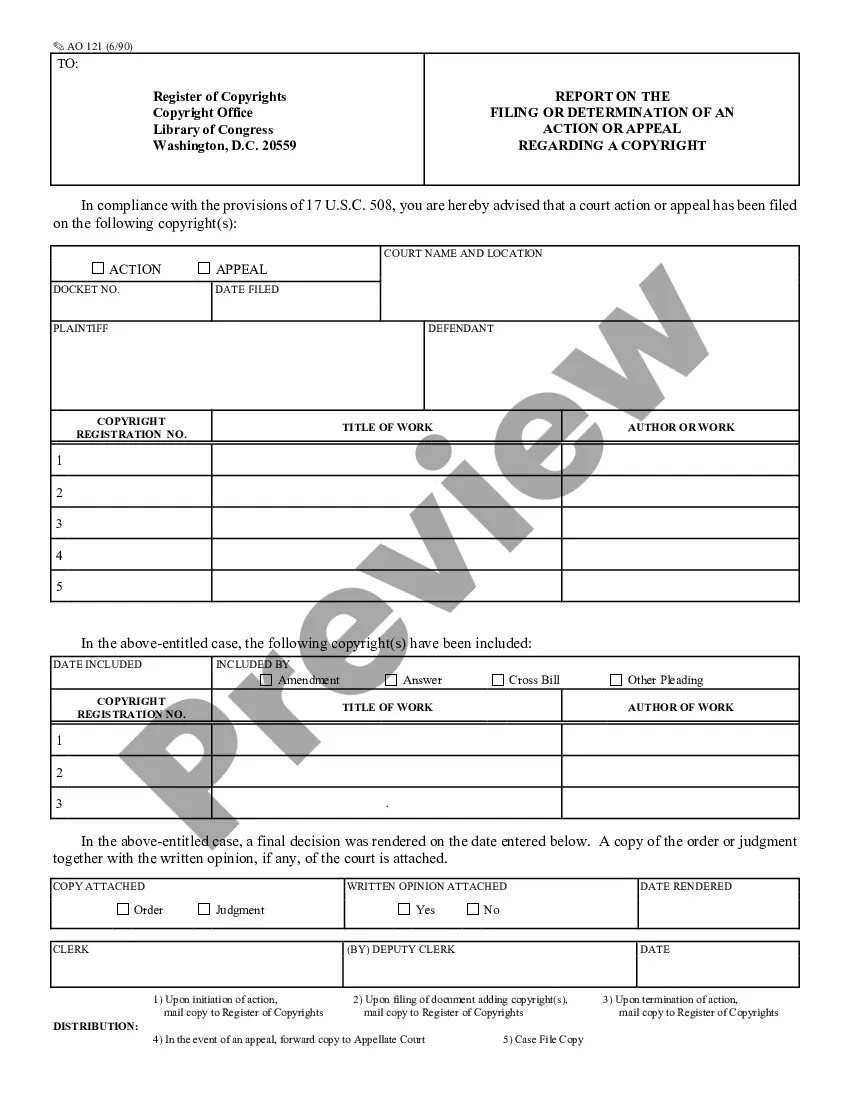

Virginia Ratification of Operating Agreement

Description

How to fill out Ratification Of Operating Agreement?

If you want to comprehensive, download, or print authorized papers templates, use US Legal Forms, the largest collection of authorized kinds, that can be found online. Utilize the site`s easy and handy search to obtain the paperwork you will need. Numerous templates for business and personal reasons are sorted by categories and states, or keywords. Use US Legal Forms to obtain the Virginia Ratification of Operating Agreement in just a few clicks.

When you are previously a US Legal Forms client, log in to your profile and click the Down load switch to find the Virginia Ratification of Operating Agreement. You can also gain access to kinds you in the past delivered electronically from the My Forms tab of the profile.

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have selected the shape for the correct metropolis/region.

- Step 2. Make use of the Review choice to look over the form`s content material. Never neglect to read through the outline.

- Step 3. When you are not happy with the type, utilize the Search field towards the top of the display to get other versions in the authorized type format.

- Step 4. After you have identified the shape you will need, go through the Get now switch. Choose the pricing prepare you favor and include your references to register on an profile.

- Step 5. Method the purchase. You can utilize your credit card or PayPal profile to finish the purchase.

- Step 6. Select the formatting in the authorized type and download it on your own product.

- Step 7. Total, edit and print or indicator the Virginia Ratification of Operating Agreement.

Each and every authorized papers format you acquire is the one you have eternally. You may have acces to each and every type you delivered electronically within your acccount. Click on the My Forms section and pick a type to print or download once more.

Contend and download, and print the Virginia Ratification of Operating Agreement with US Legal Forms. There are many expert and state-distinct kinds you may use for the business or personal requirements.

Form popularity

FAQ

The members of a limited liability company may enter into any operating agreement to regulate or establish the affairs of the limited liability company, the conduct of its business and the relations of its members.

The LLC operating agreement should state if and when member meetings will be held and include any rules regarding how, when, and where votes will be taken; who has voting rights; how many voting members must be present for a quorum; how many votes are required to approve an action; and whether members can vote by proxy ...

An LLC operating agreement should contain provisions to cover: Basic information about the LLC. ... A profit and loss allocation plan. ... The LLC's purpose. The management structure. ... Ownership percentages of each member. ... Voting rights and procedures. ... Meeting frequency. Procedures for bringing in new members.

No, your Operating Agreement doesn't need to be notarized. Each Member just needs to sign it. Once you (and the other LLC Members, if applicable) sign the Operating Agreement, then it becomes a legal document.

The good news is that you're free to write your operating agreement in any way that you wish. There aren't any legal requirements regarding what you must include in the agreement. Drafting the best operating agreement for your LLC simply means tailoring it to your business's specific needs.

To amend your Virginia Limited Liability Company, you file one original Virginia LLC Articles of Amendment with the Commonwealth of Virginia State Corporation Commission. The Articles must be signed by a manager or other person who has been delegated the right and power to manage the business and affairs of the LLC.

What should a multi-member operating agreement include? Affirms that the LLC has been formed by state laws and will conduct lawful business. Notes where key business information (such as member info and registered agent) can be found. Lists the events that can end the business (and how members can continue the LLC)

An operating agreement should include the following: Percentage of members' ownership. Meeting provisions and voting rights. Powers and duties of members and management. Distribution of profits and losses. Tax treatment preference. A liability statement. Management structure. Operating procedures.