Virgin Islands Wage Withholding Authorization

Description

How to fill out Wage Withholding Authorization?

Are you presently in the location where you require documents for potentially business or individual use almost every day.

There are numerous legal document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Virgin Islands Wage Withholding Authorization, which are designed to comply with both federal and state requirements.

When you locate the appropriate form, click Buy now.

Choose the pricing plan you need, fill out the requested information to complete your payment, and finalize the transaction using your PayPal or Visa or MasterCard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Virgin Islands Wage Withholding Authorization template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Select the form you require and ensure it is for the correct city/county.

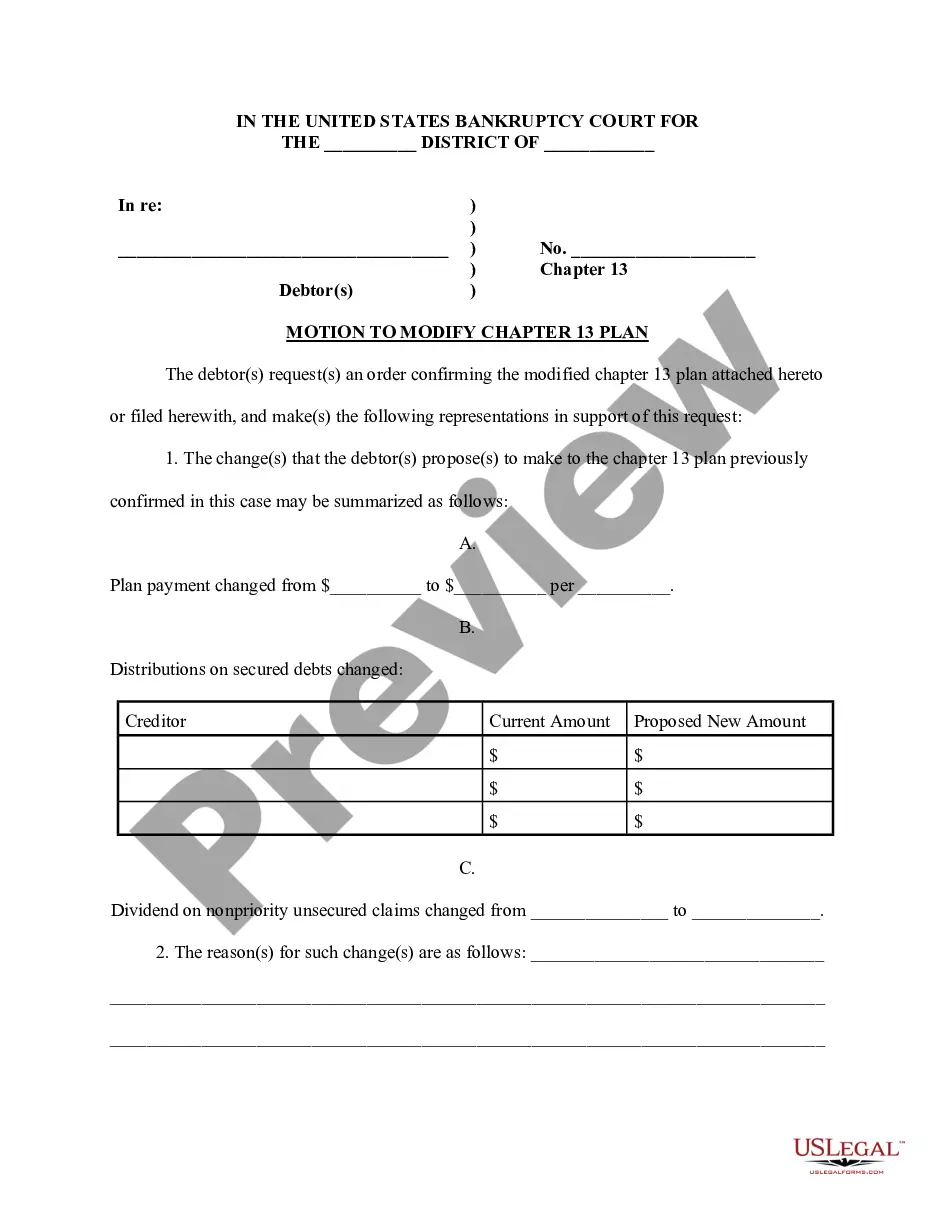

- Use the Review button to verify the form.

- Check the information to make sure that you have chosen the correct form.

- If the form is not what you need, use the Search box to find the form that matches your requirements.

Form popularity

FAQ

The U.S. Virgin Islands often attracts attention due to its favorable tax policies, making it appear as a tax haven. However, this designation can be misleading. While the region allows for certain tax benefits, compliance with local laws, including Virgin Islands Wage Withholding Authorization, is essential for proper tax management. Businesses and individuals should always seek guidance to ensure they are fulfilling all necessary obligations.

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid.

The mailing address is 9601 Estate Thomas, St. Thomas, VI 00802.

Under Reg. 1.937-1(c)(1), an individual taxpayer must be physically located in the Virgin Islands for at least 183 days during the tax year. So long as an individual is physically present in the Virgin Islands at any time during the day, for any amount of time, the day will count for purposes of the presence test.

There is no electronic filing in the Virgin Islands at this time. Taxpayers must drop off in person or mail the returns to the Bureau for processing. For more information about filing requirements for bona fide residents, please call the Office of Chief Counsel at 715-1040, ext. 2249.

About Form 8689, Allocation of Individual Income Tax to the U.S. Virgin Islands Internal Revenue Service.

To take the credit, you must complete Form 8689 and attach it to your Form 1040 or 1040-SR. Add line 41 and line 46 of Form 8689 and include the amount in the total on Form 1040 or 1040-SR, Total payments line. On the dotted line next to it, enter Form 8689 and the amount paid.

IRS Form W-2VI is used to report wage and salary information for employees earning Virgin Island wages.

Use this form to report U.S. Virgin Islands wages. Do not use this form to report wages subject to U.S. income tax withholding. Instead, use Form W-2 to show U.S. income tax withheld.

The U.S. Virgin Islands uses a mirror system of taxation, also known as the Mirror Code, meaning that USVI taxpayers pay taxes to the Virgin Islands Bureau of Internal Revenue ("BIR") generally to the same extent as U.S. taxpayers would under the Code to the U.S. Internal Revenue Service.