This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virgin Islands Proxy of Member of Nonprofit Corporation

Description

How to fill out Proxy Of Member Of Nonprofit Corporation?

Have you experienced a situation where you frequently require documents for either business or personal reasons.

There is a plethora of legitimate document templates accessible online, yet discovering reliable ones is challenging.

US Legal Forms offers numerous form templates, such as the Virgin Islands Proxy of Member of Nonprofit Corporation, designed to comply with state and federal regulations.

Once you identify the correct form, click Get now.

Select your desired pricing plan, fill out the necessary information to create your account, and complete the purchase using your PayPal or credit card. Choose a suitable document format and download your copy. Access all the document templates you have acquired in the My documents section. You can retrieve another copy of the Virgin Islands Proxy of Member of Nonprofit Corporation at any time if needed. Simply select the desired form to download or print the document template.

- If you are familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Virgin Islands Proxy of Member of Nonprofit Corporation template.

- If you do not have an account and wish to start utilizing US Legal Forms, follow these steps.

- Locate the form you need and ensure it pertains to your specific city/region.

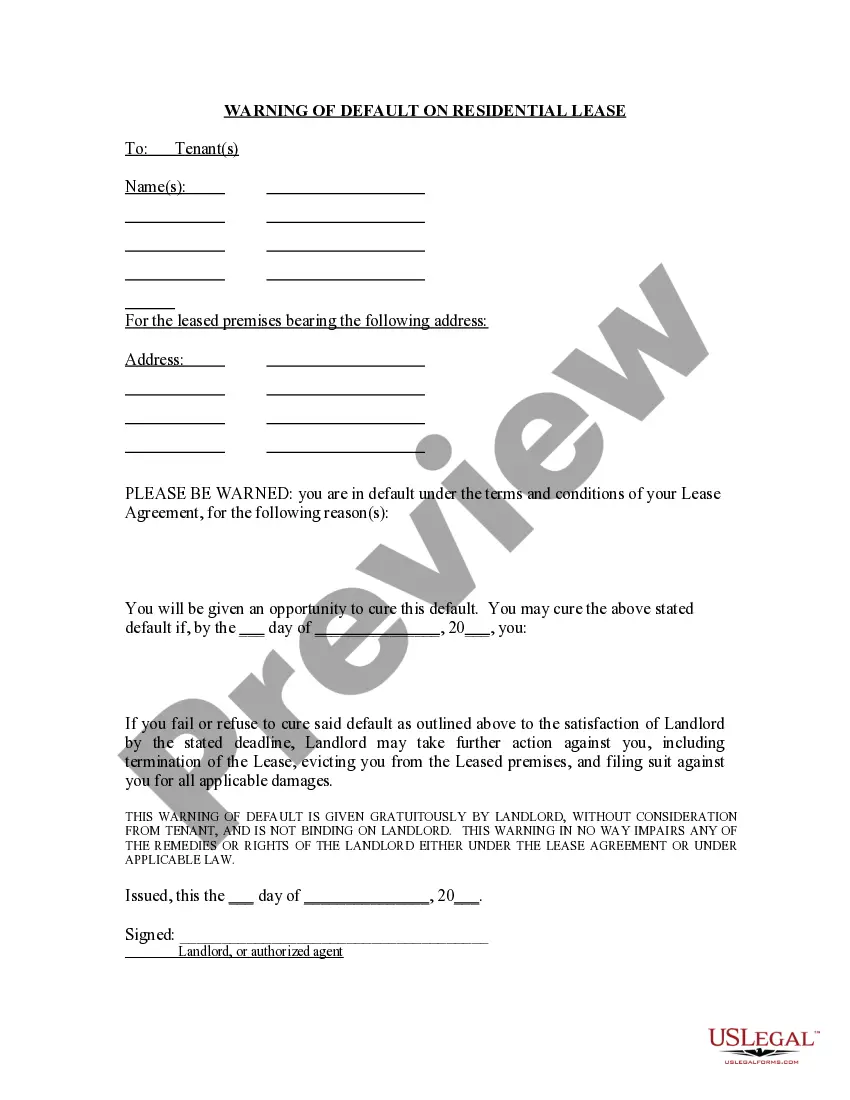

- Use the Preview button to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you require, use the Search field to find one that suits your needs.

Form popularity

FAQ

In a nonprofit corporation, non-shareholders typically do not possess voting rights. However, members who hold voting rights can appoint a proxy to vote on their behalf. This means that while non-shareholders may not vote directly, they can still influence decisions if appointed as proxies. The Virgin Islands Proxy of Member of Nonprofit Corporation concept allows for strategic participation in decision-making.

The rules for proxies in nonprofit corporations generally require that proxies be appointed in writing and filed with the organization in advance of any meeting. Additionally, the appointed proxy should have clear instructions on how to vote on specific issues. It's vital to follow these guidelines to ensure the validity of the proxy's authority during meetings. Referencing the Virgin Islands Proxy of Member of Nonprofit Corporation regulations can help clarify these rules.

Yes, a non-shareholder can act as a proxy in a nonprofit corporation. This allows for more inclusive and diverse representation at meetings. Members often choose individuals who have a strong understanding of the organization’s values and mission, rather than strictly relying on shareholders. Hence, the Virgin Islands Proxy of Member of Nonprofit Corporation accommodates this flexibility.

Starting a nonprofit in the US Virgin Islands requires several steps, starting with drafting your organization’s mission and bylaws. You must file Articles of Incorporation with the Department of Licensing and Consumer Affairs. Also, obtaining a federal tax exemption from the IRS is crucial for nonprofit status. Platforms like US Legal Forms can guide you through the documentation process to ensure you meet all legal requirements, making it easier to establish your nonprofit successfully.

No, a proxy does not need to be a shareholder in a nonprofit corporation. The primary requirement is that the individual holds membership within the organization. This allows greater flexibility in appointing someone who understands the nonprofit's goals and can represent the member's interests effectively. This feature enhances the functionality of the Virgin Islands Proxy of Member of Nonprofit Corporation process.

Any member of a nonprofit corporation can be appointed as a proxy, including individuals from outside the organization. This empowers members to delegate their voting rights to a trusted individual. It is essential, however, to ensure that the proxy understands the responsibilities entailed. Thus, when you consider a Virgin Islands Proxy of Member of Nonprofit Corporation, choose someone who is knowledgeable about the organization's mission.

The answer is yes - nonprofits can own a for-profit subsidiary or entity. A nonprofit can own a for-profit entity regardless of whether or not it is a corporation or limited liability company, but there are rules pertaining to any money invested by the nonprofit during the start-up process.

No one person or group of people can own a nonprofit organization. Ownership is the major difference between a for-profit business and a nonprofit organization. For-profit businesses can be privately owned and can distribute earnings to employees or shareholders.

Differences Between Nonprofit Corporations and Unincorporated Nonprofits. While unincorporated nonprofit associations are formed simply by two or more people coming together with the common goal of providing a public good or service, nonprofit corporations are separate legal entities.

What is your mission? One of the most vital things to consider when you are starting a nonprofit is your mission. Writing a mission statement of one to two sentences can outline why it exists, what the organization does, who it serves and where it provides services all in one place.