A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty of the payment of a debt is different from a guaranty of the collection of the debt. A guaranty of payment is absolute while a guaranty of collection is conditional.

Virgin Islands Guaranty of Collection of Promissory Note

Description

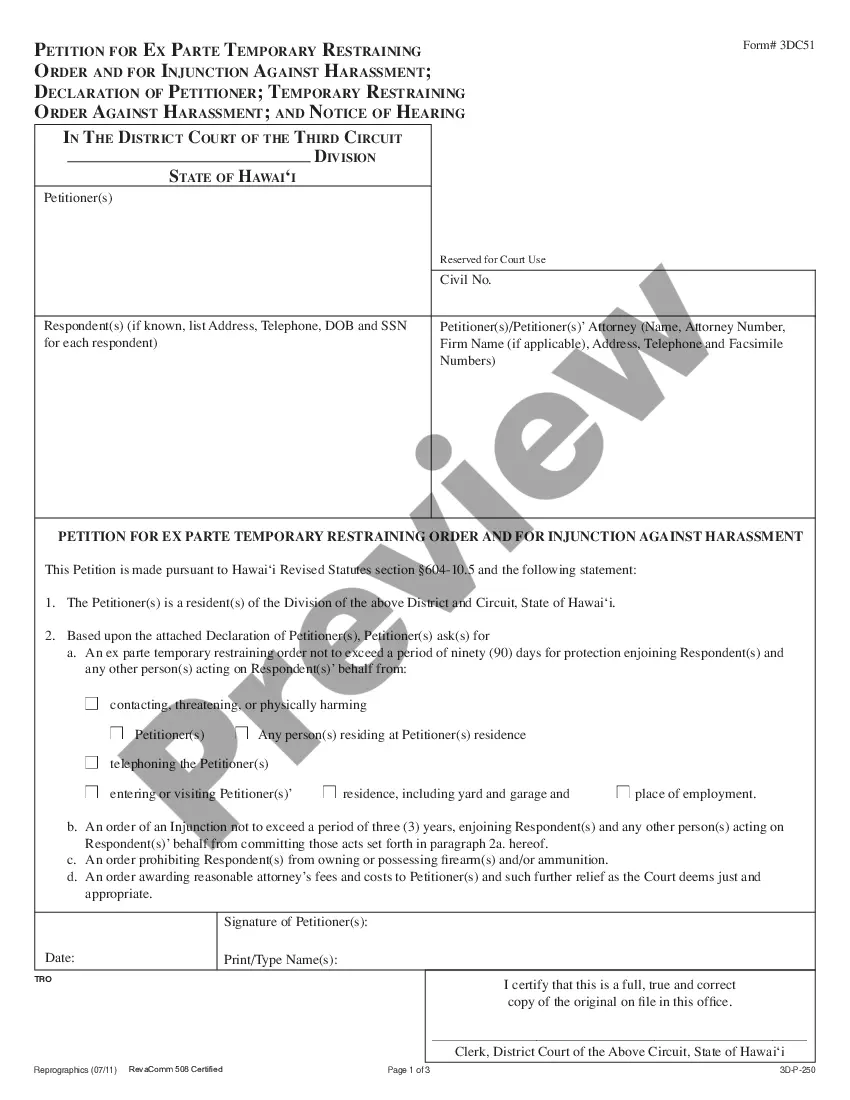

How to fill out Guaranty Of Collection Of Promissory Note?

It is feasible to invest time online attempting to discover the valid document template that meets the federal and state prerequisites you need.

US Legal Forms provides thousands of valid forms that can be examined by experts.

You can conveniently download or print the Virgin Islands Guaranty of Collection of Promissory Note from my assistance.

Review the form description to confirm you have chosen the right form. If available, utilize the Preview button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can fill out, modify, print, or sign the Virgin Islands Guaranty of Collection of Promissory Note.

- Each valid document template you obtain is your own forever.

- To get an additional copy of a purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

Form popularity

FAQ

The format of a promissory note generally includes a title, introductory information, body text detailing the agreement, and a signature section. Typically, a promissory note will state the date, amount, names of the parties, repayment schedule, and additional clauses regarding defaults and remedies. To ensure you are meeting legal requirements under the Virgin Islands Guaranty of Collection of Promissory Note, refer to US Legal Forms where you can find structured templates.

The borrower is primarily liable on a promissory note. This means that if the borrower fails to repay the note, the lender can take action to collect the owed amount. In the context of the Virgin Islands Guaranty of Collection of Promissory Note, this liability allows lenders to enforce their rights effectively. Understanding this responsibility is crucial for both parties involved.

Promissory notes can be either secured or unsecured. Secured promissory notes include collateral, while unsecured notes rely solely on the borrower's promise to repay. When looking into the Virgin Islands Guaranty of Collection of Promissory Note, it is crucial to understand the distinctions between these types of notes to make informed decisions.

The value of a promissory note depends on factors such as the amount borrowed, interest rate, and repayment terms. Typically, the worth reflects the borrower's promise and creditworthiness. Understanding how these factors influence the Virgin Islands Guaranty of Collection of Promissory Note is vital during negotiations.

Generally, notes are not secured debt unless specified. In secured notes, collateral backs the debt, providing the lender with assurance. When considering financing options, understanding secured versus unsecured notes helps clarify the role of a Virgin Islands Guaranty of Collection of Promissory Note.

Promissory notes can be categorized mainly into demand notes, installment notes, and bullet notes. Demand notes require immediate payment on request, while installment notes allow for periodic payments. Bullet notes involve a single payment at the end of the term, relevant to those looking into the Virgin Islands Guaranty of Collection of Promissory Note.

Correcting a promissory note involves identifying any errors, such as incorrect dates or amounts, and making the necessary changes. It is crucial to obtain the consent of all parties involved in the agreement to ensure legality. In terms of the Virgin Islands Guaranty of Collection of Promissory Note, maintaining accurate documentation is vital for protecting your interests. US Legal Forms offers templates and guidance that can assist you in accurately editing your document.

A legal promise to repay a debt is commonly referred to as a promissory note. It articulates the borrower's obligation and the lender's right to collect the debt. Incorporating a Virgin Islands Guaranty of Collection of Promissory Note can enhance this legal promise, ensuring that both parties have clear recourse in the event of non-payment.

Exiting a promissory note can be complex and often depends on the terms outlined within the document. Typically, you may seek to negotiate with the lender for a release or modification. Enlisting services like those of uslegalforms can guide you through this process, especially when dealing with a Virgin Islands Guaranty of Collection of Promissory Note.

The main difference lies in the responsibilities they impose on the guarantor. A guaranty of collection requires the lender to attempt to collect the debt from the borrower before seeking payment from the guarantor. In contrast, a guaranty of payment allows the lender to go directly to the guarantor without first pursuing the borrower. Understanding this distinction can clarify your financial obligations in the context of a Virgin Islands Guaranty of Collection of Promissory Note.