Virgin Islands Confidentiality and Nondisclosure Agreement - Promoter to Owner

Description

How to fill out Confidentiality And Nondisclosure Agreement - Promoter To Owner?

If you're looking to acquire comprehensive, obtain, or print legal document templates, visit US Legal Forms, the largest collection of legal documents available online.

Utilize the site's user-friendly and convenient search feature to locate the documents you need.

A diverse selection of templates for business and personal purposes are sorted by categories and states, or keywords.

Step 4. Once you have found the form you need, select the Purchase now option. Pick the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can use your Мisa or Ьastercard or PayPal account to finish the purchase. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Virgin Islands Confidentiality and Nondisclosure Agreement - Promoter to Owner.

- Use US Legal Forms to find the Virgin Islands Confidentiality and Nondisclosure Agreement - Promoter to Owner with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to find the Virgin Islands Confidentiality and Nondisclosure Agreement - Promoter to Owner.

- You can also access documents you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure that you have chosen the form for the correct city/state.

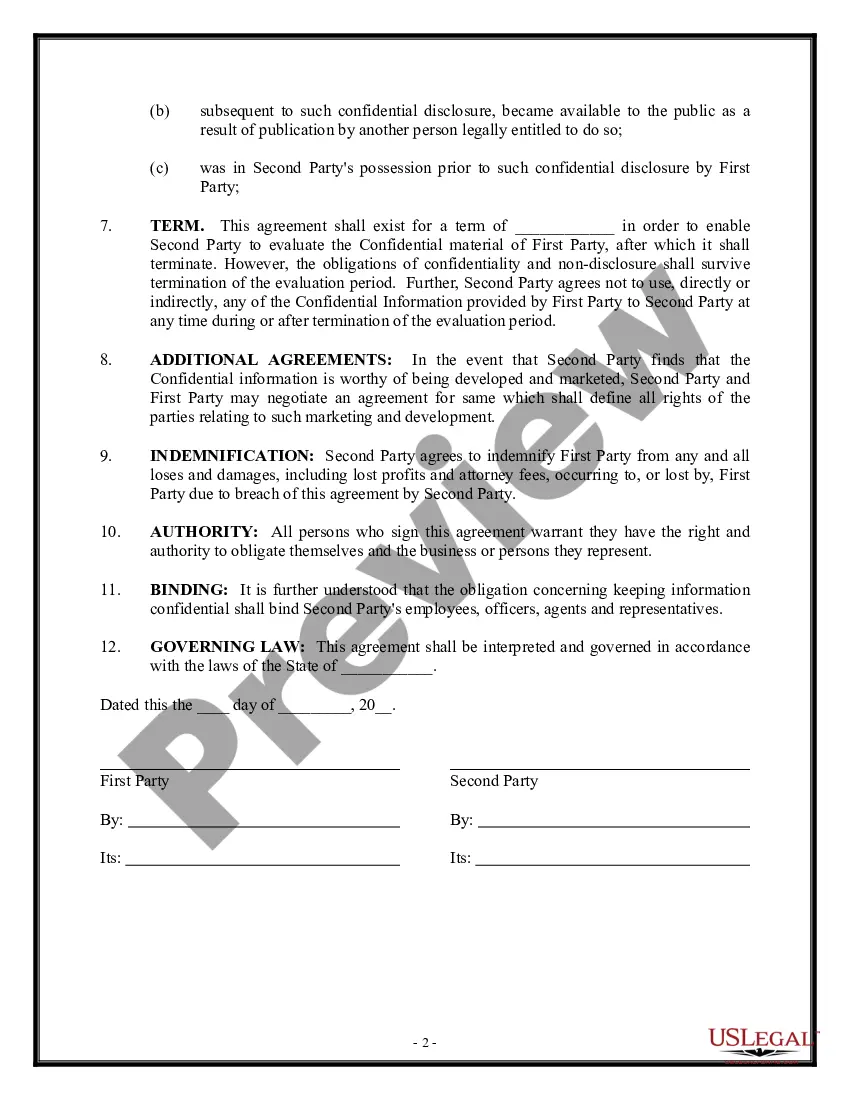

- Step 2. Use the Preview option to view the details of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to look for other variations of the legal form format.

Form popularity

FAQ

Contract law in the British Virgin Islands follows common law principles, emphasizing the importance of offer, acceptance, and consideration. Contracts must be clear and sufficiently detailed to be enforceable, and local statutes may also apply. When entering into agreements, such as a Virgin Islands Confidentiality and Nondisclosure Agreement - Promoter to Owner, ensure that you fully understand your rights and obligations under local law.

To register a business in the British Virgin Islands, you need to choose a unique business name and appoint a registered agent. The registration process involves submitting the company’s charter and relevant documentation to the Financial Services Commission. After registration, consider employing a Virgin Islands Confidentiality and Nondisclosure Agreement - Promoter to Owner to ensure your business information remains secure.

US laws do not automatically apply in the British Virgin Islands since it operates as a separate jurisdiction. However, certain US federal regulations may influence businesses when they operate internationally. If you are a US business looking to protect your interests, drafting a Virgin Islands Confidentiality and Nondisclosure Agreement - Promoter to Owner is a practical way to safeguard proprietary information.

In the British Virgin Islands, both local statutes and common law govern legal matters. The territory has its own laws that cater to its specific context while still aligning with UK law. Therefore, when forming agreements, such as a Virgin Islands Confidentiality and Nondisclosure Agreement - Promoter to Owner, it is essential to consult these legal codes to ensure they meet local standards.

The British Virgin Islands operates under a common law legal system, which is heavily influenced by English law. This means that legal precedents set by court decisions play a significant role in shaping the law. For businesses, this is vital when creating contracts, including a Virgin Islands Confidentiality and Nondisclosure Agreement - Promoter to Owner, to ensure legal compliance and enforceability.

BVI labor law primarily governs employment relationships within the British Virgin Islands. It includes regulations on wages, working hours, employee rights, and employer obligations. Understanding these laws is crucial for any business operating in the region. When dealing with employee confidentiality, a Virgin Islands Confidentiality and Nondisclosure Agreement - Promoter to Owner can help protect sensitive business information.

While both terms often overlap, the primary difference lies in their applications and legal implications. An NDA primarily focuses on prohibiting the sharing of specific details, making it a crucial instrument in the Virgin Islands Confidentiality and Nondisclosure Agreement - Promoter to Owner. On the other hand, a confidentiality agreement may be broader and cover various aspects of information sharing, depending on the context of its use.

A nondisclosure agreement, particularly the Virgin Islands Confidentiality and Nondisclosure Agreement - Promoter to Owner, safeguards the interests of both business owners and customers by preventing the unauthorized sharing of sensitive information. Protecting trade secrets, client details, and business strategies creates a sense of trust among stakeholders. In turn, this fosters a secure environment that encourages collaboration, innovation, and customer loyalty.

While an NDA and a confidentiality agreement serve similar functions, they are not entirely interchangeable. Both emphasize the protection of sensitive information, yet an NDA typically emphasizes legal recourse for breaches. The Virgin Islands Confidentiality and Nondisclosure Agreement - Promoter to Owner is a specific type of NDA that provides clear boundaries for both parties involved.

A confidentiality deed is usually a formal document that outlines obligations related to secrecy, while a nondisclosure agreement (NDA) often serves a broader purpose by emphasizing legal implications. In the context of the Virgin Islands Confidentiality and Nondisclosure Agreement - Promoter to Owner, the NDA directly binds all parties to confidentiality regarding shared information. Understanding these distinctions can help you choose the best document for your specific needs.