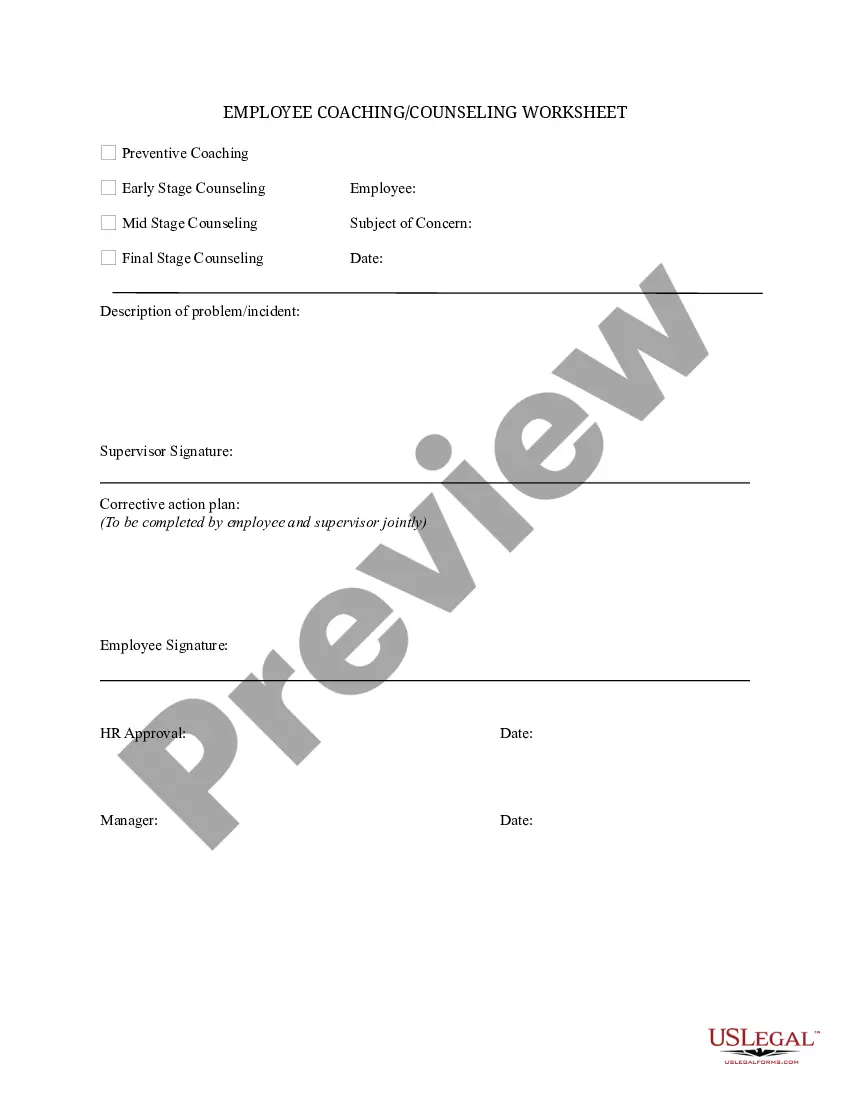

Virgin Islands Coaching Worksheet

Description

How to fill out Coaching Worksheet?

If you want to complete, obtain, or printing authorized file templates, use US Legal Forms, the most important variety of authorized kinds, that can be found on the Internet. Utilize the site`s basic and convenient search to find the paperwork you need. A variety of templates for company and person uses are categorized by categories and states, or key phrases. Use US Legal Forms to find the Virgin Islands Coaching Worksheet with a handful of clicks.

Should you be currently a US Legal Forms consumer, log in to the profile and click on the Down load key to have the Virgin Islands Coaching Worksheet. Also you can entry kinds you in the past saved within the My Forms tab of your respective profile.

If you work with US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have chosen the form to the proper metropolis/nation.

- Step 2. Make use of the Review option to check out the form`s information. Do not neglect to read through the information.

- Step 3. Should you be not happy together with the type, take advantage of the Research discipline towards the top of the display to discover other versions of your authorized type web template.

- Step 4. When you have found the form you need, go through the Purchase now key. Select the costs plan you like and add your qualifications to register to have an profile.

- Step 5. Procedure the transaction. You may use your bank card or PayPal profile to perform the transaction.

- Step 6. Find the file format of your authorized type and obtain it on the product.

- Step 7. Total, change and printing or sign the Virgin Islands Coaching Worksheet.

Each and every authorized file web template you buy is your own eternally. You may have acces to every type you saved inside your acccount. Go through the My Forms portion and decide on a type to printing or obtain again.

Remain competitive and obtain, and printing the Virgin Islands Coaching Worksheet with US Legal Forms. There are millions of specialist and express-distinct kinds you may use to your company or person requires.

Form popularity

FAQ

A U.S. citizen or resident alien (other than a bona fide resident of the U.S. Virgin Islands (USVI)) with income from sources in the USVI or income effectively connected with the conduct of a trade or business in the USVI uses this form to figure the amount of U.S. tax allocable to the USVI. About Form 8689, Allocation of Individual Income Tax to the ... - IRS irs.gov ? forms-pubs ? about-form-8689 irs.gov ? forms-pubs ? about-form-8689

The US Congress has granted USVI the authority to allow a lowered tax rate to bona fide residents of the USVI. Any income related to a USVI business is also taxed at a lower rate. Bona fide USVI residents pay taxes to the Virgin Islands Bureau of Internal Revenue (BIR) instead of the IRS.

USVI Bona-Fide Resident (Pub 570) Meet the presence test, Do not have a tax home outside the relevant territory, and. Do not have a closer connection to the United States or to a foreign country than to the relevant territory.

US Virgin Islands does not use a state withholding form because there is no personal income tax in US Virgin Islands. US Virgin Islands Payroll Tools, Tax Rates and Resources - PaycheckCity paycheckcity.com ? payroll-resources ? us-v... paycheckcity.com ? payroll-resources ? us-v...

USVI Bona-Fide Resident (Pub 570) Meet the presence test, Do not have a tax home outside the relevant territory, and. Do not have a closer connection to the United States or to a foreign country than to the relevant territory. Do I Qualify as a USVI Bona-Fide Resident or File Form 8969? irsstreamlinedprocedures.com ? do-i-qualify... irsstreamlinedprocedures.com ? do-i-qualify...

An individual who qualifies as a bona fide resident of the U.S. Virgin Islands (or who files a joint U.S. return with a U.S. citizen or resident with U.S. Virgin Islands income) will generally have no U.S. tax liability so long as the taxpayer reports all income from all sources on the return filed with the U.S. Virgin ... Resident of U.S. Virgin Islands - Master Tax Guide cch.com ? document ? resident-of-... cch.com ? document ? resident-of-...

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least:singleunder 65$12,950single65 or older$14,700head of householdunder 65$19,400head of household65 or older$21,1506 more rows

If your income is less than your standard deduction, you generally don't need to file a return (provided you don't have a type of income that requires you to file a return for other reasons, such as self-employment income).