Complex Will - Max. Credit Shelter Marital Trust to Children, which can be used for company and private demands. All the forms are examined by experts and fulfill state and federal specifications.

Should you be currently authorized, log in for your bank account and click the Acquire button to find the Virgin Islands Complex Will - Max. Credit Shelter Marital Trust to Children. Utilize your bank account to appear throughout the legitimate forms you may have acquired in the past. Check out the My Forms tab of your own bank account and obtain one more backup in the file you require.

Should you be a whole new user of US Legal Forms, here are straightforward instructions that you can adhere to:

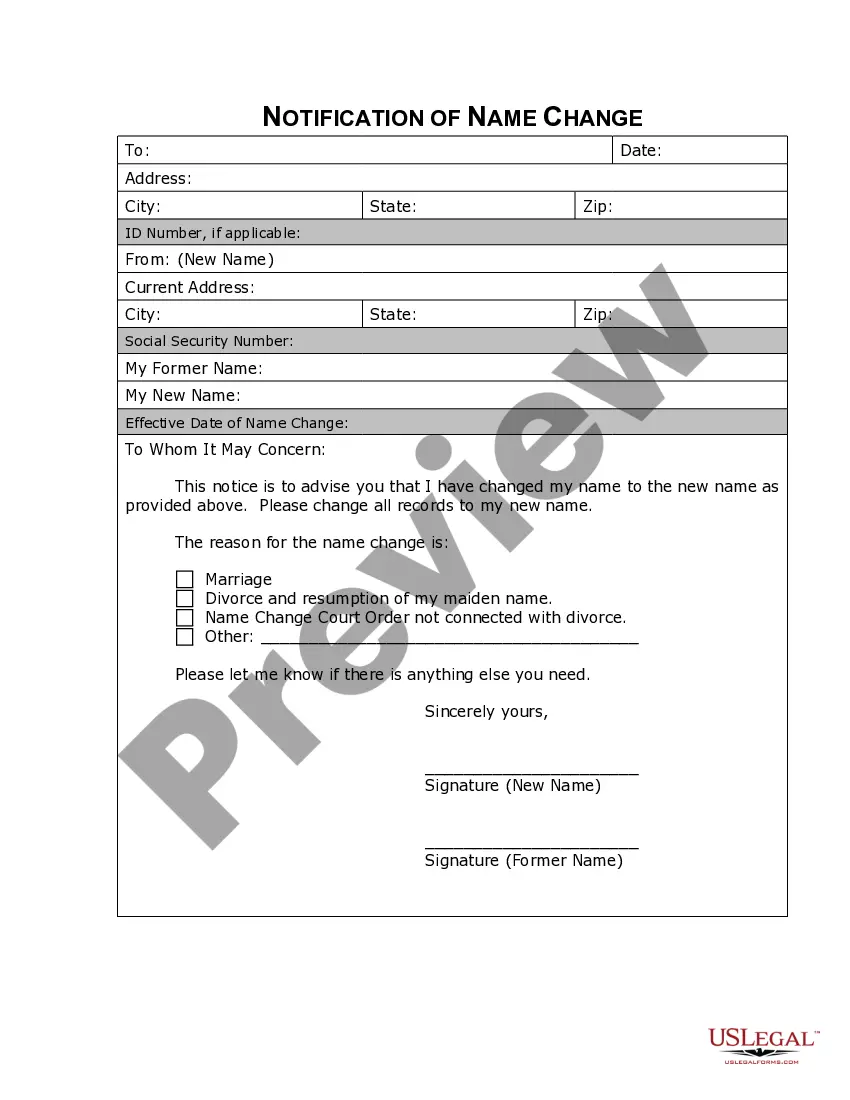

- First, ensure you have selected the correct develop for your personal town/region. You can look over the form while using Preview button and browse the form explanation to make sure this is basically the best for you.

- When the develop will not fulfill your preferences, use the Seach discipline to find the proper develop.

- When you are sure that the form is proper, click on the Get now button to find the develop.

- Opt for the prices strategy you want and type in the needed information. Design your bank account and purchase an order making use of your PayPal bank account or credit card.

- Pick the document formatting and acquire the legitimate file template for your gadget.

- Total, edit and produce and indication the acquired Virgin Islands Complex Will - Max. Credit Shelter Marital Trust to Children.

US Legal Forms is the greatest catalogue of legitimate forms for which you can see numerous file web templates. Use the company to acquire appropriately-made documents that adhere to state specifications.

Form popularity

FAQ

One disadvantage is that the grantor cannot change their mind about the trust after it has been created. Another disadvantage is that the trustee must manage the property following the terms of the trust, which can be complex. Finally, a QTIP trust can be expensive to set up and maintain.

Unlike a QTIP trust, the assets of the credit shelter trust are not included in the beneficiary's gross estate and, as a result, are not subject to estate tax at the beneficiary's death (in other words, the assets bypass the beneficiary's estate).

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

Credit Shelter Trusts are a popular tool for estate planning, and there are two main types of CSTs, the Marital Gift Trust and the Qualified Terminable Interest Property Trust (QTIP). Both of these Trusts preserve wealth via estate tax exemptions.

This trust is irrevocable and will pass to beneficiaries other than the surviving spouse (usually their children). The surviving spouse must follow the trust's plan without overly benefiting from its operation, but this trust often passes income to the surviving spouse to live on for the rest of their life.

A bypass trust, or AB trust, is a legal arrangement that allows married couples to avoid estate tax on certain assets when one spouse passes away. When one spouse dies, the estate's assets are split into two separate trusts. The first part is the marital trust or ?A? trust. The second is a bypass, family or ?B? trust.

A spousal lifetime access trust (SLAT) is a trust created by one spouse (trustmaker spouse) for the benefit of the other (beneficiary spouse). This estate planning tool can be used to retain as much control over your property and assets as possible while not paying any more taxes than you have to.

Upon the death of the surviving spouse, the trust transfers to the heirs, who are exempt from the estate tax that would have resulted from a combined inheritance. Disadvantages of a CST include formation costs and the surviving spouse's lack of control.