Virgin Islands Triple Net Lease

Description

How to fill out Triple Net Lease?

Are you currently in a position where you require documents for either business or personal purposes almost daily? There are numerous legitimate document templates available online, but finding reliable versions can be challenging.

US Legal Forms provides thousands of form templates, including the Virgin Islands Triple Net Lease, which are created to comply with federal and state requirements.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can access the Virgin Islands Triple Net Lease template.

Access all the document templates you have purchased in the My documents section. You can download another copy of the Virgin Islands Triple Net Lease at any time if needed. Simply click on the desired form to download or print the document template.

Use US Legal Forms, perhaps the most extensive collection of lawful forms, to save time and minimize mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- Obtain the form you need and confirm it is for the correct city/county.

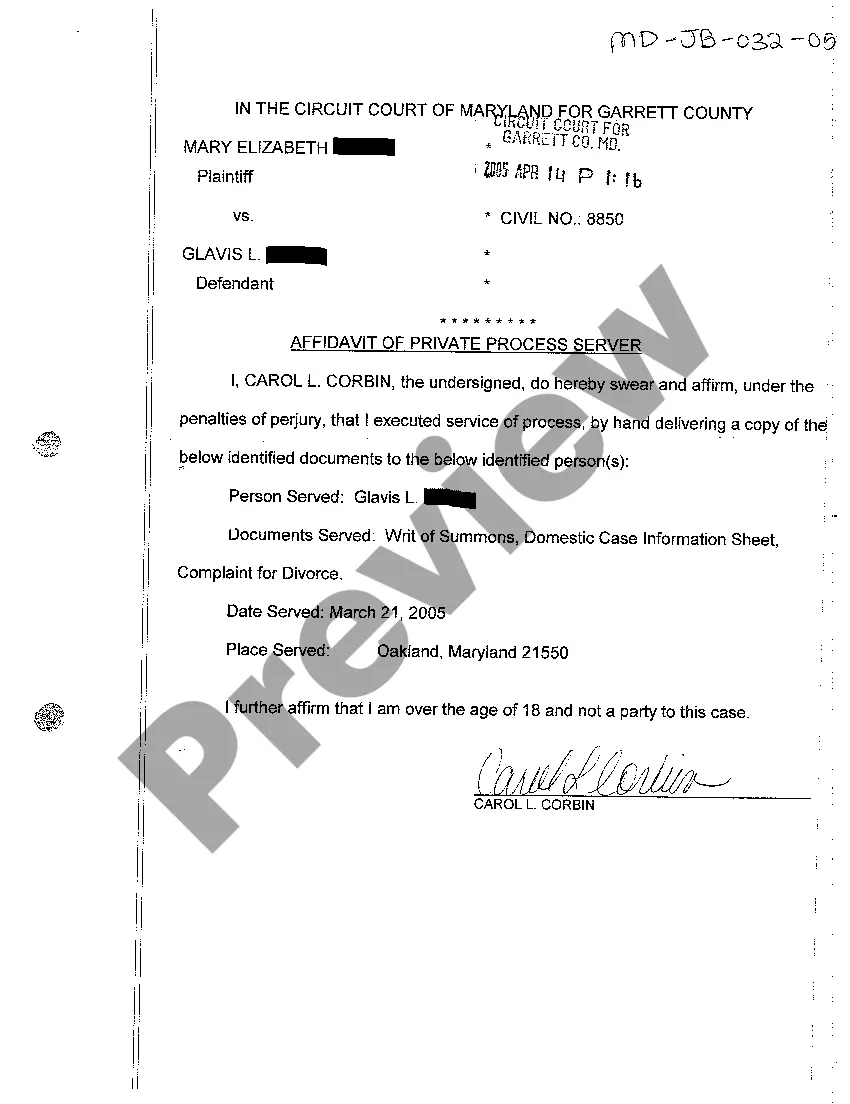

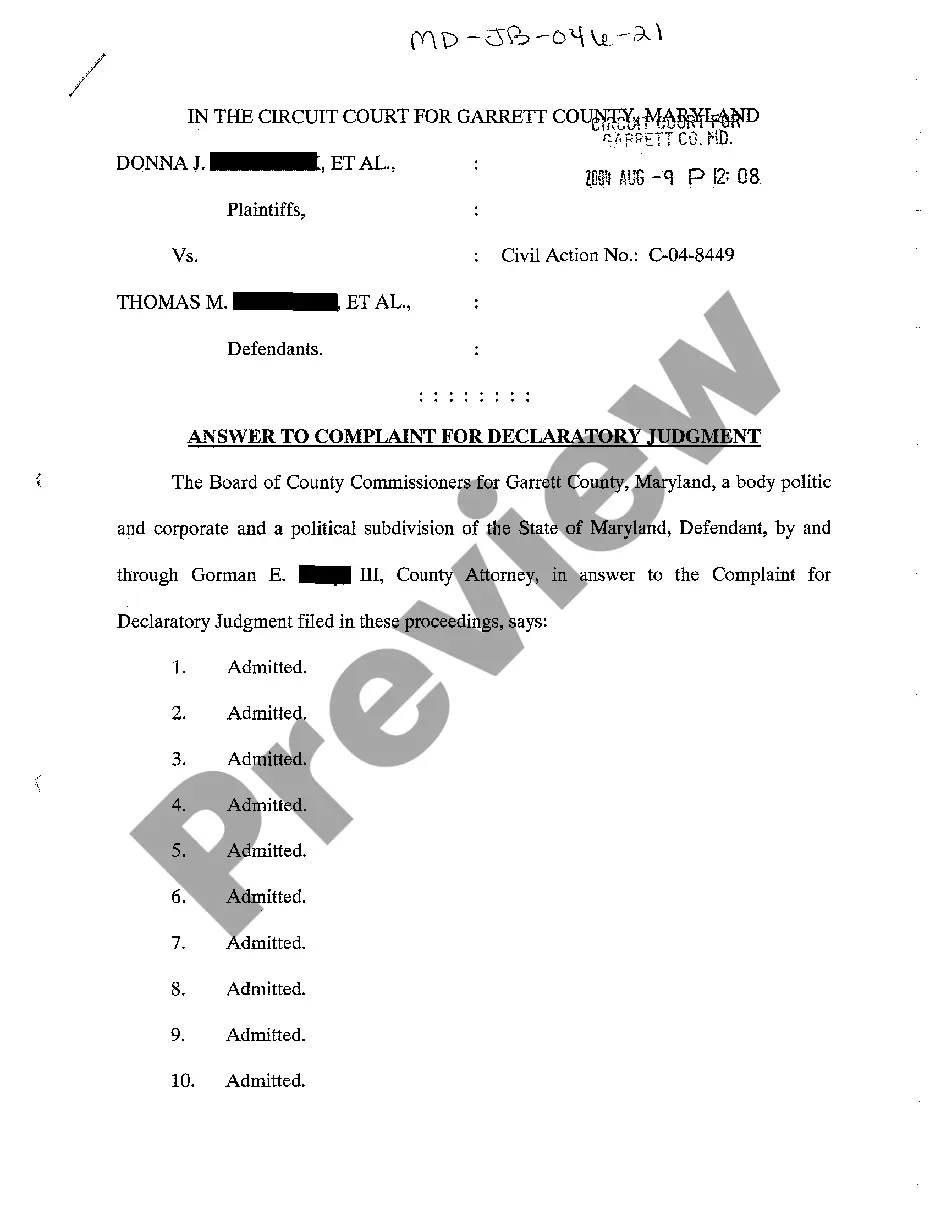

- Utilize the Preview feature to inspect the form.

- Check the description to ensure you have selected the correct document.

- If the form does not match your needs, use the Lookup field to find the form that suits your requirements.

- Once you find the correct form, click on Get now.

- Select the payment plan you require, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

The best tenants for a Virgin Islands Triple Net Lease typically include established businesses with a stable financial history, such as national retail chains, restaurants, or pharmacies. These tenants usually exhibit strong credit profiles, which provide security for landlords. Investing in properties leased to reputable tenants reduces risk and promotes long-term income stability. Therefore, thorough tenant screening can help you choose the right partners for your investment.

Structuring a Virgin Islands Triple Net Lease involves defining the terms clearly in a legal agreement. Begin by outlining the base rent and identifying which costs the tenant will cover, including property taxes, insurance, and maintenance expenses. It is crucial to specify details regarding the calculation of these costs to avoid confusion. A well-drafted lease agreement protects both the landlord’s investment and the tenant’s interests.

Yes, a US citizen can buy a house in the US Virgin Islands. The process for purchasing property is straightforward, as US citizens do not face additional restrictions compared to local buyers. Understanding the local real estate market can help you find the right Virgin Islands Triple Net Lease properties and make informed purchasing decisions. Engage with local real estate experts to navigate regulations effortlessly.

An example of a Virgin Islands Triple Net Lease can be seen in a commercial property lease where the tenant pays a fixed monthly rent plus property taxes, insurance, and maintenance costs. For instance, a retail space might have a monthly base rent of $2,000, and the tenant may also cover $300 in property taxes and $200 in insurance. This arrangement clearly outlines financial responsibilities for both parties, promoting smooth transactions.

Calculating a Virgin Islands Triple Net Lease requires you to determine the base rent and identify the additional expenses associated with the property. These additional expenses typically include property taxes, insurance premiums, and maintenance costs. By adding these amounts to the base rent, you arrive at the total lease amount. This calculation is essential for both parties to ensure transparency and avoid any misunderstandings.

To calculate a Virgin Islands Triple Net Lease, you need to consider the base rent, property taxes, insurance, and maintenance costs. Start with the property's annual rent and then add the estimated annual costs of the additional expenses. This total gives you a clear picture of your financial commitment. Understanding these elements helps both landlords and tenants manage their responsibilities effectively.

A net lease is a rental agreement where the tenant assumes certain financial responsibilities, effectively lowering the management burden on the landlord. In a Virgin Islands Triple Net Lease, tenants cover property taxes, insurance, and maintenance expenses. This allows property owners to enjoy steady income while maintaining a hands-off approach to management.

Calculating a triple net lease involves determining the base rent and adding estimates for property taxes, insurance, and maintenance costs. In a Virgin Islands Triple Net Lease, precise estimates of these additional costs will ensure accurate budgeting. Tools and resources, such as those offered by uslegalforms, can streamline this process.

To calculate a net lease, take the total rental amount and subtract any costs included in the lease. For a Virgin Islands Triple Net Lease, this typically means factoring in the monthly expenses for taxes, insurance, and maintenance. This straightforward calculation helps landlords and tenants understand their financial commitments clearly.

A Virgin Islands Triple Net Lease includes property taxes, insurance, and maintenance costs that tenants must cover. This arrangement allows property owners to secure their investment while transferring most operational responsibilities to the tenant. By fully understanding the inclusions, both parties can establish clearer expectations and responsibilities.