Virgin Islands Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.

Description

How to fill out Directors Stock Appreciation Rights Plan Of American Annuity Group, Inc.?

Are you currently in the situation the place you need to have papers for sometimes business or person purposes nearly every day time? There are plenty of legitimate papers themes available on the Internet, but discovering ones you can trust is not simple. US Legal Forms offers thousands of type themes, such as the Virgin Islands Directors Stock Appreciation Rights Plan of American Annuity Group, Inc., that happen to be composed to fulfill state and federal needs.

In case you are already knowledgeable about US Legal Forms internet site and also have a free account, basically log in. Afterward, you can obtain the Virgin Islands Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. template.

Unless you provide an accounts and would like to start using US Legal Forms, follow these steps:

- Obtain the type you will need and ensure it is for the right city/state.

- Utilize the Preview option to check the shape.

- Look at the explanation to ensure that you have selected the correct type.

- When the type is not what you`re searching for, take advantage of the Lookup industry to discover the type that suits you and needs.

- Once you find the right type, click Get now.

- Choose the pricing prepare you would like, complete the specified information to produce your money, and pay money for your order making use of your PayPal or Visa or Mastercard.

- Select a convenient document formatting and obtain your backup.

Locate all of the papers themes you have purchased in the My Forms menus. You can get a more backup of Virgin Islands Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. any time, if required. Just go through the needed type to obtain or print the papers template.

Use US Legal Forms, by far the most substantial selection of legitimate varieties, to save time and avoid errors. The support offers skillfully created legitimate papers themes that can be used for a selection of purposes. Create a free account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

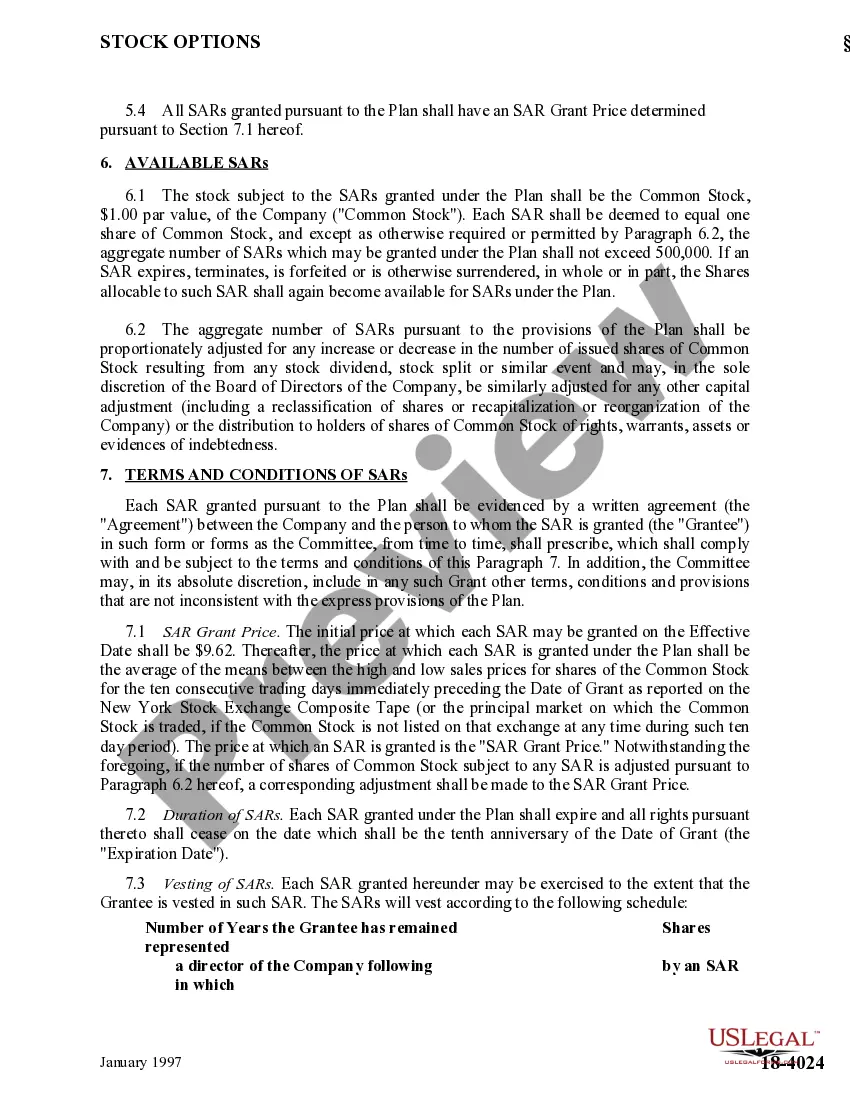

A stock appreciation right (SAR) entitles an employee to the appreciation in value of a specified number of shares of employer stock over an ?exercise price? or ?grant price? over a specified period of time. The base price generally is equal to the underlying stock's fair market value on the date of grant.

Stock Appreciation Rights Are Not Securities.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

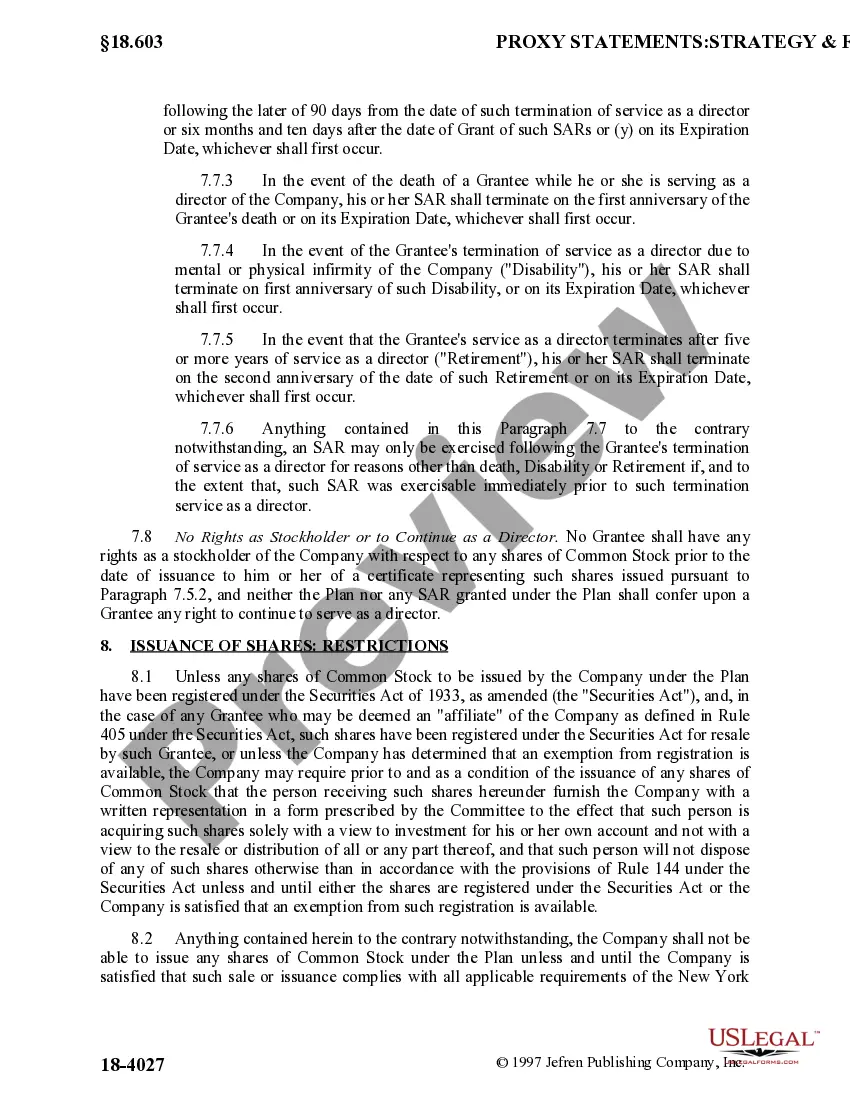

SARs are taxed the same way as non-qualified stock options (NSOs). There are no tax consequences of any kind on either the grant date or when they are vested. However, participants must recognize ordinary income on the spread at the time of exercise. 2 Most employers will also withhold supplemental federal income tax.

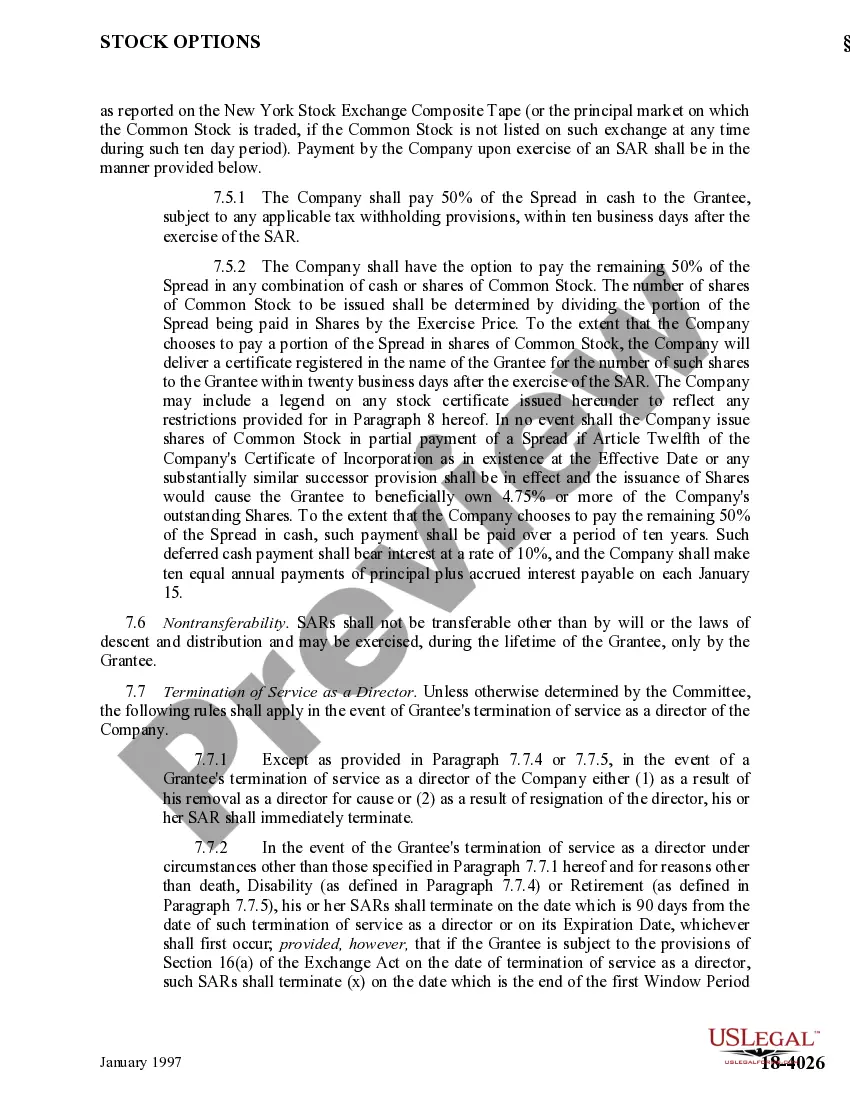

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).

Stock appreciation rights are granted as part of a compensation package. They're issued with a grant date, exercise price, vesting date, and expiration date. The grant of an SAR is a non-taxable event.

Once a SAR vests, an employee can exercise it at any time prior to its expiration. The proceeds will be paid either in cash, shares, or a combination of cash and shares depending on the rules of an employee's plan.

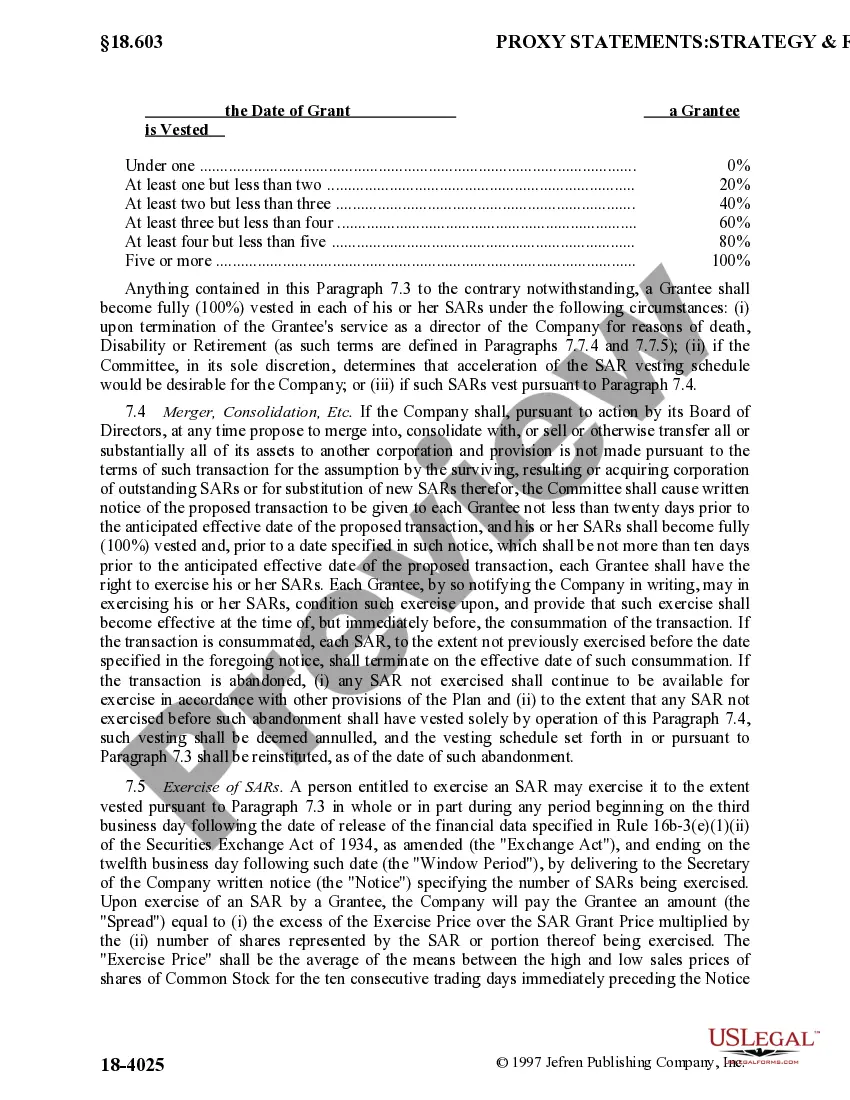

Employees can only exercise the stock appreciation rights after the shares have vested. The vesting period is the minimum period employees must hold the stocks before they can exercise the stock appreciation rights. Generally, employers offer stock appreciation rights along with stock options.