Virgin Islands Deferred Compensation Investment Account Plan

Description

How to fill out Deferred Compensation Investment Account Plan?

US Legal Forms - among the greatest libraries of legitimate kinds in the United States - offers a wide array of legitimate papers layouts you may down load or produce. Utilizing the web site, you can find thousands of kinds for organization and specific reasons, categorized by categories, claims, or keywords.You will find the most up-to-date types of kinds such as the Virgin Islands Deferred Compensation Investment Account Plan within minutes.

If you currently have a registration, log in and down load Virgin Islands Deferred Compensation Investment Account Plan from your US Legal Forms collection. The Down load button will appear on every form you view. You get access to all in the past acquired kinds inside the My Forms tab of the profile.

If you want to use US Legal Forms the first time, listed here are straightforward recommendations to obtain started out:

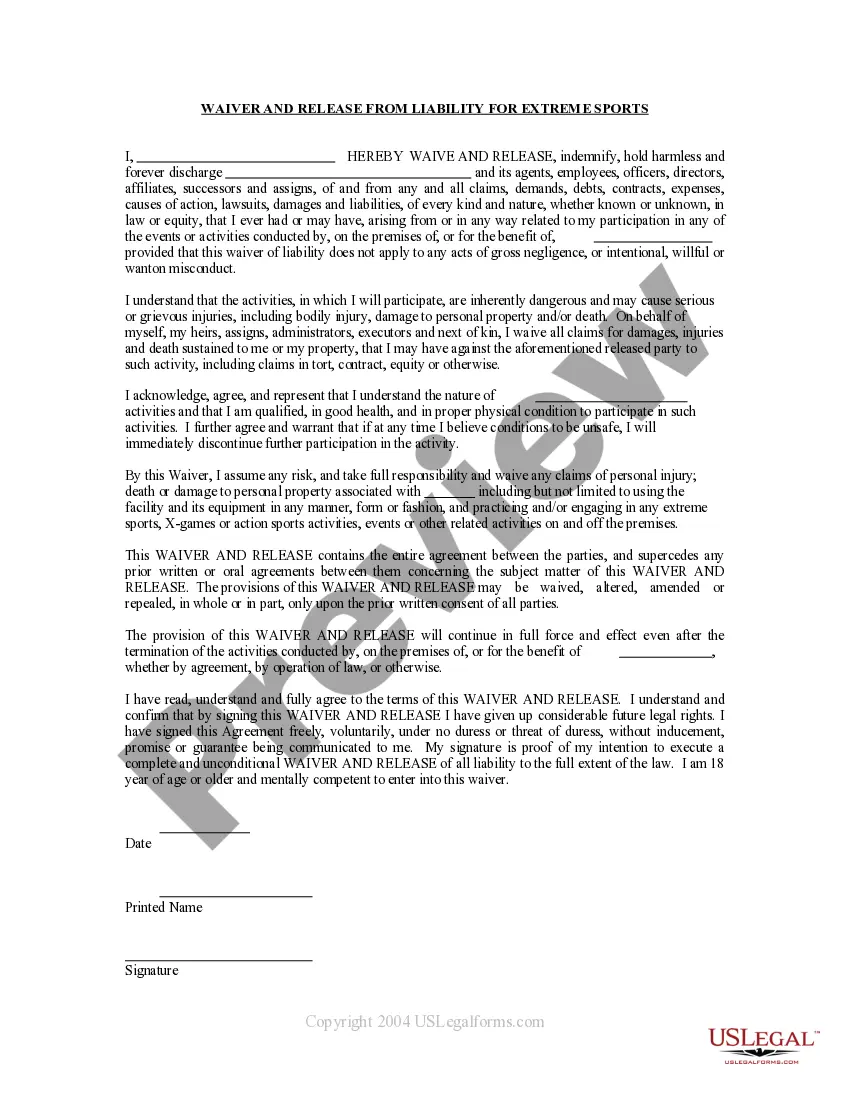

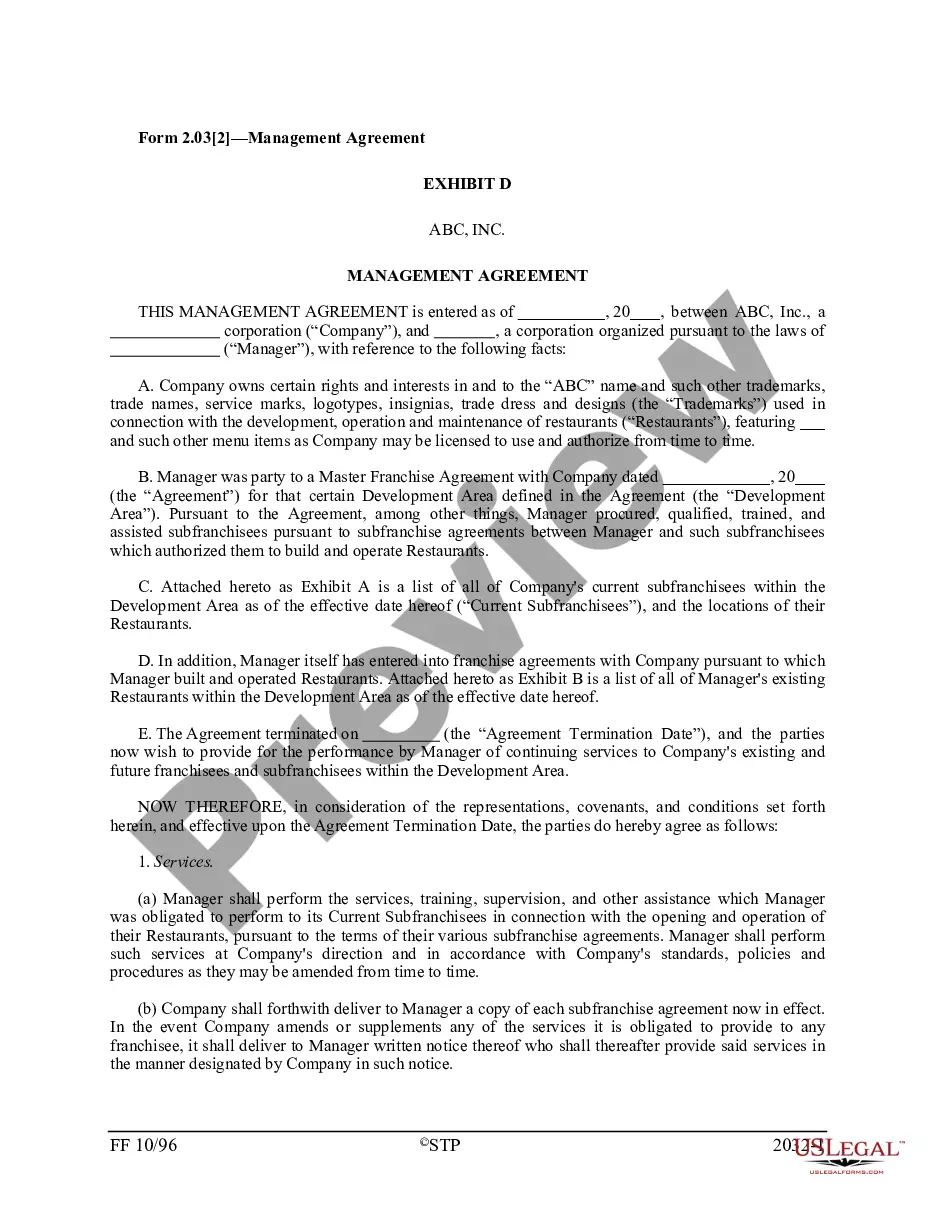

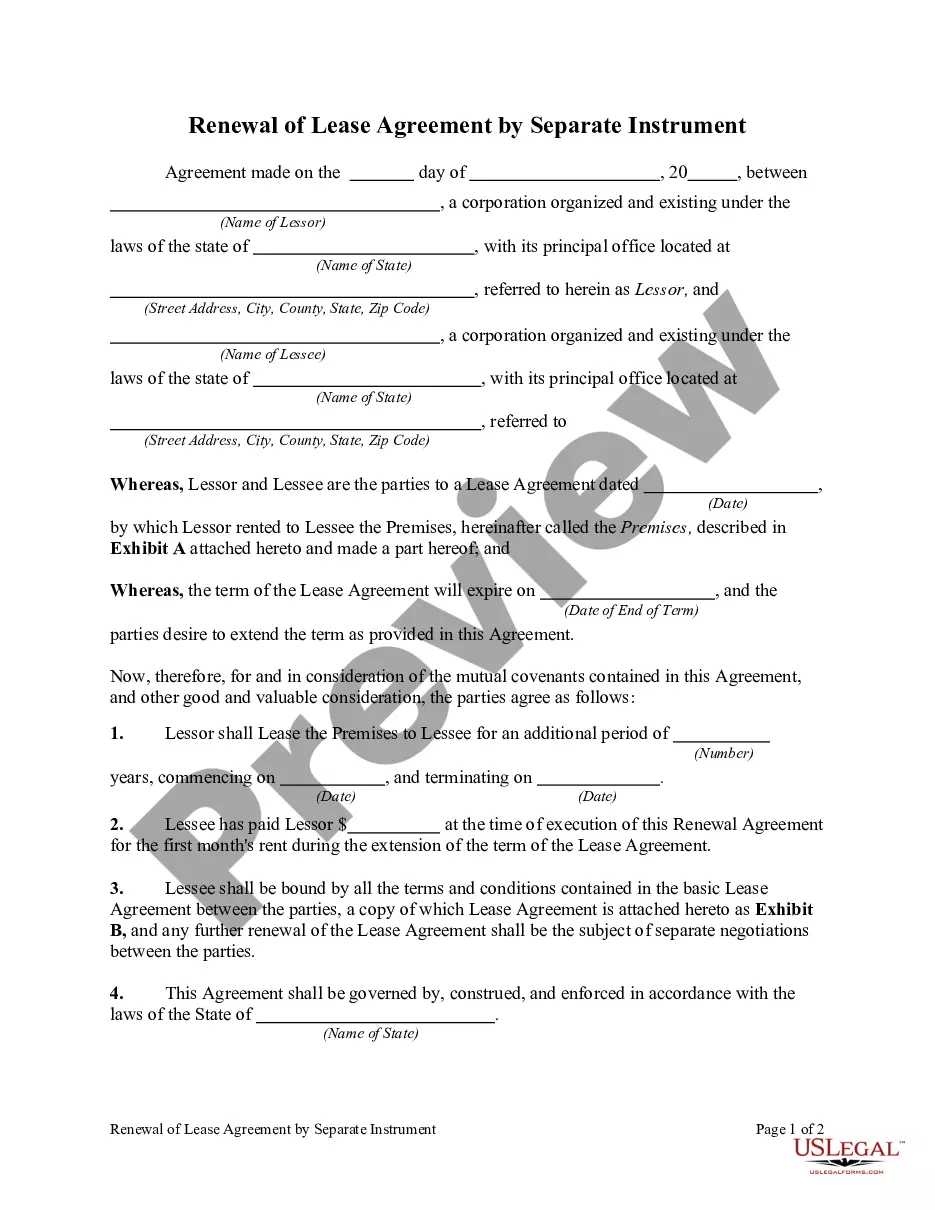

- Be sure to have picked the right form for your metropolis/county. Select the Preview button to examine the form`s articles. See the form description to ensure that you have chosen the proper form.

- When the form doesn`t suit your requirements, make use of the Look for industry near the top of the display to get the one which does.

- When you are satisfied with the form, verify your decision by visiting the Acquire now button. Then, pick the costs strategy you favor and supply your qualifications to register to have an profile.

- Procedure the deal. Make use of Visa or Mastercard or PayPal profile to perform the deal.

- Choose the file format and down load the form on your system.

- Make alterations. Fill out, revise and produce and indication the acquired Virgin Islands Deferred Compensation Investment Account Plan.

Every web template you included with your bank account does not have an expiry day and is yours permanently. So, in order to down load or produce yet another version, just visit the My Forms segment and click on in the form you will need.

Gain access to the Virgin Islands Deferred Compensation Investment Account Plan with US Legal Forms, the most extensive collection of legitimate papers layouts. Use thousands of expert and status-specific layouts that meet your company or specific demands and requirements.

Form popularity

FAQ

You can take out small or large sums anytime, or you can set up automatic, periodic payments. If your plan allows it, you may be able to have direct deposit which allows for fast transfer of funds. Unlike a check, direct deposit typically doesn't include a hold on the funds from your account.

Deferred compensation plans can be a powerful tool for early retirement goals. Deferring income to retirement might help avoid high state income taxes (ex: California, New York, etc) if you're planning to move to a low-tax state.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

Key Differences Deferred compensation plans tend to offer better investment options than most 401(k) plans, but are at a disadvantage regarding liquidity. Typically, deferred compensation funds cannot be accessed, for any reason, before the specified distribution date.

In general, deferred compensation plans allow the participant to defer income today and withdraw it at some point in the future (usually upon retirement) when taxable income is likely to be lower. Like 401(k) plans, participants must elect how to invest their contributions.

457(b) Assets can be withdrawn without penalty at any age upon separation from service from the plan sponsor, or age 70½ if still working.

Deferred compensation plans can be a powerful tool for early retirement goals. Deferring income to retirement might help avoid high state income taxes (ex: California, New York, etc) if you're planning to move to a low-tax state.

You can take penalty-free withdrawals from your 457 account at any age after you leave your job. Most other types of retirement-savings plans assess a 10% penalty if you withdraw money before age 55 or 59½, depending on when you leave your job.