Maine Debtor's Certification of Completion of Instructional Course Concerning Personal Financial Management - Post 2005

Description

How to fill out Debtor's Certification Of Completion Of Instructional Course Concerning Personal Financial Management - Post 2005?

US Legal Forms - one of several greatest libraries of legitimate varieties in the United States - gives a wide range of legitimate file templates it is possible to down load or produce. Making use of the internet site, you can get a large number of varieties for organization and individual purposes, categorized by groups, says, or keywords.You can get the latest versions of varieties like the Maine Debtor's Certification of Completion of Instructional Course Concerning Personal Financial Management - Post 2005 in seconds.

If you already have a monthly subscription, log in and down load Maine Debtor's Certification of Completion of Instructional Course Concerning Personal Financial Management - Post 2005 through the US Legal Forms local library. The Download switch can look on every form you view. You have access to all in the past delivered electronically varieties within the My Forms tab of your respective account.

If you wish to use US Legal Forms the first time, listed below are easy guidelines to obtain began:

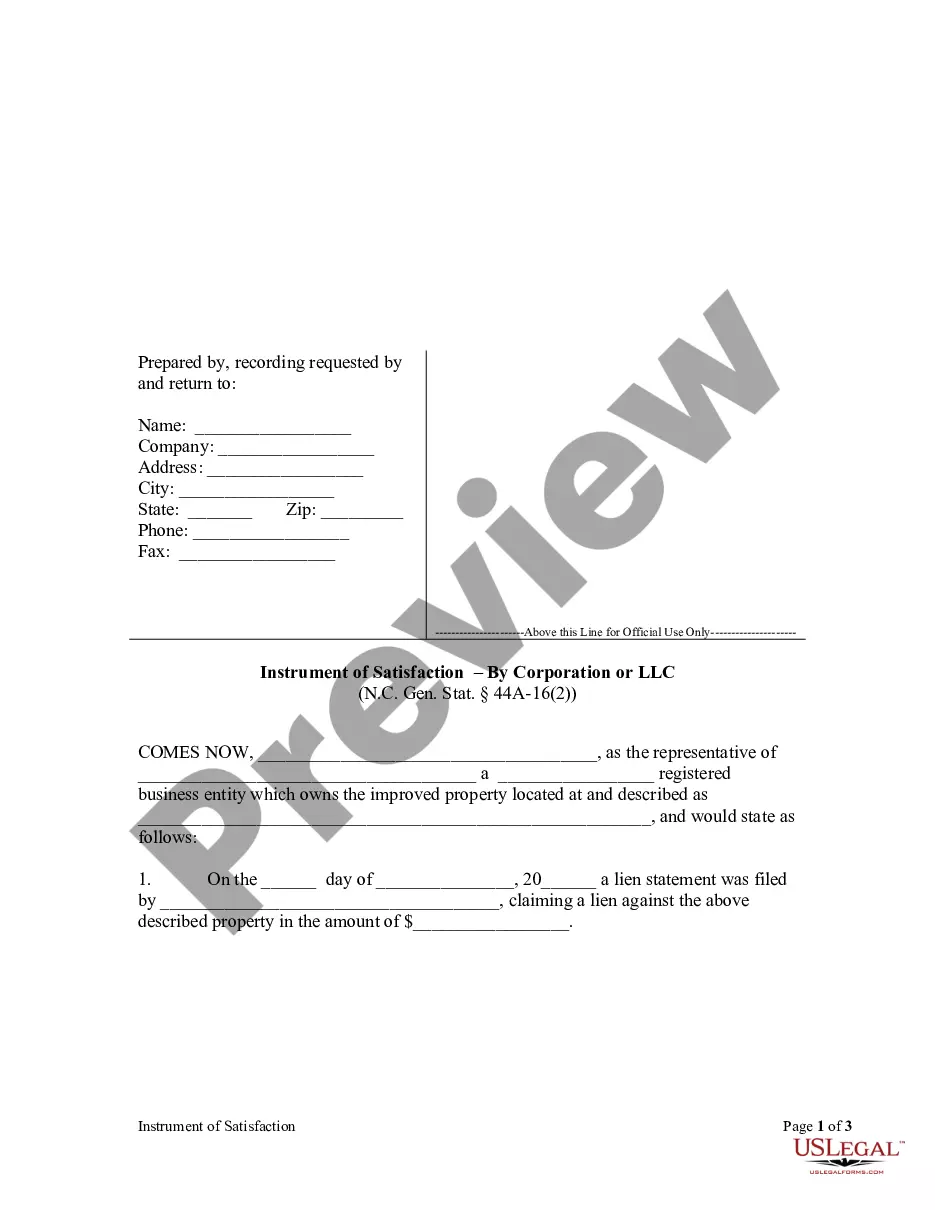

- Be sure you have selected the right form for your personal area/region. Click on the Preview switch to review the form`s information. Read the form information to actually have selected the proper form.

- In case the form does not satisfy your specifications, make use of the Lookup field on top of the display screen to find the one which does.

- If you are satisfied with the form, confirm your decision by clicking on the Acquire now switch. Then, opt for the pricing plan you like and supply your references to register to have an account.

- Process the transaction. Use your credit card or PayPal account to perform the transaction.

- Find the format and down load the form on the system.

- Make changes. Complete, revise and produce and signal the delivered electronically Maine Debtor's Certification of Completion of Instructional Course Concerning Personal Financial Management - Post 2005.

Every single template you put into your bank account lacks an expiration date and it is yours permanently. So, if you wish to down load or produce an additional duplicate, just check out the My Forms area and click about the form you need.

Gain access to the Maine Debtor's Certification of Completion of Instructional Course Concerning Personal Financial Management - Post 2005 with US Legal Forms, by far the most comprehensive local library of legitimate file templates. Use a large number of skilled and status-specific templates that satisfy your business or individual demands and specifications.

Form popularity

FAQ

A $500 to $600 monthly A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly. Average Monthly Payment for Chapter 13 Bankruptcy Case | Jackson MS therollinsfirm.com ? average-monthly-paym... therollinsfirm.com ? average-monthly-paym...

Whether it's a Chapter 13 or 7 or 11, no bankruptcy filing eliminates all debts. Child support and alimony payments aren't dischargeable, nor are student loans and most taxes. Chapter 13 Bankruptcy - What It Is & How It Works - Debt.org Debt.org ? Bankruptcy Debt.org ? Bankruptcy

Also do not not incur debt, use credit, credit cards, or enter into leases while in Chapter 13 without Bankruptcy Court approval, except in the case of an emergency for the protection and preservation of life, health or property. Contact your attorney if you need to sell property or incur debt. What are My Responsibilities in Chapter 13? ch13cha.com ? For Debtors ch13cha.com ? For Debtors

Bankruptcy Courses If you are on the receiving end of Bankruptcy Official Form 423, then it is safe to say that you are in the middle of a bankruptcy. The law requires bankruptcy filers to complete two classes. First, a debtor must complete a pre-filing class. Second, a debtor must complete a post-filing class.

The Bankruptcy Form B23 is essential to finish the last steps of your bankruptcy discharge. In a Chapter 7 case, the Form B23 along with your Personal Financial Management Course Certificate (pre-discharge certificate), must be filed within 45 days after the first 341(a) Meeting of Creditors has happened.