Virgin Islands Self-Employed Independent Contractor Questionnaire

Description

How to fill out Self-Employed Independent Contractor Questionnaire?

If you need to access, download, or print authorized document templates, utilize US Legal Forms, the premier source of legal forms available online.

Leverage the site's user-friendly search functions to locate the documents you require. A variety of templates for business and personal purposes are classified by categories and suggestions, or keywords.

Use US Legal Forms to acquire the Virgin Islands Self-Employed Independent Contractor Questionnaire with just a few clicks.

Every legal document template you purchase is yours to keep permanently. You will have access to each form you downloaded within your account. Click the My documents section to select a form to print or download again.

Be proactive and download, and print the Virgin Islands Self-Employed Independent Contractor Questionnaire from US Legal Forms. There are numerous professional and jurisdiction-specific forms available for your business or personal needs.

- If you are a returning US Legal Forms user, Log In to your account and click the Download button to locate the Virgin Islands Self-Employed Independent Contractor Questionnaire.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the correct form for your city/state.

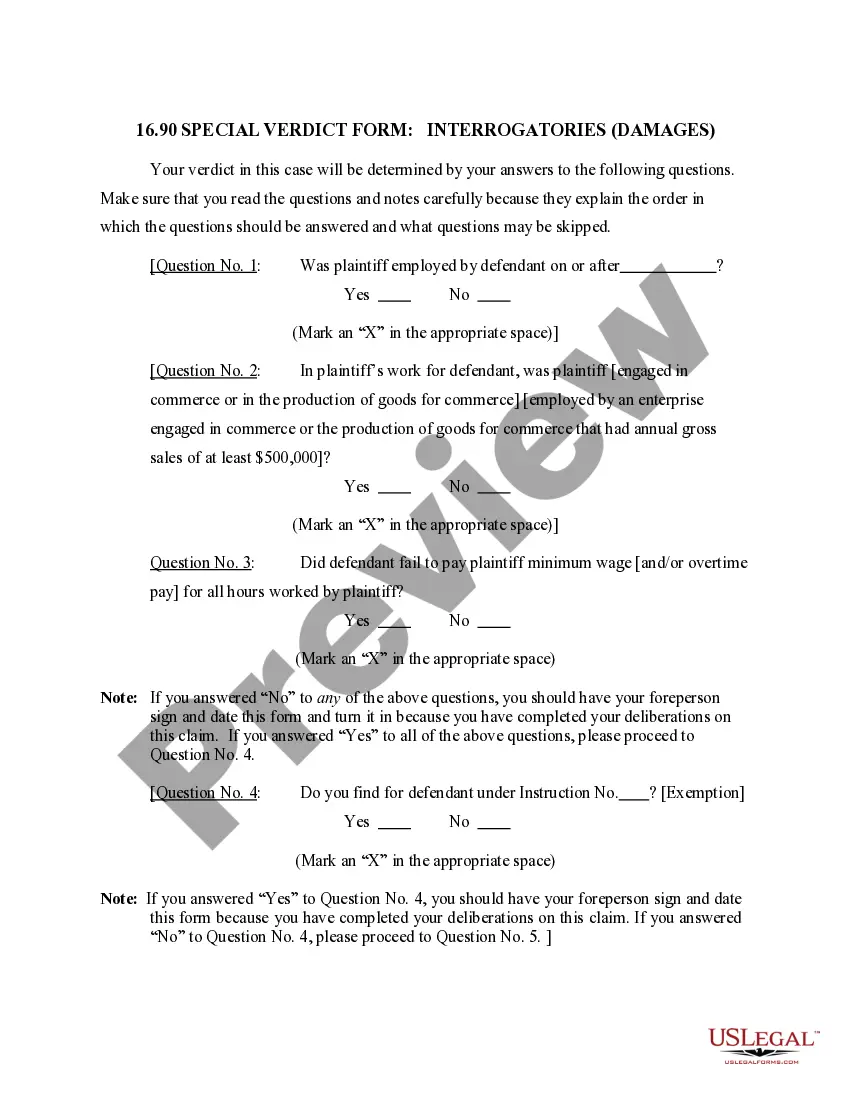

- Step 2. Use the Preview feature to review the form's content. Don’t forget to read the information carefully.

- Step 3. If the form does not meet your expectations, use the Search section at the top of the page to find other versions of the legal form.

- Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you prefer and input your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account for the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Virgin Islands Self-Employed Independent Contractor Questionnaire.

Form popularity

FAQ

Nonresident aliens are not subject to self-employment tax. However, self-employment income you receive while you are a resident alien is subject to self-employment tax even if it was paid for services you performed as a nonresident alien.

Nonresident aliens are not subject to self-employment tax. However, self-employment income you receive while you are a resident alien is subject to self-employment tax even if it was paid for services you performed as a nonresident alien.

However, there are three good ways that you can reduce the amount of self-employment tax that you owe.Increase Your Business Expenses. The only guaranteed way to lower your self-employment tax is to increase your business-related expenses.Increase Tax During Years With Losses.Consider Forming an S-Corporation.

Some ways to prove self-employment income include:Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.

Nevertheless, independent contractors are usually responsible for paying the Self-Employment Tax and income tax. With that in mind, it's best practice to save about 2530% of your self-employed income to pay for taxes. (If you're looking to automate this, check out Tax Vault!)

However, there are three good ways that you can reduce the amount of self-employment tax that you owe.Increase Your Business Expenses. The only guaranteed way to lower your self-employment tax is to increase your business-related expenses.Increase Tax During Years With Losses.Consider Forming an S-Corporation.

Independent Contractor? Don't Make These 5 Tax MistakesForgetting about self-employment tax.Not making estimated tax payments on time (and in sufficient amounts)Taking the home office deduction if you aren't entitled to it.Not taking advantage of the retirement accounts available to you.Not reporting your 1099 income.

Workers who are considered self-employed include sole proprietors, freelancers, and independent contractors who carry on a trade or business. Individuals who are self-employed and earn less than $400 a year (or less than $108.28 from a church) are exempt from paying the self-employment tax.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.