Virgin Islands Triple Net Lease for Industrial Property

Description

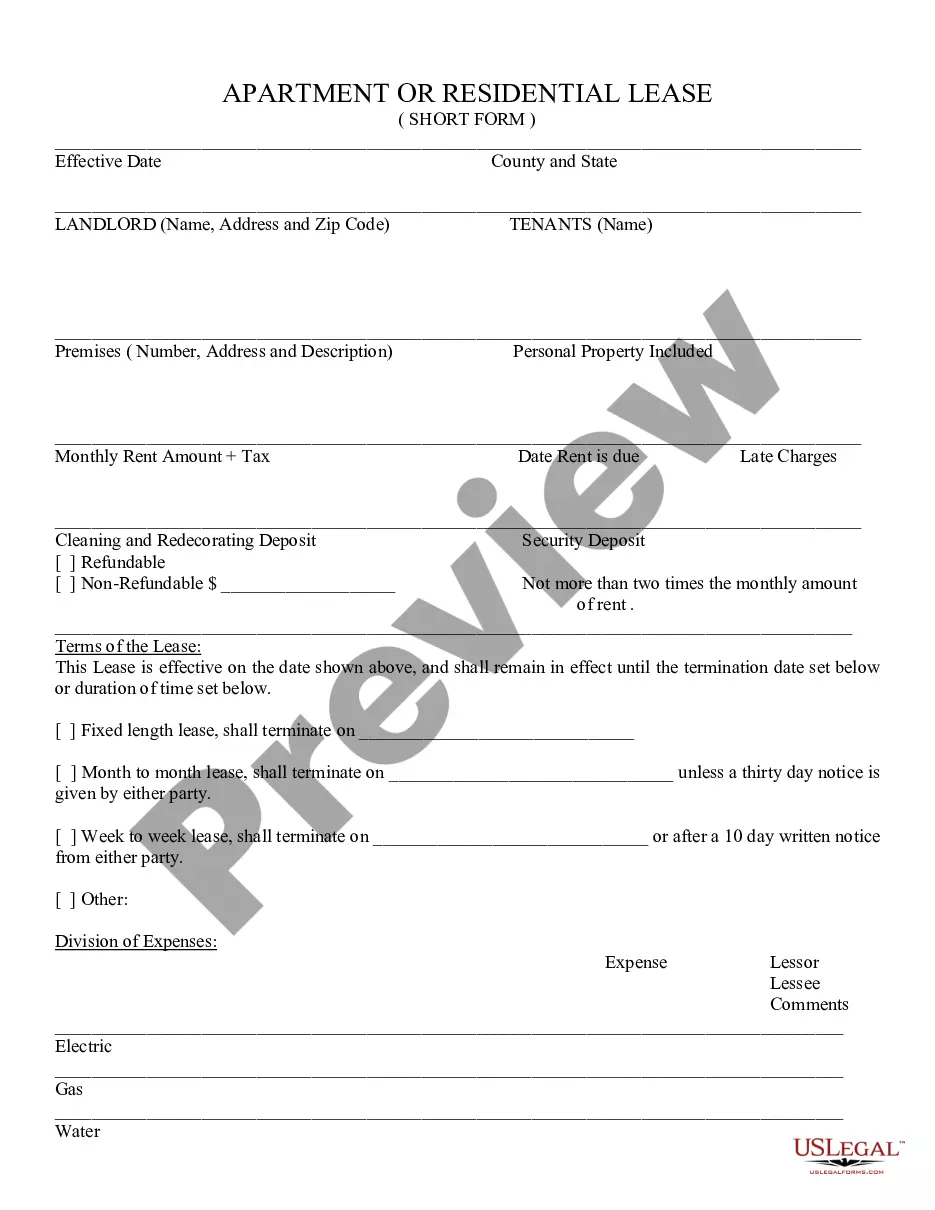

How to fill out Triple Net Lease For Industrial Property?

Selecting the appropriate legal document format can be challenging.

Certainly, there are numerous templates available online, but how do you find the legal form you require.

Utilize the US Legal Forms platform. This service provides thousands of templates, such as the Virgin Islands Triple Net Lease for Industrial Property, which you can use for business and personal purposes.

You can browse the form using the Review button and view the form summary to confirm that this is the right one for you.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the Virgin Islands Triple Net Lease for Industrial Property.

- Use your account to check the legal forms you have acquired previously.

- Navigate to the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple guidelines you can follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

$24.00 sf yr implies the rental rate is $24 per square foot per year. This figure indicates the basic rent amount before considering any additional expenses. For those looking at a Virgin Islands Triple Net Lease for Industrial Property, it's essential to factor in other costs to understand your full financial commitment.

$12 sf NNN indicates that the property rent is $12 per square foot per year, with the tenant responsible for additional expenses. These expenses typically include property taxes, insurance, and repair costs. Understanding this term is crucial when pursuing a Virgin Islands Triple Net Lease for Industrial Property, as it helps you gauge your total financial obligations.

To calculate commercial rent with a Triple Net Lease (NNN) in the Virgin Islands, you need to determine the base rent per square foot and add the property expenses. Typically, the total expenses include property taxes, insurance, and maintenance costs, which are then allocated to the tenant. This approach allows you to understand your overall financial commitment when renting industrial property under a Virgin Islands Triple Net Lease.

One of the primary advantages of a gross lease is the simplicity it offers tenants. Since the landlord usually covers most operating expenses, tenants can predict their monthly costs more accurately. This arrangement often appeals to businesses that want to budget without the burden of varying property expenses. Considering a Virgin Islands Triple Net Lease for Industrial Property may lead you to weigh these factors against your operational preferences.

To secure a triple net lease, you typically start by identifying a property that meets your business needs. Next, you negotiate terms with the landlord, which may involve discussions about maintenance, taxes, and insurance responsibilities. Engaging with a real estate agent familiar with commercial leases can streamline this process. When pursuing a Virgin Islands Triple Net Lease for Industrial Property, having expert guidance can result in a beneficial agreement.

Commercial leases cover a broad spectrum of real estate types, including retail and office space, while industrial leases specifically pertain to properties used for manufacturing, warehousing, or distribution. The terms often differ significantly; for example, industrial leases frequently include specialized conditions for equipment and space requirements. If you are looking into a Virgin Islands Triple Net Lease for Industrial Property, knowing these distinctions can benefit your search.

The key difference between a triple net (NNN) lease and an industrial gross lease lies in the distribution of expenses. In a NNN lease, the tenant assumes responsibility for operating costs, property taxes, and insurance, on top of the base rent. Conversely, in an industrial gross lease, many of these costs are handled by the landlord. For those exploring a Virgin Islands Triple Net Lease for Industrial Property, recognizing these nuances can guide your decision-making.

An industrial gross lease is a type of agreement where the tenant pays a base rent that includes some property expenses. In this arrangement, the landlord often covers costs like property taxes, insurance, and maintenance. This makes budgeting easier for businesses, allowing them to focus on operational costs. If you're considering options like a Virgin Islands Triple Net Lease for Industrial Property, understanding industrial gross leases is essential.

The term 'NNN' stands for 'triple net,' indicating that the tenant is responsible for three primary expenses: property taxes, insurance, and maintenance costs. This structure is commonly used in the Virgin Islands Triple Net Lease for Industrial Property, allowing landlords to have a predictable income stream. Tenants can benefit from this arrangement, as it helps them gain control over their operating costs.

An industrial net lease refers to a leasing agreement where the tenant takes on most of the property-related expenses, such as taxes, insurance, and maintenance. The Virgin Islands Triple Net Lease for Industrial Property exemplifies this type of lease, providing clarity in financial obligations for both parties. This lease structure allows for streamlined management and can often lead to better tenant satisfaction.