Virgin Islands Chattel Mortgage on Mobile Home

Description

How to fill out Chattel Mortgage On Mobile Home?

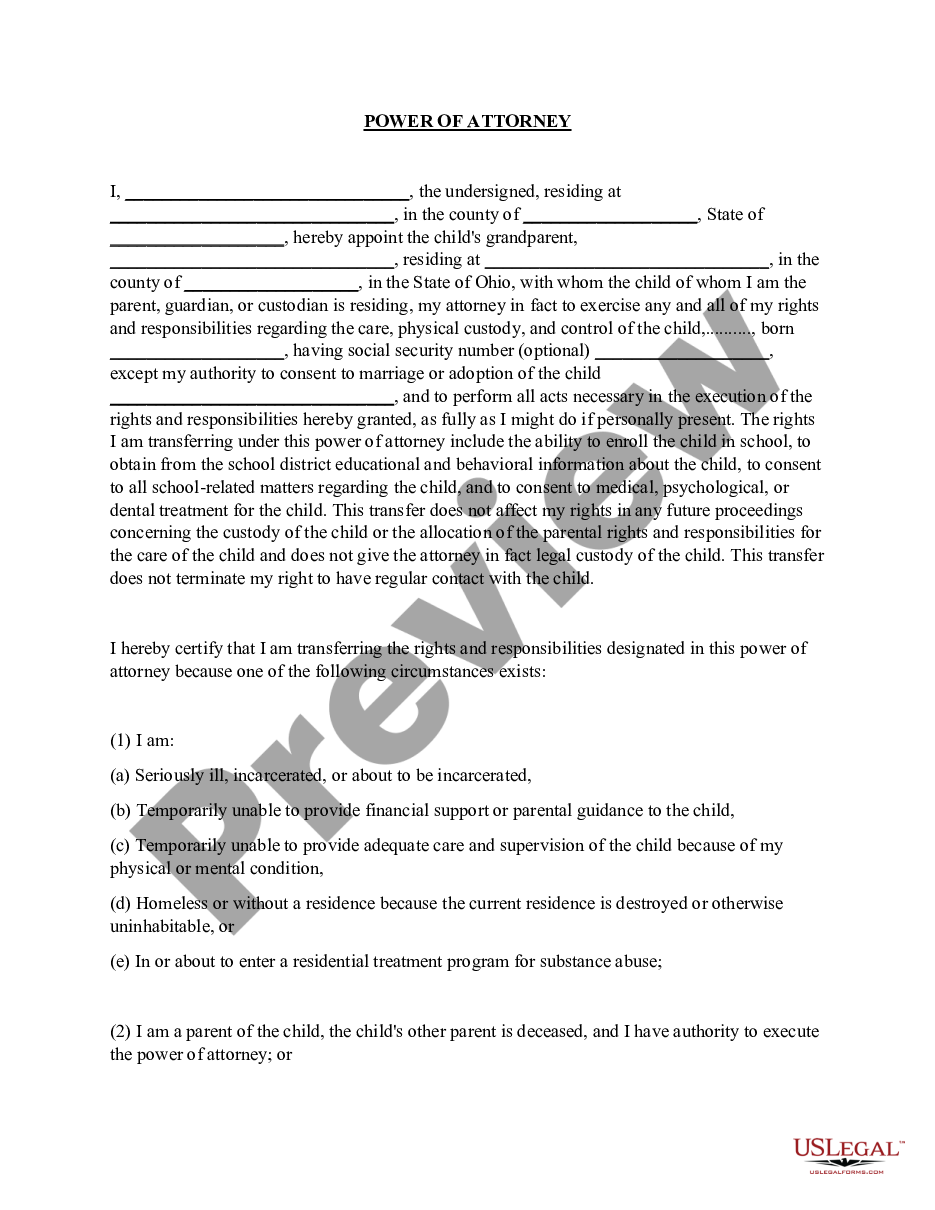

Discovering the right legal document web template could be a struggle. Naturally, there are a variety of web templates available online, but how do you find the legal kind you want? Utilize the US Legal Forms website. The assistance gives thousands of web templates, like the Virgin Islands Chattel Mortgage on Mobile Home, that can be used for company and private requirements. Each of the varieties are checked by specialists and meet state and federal demands.

If you are currently signed up, log in to the account and click the Acquire option to have the Virgin Islands Chattel Mortgage on Mobile Home. Make use of your account to search with the legal varieties you possess ordered earlier. Visit the My Forms tab of your respective account and obtain an additional duplicate from the document you want.

If you are a fresh consumer of US Legal Forms, here are basic instructions for you to comply with:

- Initially, be sure you have chosen the appropriate kind for your metropolis/region. You can look over the form using the Review option and read the form explanation to ensure it will be the best for you.

- When the kind is not going to meet your preferences, make use of the Seach industry to discover the right kind.

- When you are certain the form is suitable, click on the Get now option to have the kind.

- Select the prices strategy you would like and type in the essential details. Make your account and buy the order using your PayPal account or Visa or Mastercard.

- Pick the document format and acquire the legal document web template to the product.

- Total, revise and produce and indicator the received Virgin Islands Chattel Mortgage on Mobile Home.

US Legal Forms may be the most significant catalogue of legal varieties for which you will find numerous document web templates. Utilize the company to acquire professionally-made paperwork that comply with state demands.

Form popularity

FAQ

A chattel mortgage is established for a fixed rate over a fixed term. Your repayments will need to cover both the interest on your loan, and the principal amount. This means when you first begin repaying your chattel mortgage, a greater portion of the repayments will go toward repaying the interest amount.

Current interest rates Type of loanTypical ratesTypical termsFHA6.98%Up to 30 yearsFannie MaeVariesUp to 30 yearsFreddie MacVariesUp to 30 yearsChattel5.99% -12.99%Up to 20 years1 more row ?

Without an included property, banks feel there is a greater risk they will not get their money back in the event of a foreclosure. In order for banks to cover their risk, a chattel loan will have interest rates between 5.99% and 12.99%, depending on income, credit score, and other variables.

Best Mobile Home Loans Reviews Best for Rural Areas: USDA. ... Best for a Variety of Loan Options: Vanderbilt Mortgage and Finance. ... Best for Low Credit Scores: Manufactured Nationwide. ... Best for Good Credit Scores: ManufacturedHome. ... Best for Mobile Homes Within a Community or Park: 21st Mortgage Corporation.

Prepare to meet these requirements to qualify for a chattel mortgage: Credit score: You'll need an excellent credit score (around 680 or higher) to qualify for this type of loan.

Typically, a mobile home has to be built after 1976 to qualify for a mortgage, as we'll explain below. In this case your loan would work almost exactly the same as financing for traditional ?stick-built? houses.

A chattel mortgage is a loan for a manufactured home or other movable piece of personal property, such as machinery or a vehicle. The movable property, called ?chattel,? also acts as collateral for the loan.

For one thing, chattel loans are typically much shorter than with a traditional mortgage. There's also the fact that processing fees and loan amounts are up to 50% lower on these loans. The one obvious downside of a chattel mortgage is a higher interest rate.