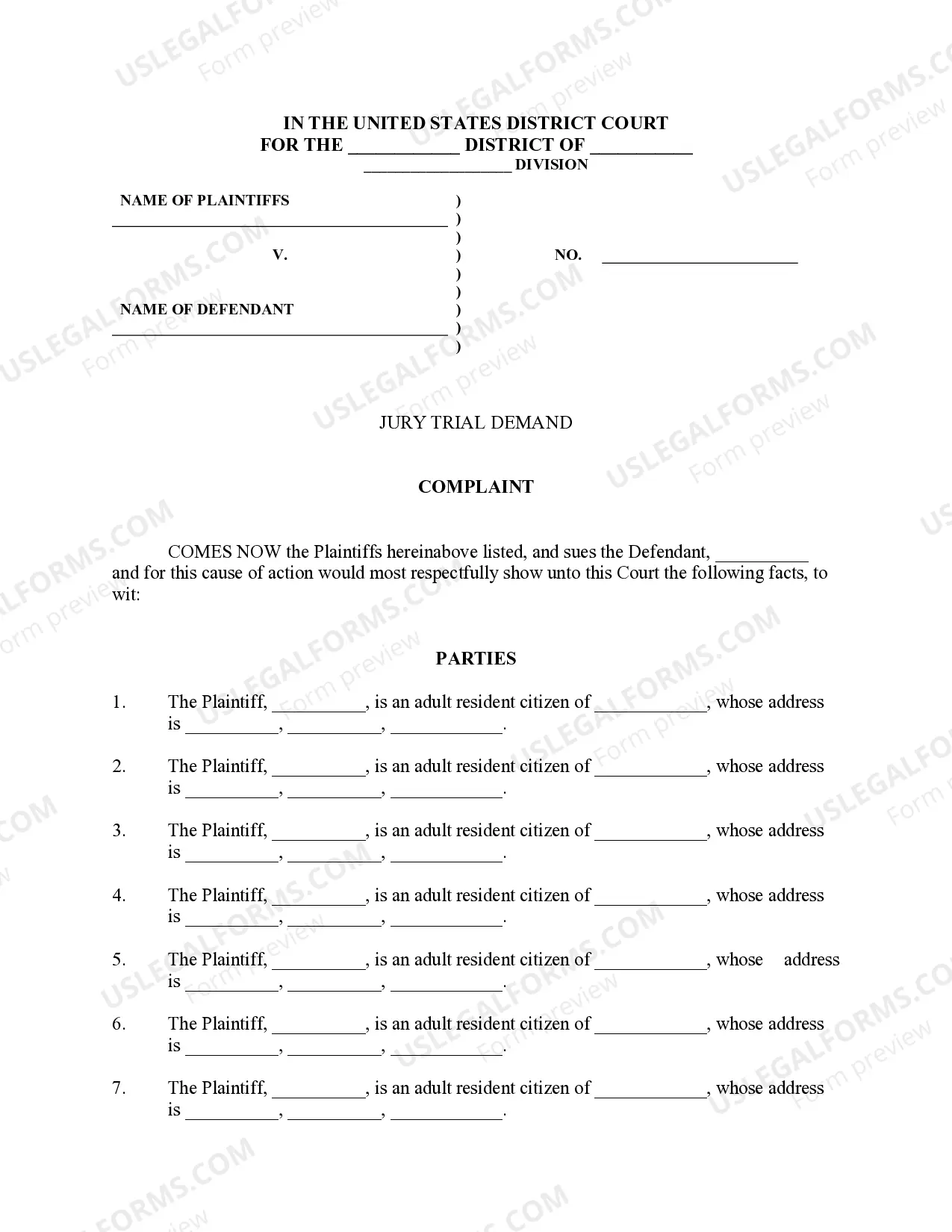

Virgin Islands Agreement Replacing Joint Interest with Annuity

Description

How to fill out Agreement Replacing Joint Interest With Annuity?

It is feasible to allocate time on the internet seeking the legal document format that aligns with the state and federal requirements you need.

US Legal Forms offers a vast array of legal templates that have been reviewed by experts.

You can conveniently obtain or print the Virgin Islands Agreement Replacing Joint Interest with Annuity through the service.

If available, use the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the Virgin Islands Agreement Replacing Joint Interest with Annuity.

- Every legal document template you obtain is yours to keep indefinitely.

- To access another copy of any purchased form, navigate to the My documents tab and click the relevant button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the area/city of your preference.

- Review the form description to confirm that you have selected the correct form.

Form popularity

FAQ

Distributions from your annuity are generally reportable on Form 1040, Form 1040-SR, or 1040-NR. You are required to attach Copy B of your 1099-R to your federal income tax return only if federal income tax is withheld and an amount is shown in Box 4.

You do not owe income taxes on your annuity until you withdraw money or begin receiving payments. Upon a withdrawal, the money will be taxed as income if you purchased the annuity with pre-tax funds. If you purchased the annuity with post-tax funds, you would only pay tax on the earnings.

Annuity early withdrawal penalties Annuity withdrawals made before you reach age 59½ are typically subject to a 10% early withdrawal penalty tax. For early withdrawals from a qualified annuity, the entire distribution amount may be subject to the penalty.

To avoid owing penalties to the IRS, wait to withdraw until you are 59 ½ and set up a systematic withdrawal schedule. What is the free annuity withdrawal provision? Many, but not all, insurance companies allow you to withdraw up to 10 percent of your funds prior to the end of the surrender period.

Definition: Replacement is any transaction where, in connection with the purchase of New Insurance or a New Annuity, you lapse, surrender, convert to Paid-up Insurance, Place on Extended Term, or borrow all or part of the policy loan values on an existing insurance policy or an annuity.

How Do I Fill Out Form W-8BEN?Part I Identification of Beneficial Owner:Line 1: Enter your name as the beneficial owner.Line 2: Enter your country of citizenship.Line 3: Enter your permanent residence/mailing address.Line 4: Enter your mailing address, if different.More items...

You do not owe income taxes on your annuity until you withdraw money or begin receiving payments. Upon a withdrawal, the money will be taxed as income if you purchased the annuity with pre-tax funds. If you purchased the annuity with post-tax funds, you would only pay tax on the earnings.

A replacement occurs when a new policy or contract is purchased and, in connection with the sale, you discontinue making premium payments on the existing policy or contract, or an existing policy or contract is surrendered, forfeited, assigned to the replacing insurer, or otherwise terminated or used in a financed

The taxable part of your pension or annuity payments is generally subject to federal income tax withholding. You may be able to choose not to have income tax withheld from your pension or annuity payments (unless they're eligible rollover distributions) or may want to specify how much tax is withheld.

As long as you do not withdraw your investment gains and keep them in the annuity, they are not taxed. A variable annuity is linked to market performance. If you do not withdraw your earnings from the investments in the annuity, they are tax-deferred until you withdraw them.