Virgin Islands Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Security Agreement Involving Sale Of Collateral By Debtor?

You might spend hours online seeking the legal document template that meets your state and federal requirements.

US Legal Forms offers thousands of legal forms that have been reviewed by professionals.

You can easily acquire or create the Virgin Islands Security Agreement regarding Sale of Collateral by Debtor through our service.

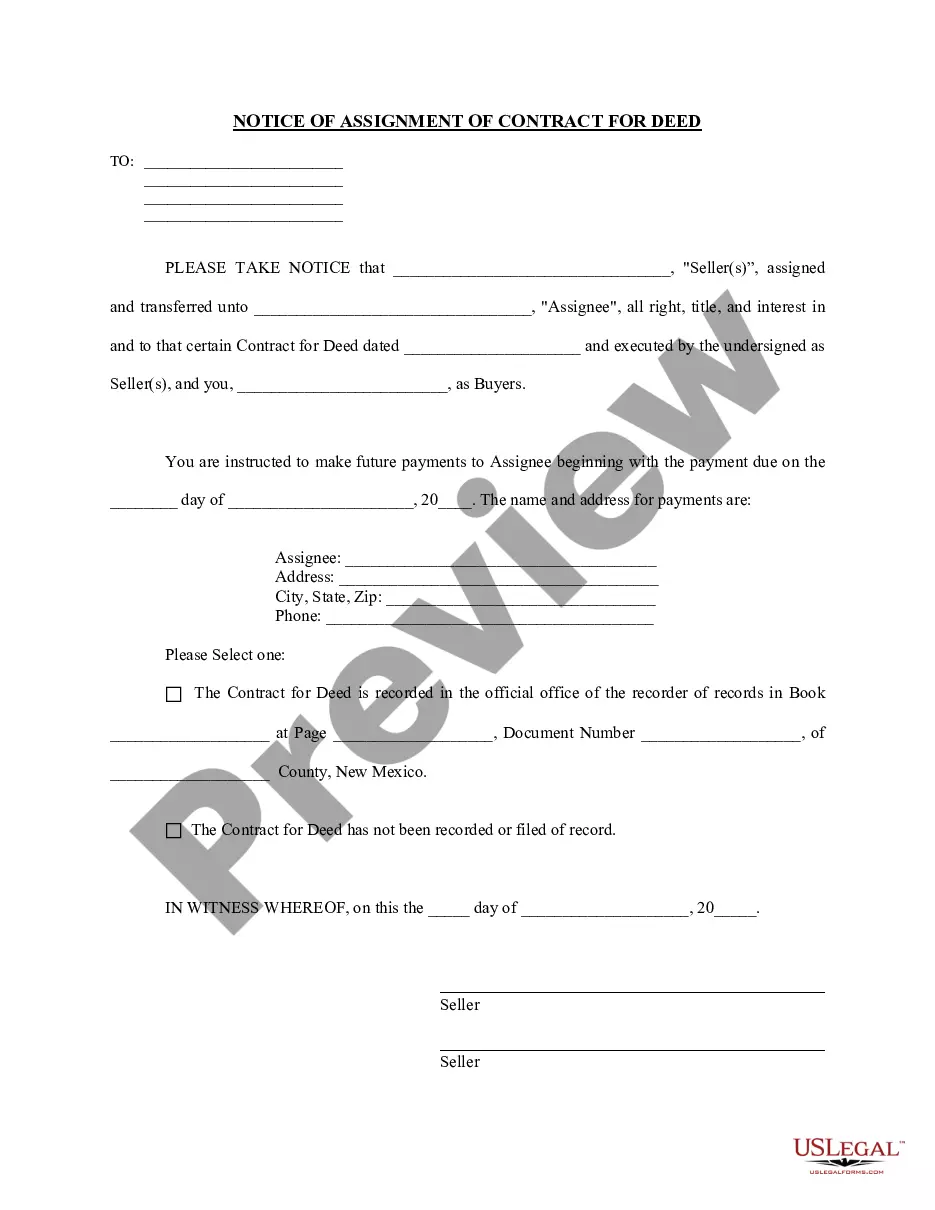

If available, use the Preview button to look through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Virgin Islands Security Agreement regarding Sale of Collateral by Debtor.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure that you have selected the correct document template for the state/city you choose.

- Read the form description to confirm that you have chosen the right form.

Form popularity

FAQ

Typically, a security agreement should be filed with the appropriate local or state registry to provide public notice of the secured interest. In the U.S. Virgin Islands, this might involve recording the agreement through specific governmental offices that handle property and business filings. Properly filing a Virgin Islands Security Agreement involving Sale of Collateral by Debtor reinforces the security interest and can help avoid disputes.

While a security agreement and a lien are related, they are not the same. A security agreement is the contract that establishes the secured interest in the collateral, while a lien is the legal right granted to the lender over the collateral. In a Virgin Islands Security Agreement involving Sale of Collateral by Debtor, the security agreement would detail the collateral, whereas the lien represents the lender's claim to it.

An Article 9 certificate is a document related to the Uniform Commercial Code that provides details about a secured party's interest in collateral. This document is essential in the context of the Virgin Islands Security Agreement involving Sale of Collateral by Debtor. It serves as record-keeping for security interests and helps establish the priority of claims in case of litigation. Using an Article 9 certificate adds another layer of protection for creditors.

The process of making a security interest in the collateral enforceable begins with the execution of the security agreement. Following that, the creditor must either take possession of the collateral or file a financing statement. This ensures public notice of the creditor's interest. Ultimately, completing these steps solidifies the enforceability of the Virgin Islands Security Agreement involving Sale of Collateral by Debtor.

For a creditor to establish an enforceable security interest, three key requirements must be met. First, there must be a valid security agreement, such as the Virgin Islands Security Agreement involving Sale of Collateral by Debtor. Second, the creditor must ensure that the debtor has rights in the collateral. Finally, the creditor must take possession of the collateral or perfect the security interest through filing. Meeting these conditions protects both parties.

Yes, a debtor's signature or authentication is necessary to create a security interest. This requirement ensures that the debtor consents to the terms of the Virgin Islands Security Agreement involving Sale of Collateral by Debtor. Without this authentication, the security interest may not be enforceable. Therefore, having the proper documentation is essential for legal protection.

The Virgin Islands Security Agreement involving Sale of Collateral by Debtor must be signed by the debtor. This agreement outlines the terms under which the debtor offers collateral to secure a debt. By signing this document, the debtor acknowledges the obligation and the specific items involved. It is a critical step in establishing a legally binding secured transaction.

A security agreement is a contract that outlines the terms of the security interest, while a UCC filing is the official documentation that makes the security interest public. The filing serves to notify other creditors about the lender's interest in the debtor's collateral, providing legal protection. For those dealing with a Virgin Islands Security Agreement involving Sale of Collateral by Debtor, it is crucial to complete both steps to ensure the security interests are enforceable.

The purpose of a security agreement is to outline the terms and conditions under which a debtor is allowed to use certain collateral while guaranteeing that the lender has a legal claim to that collateral. This agreement helps clarify the rights and responsibilities of both parties, minimizing ambiguity. A well-crafted Virgin Islands Security Agreement involving Sale of Collateral by Debtor can facilitate smoother transactions and bolster trust between lenders and borrowers.

A security agreement under the Uniform Commercial Code (UCC) is a legal document that grants a lender a security interest in a debtor's collateral. This agreement outlines the terms under which the collateral can be used and the rights of both parties. In the context of a Virgin Islands Security Agreement involving Sale of Collateral by Debtor, it ensures that creditors have a claim to the collateral in case the debtor defaults.