Virgin Islands Invoice Template for Self Employed

Description

How to fill out Invoice Template For Self Employed?

Are you presently in a circumstance where you need documents for either business or particular purposes nearly every day.

There are numerous legal document templates accessible online, but finding those you can trust is not simple.

US Legal Forms provides thousands of form templates, including the Virgin Islands Invoice Template for Self Employed, designed to meet state and federal requirements.

Once you find the correct form, click on Purchase now.

Select the pricing plan you desire, enter the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Virgin Islands Invoice Template for Self Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

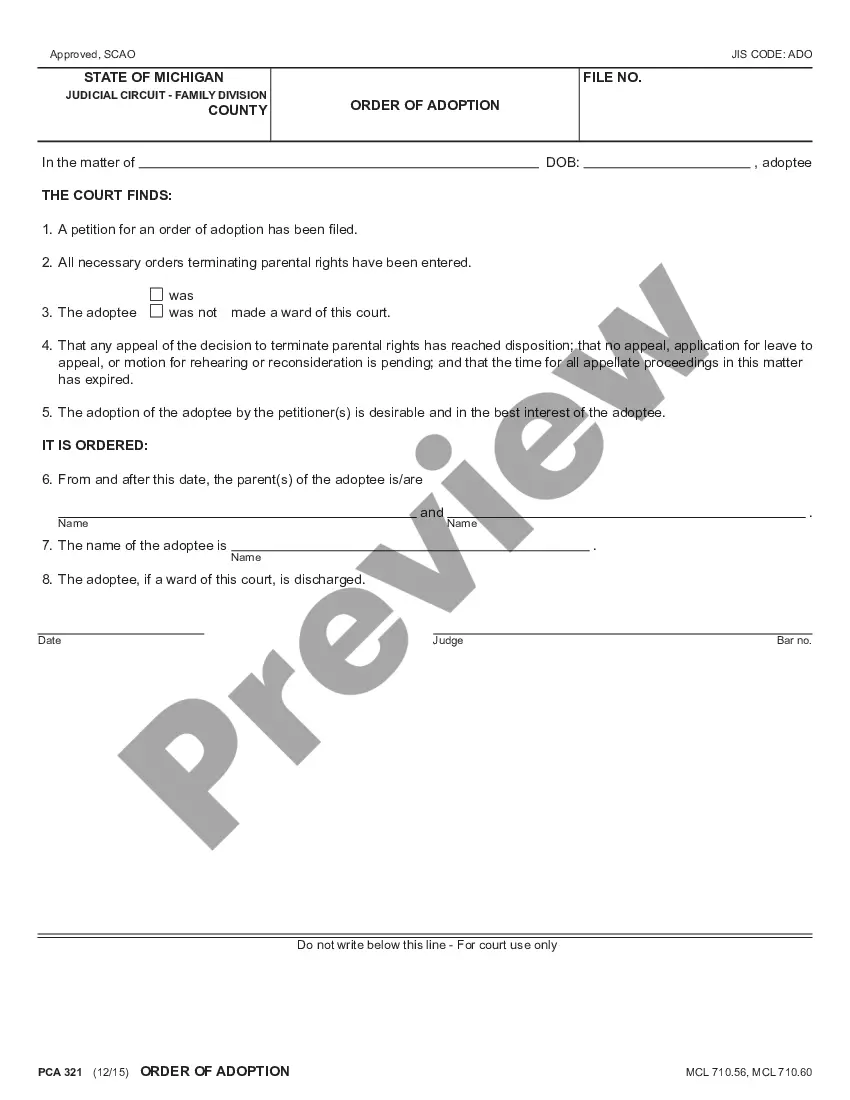

- Use the Review button to examine the form.

- Read the description to verify you have selected the correct form.

- If the form is not what you are looking for, utilize the Search section to find the form that fits your needs.

Form popularity

FAQ

Yes, you can create an invoice without forming an LLC. Just use a Virgin Islands Invoice Template for Self Employed to facilitate the process. Make sure to include your personal details and outline the services you provide. Always comply with local tax laws to ensure you manage your income correctly.

Submitting an invoice to an independent contractor involves a few straightforward steps. First, customize a Virgin Islands Invoice Template for Self Employed that includes your contact information, payment terms, and detailed service descriptions. Once you've filled it out, email or deliver the invoice personally, making sure to track it for your records. Clear communication ensures prompt payments.

To create a self employed invoice, start by selecting a reliable Virgin Islands Invoice Template for Self Employed. Include essential information such as your name, address, contact details, and a unique invoice number. Specify the services rendered, along with costs, and clearly state the payment terms. Once completed, send the invoice to your client, ensuring that it meets all legal requirements.

To create a self-billing invoice, utilize a Virgin Islands Invoice Template for Self Employed to simplify the process. Begin by noting your services and expenses, ensuring every detail is clear. The client will agree to the invoice terms beforehand, allowing you to issue invoices on their behalf. This method can streamline payments and minimize administrative tasks.

Yes, generating an invoice from yourself is easy with the right tools. Using a Virgin Islands Invoice Template for Self Employed allows you to manage this efficiently. Fill in your details and the services rendered to create a professional invoice. This method ensures that your invoices are accurate and reflect your business identity.

Creating an independent contractor invoice involves using a reliable Virgin Islands Invoice Template for Self Employed. Start by detailing your services, hours worked, and applicable rates. Include both your contact information and the client's details, along with payment terms. This organized approach not only makes invoicing easier but also accelerates your payment cycle.

To ensure you receive payment, begin your invoice with a Virgin Islands Invoice Template for Self Employed. Clearly state your services, rates, and payment terms upfront. It's important to specify due dates and available payment methods to streamline the process for your clients. This transparency fosters trust and encourages timely payment.

Creating a self-employed invoice is straightforward when using a Virgin Islands Invoice Template for Self Employed. Begin with your business name and logo, followed by the client's information. Clearly outline the services provided, along with the amount due, and make sure to state payment terms. A well-structured invoice portrays professionalism and helps in receiving payments promptly.

For beginners, invoicing begins with understanding the basics of a Virgin Islands Invoice Template for Self Employed. Start by listing your services and corresponding costs in an organized manner. Make sure to add your payment details and incentivize prompt payments, such as by including due dates. Familiarizing yourself with templates can simplify this process significantly.

To create a self-invoice, start by choosing a Virgin Islands Invoice Template for Self Employed that meets your needs. Fill in essential details such as your name, contact information, and the services rendered. Include the invoice number, date, payment terms, and a breakdown of your charges. By using a clear and professional format, you ensure your clients understand the invoice easily.