Virginia Partial Release of Easement and Agreement (Pipeline Easement)

Description

How to fill out Partial Release Of Easement And Agreement (Pipeline Easement)?

Are you presently in a placement that you need to have documents for sometimes organization or individual purposes nearly every day? There are a variety of lawful file themes accessible on the Internet, but discovering kinds you can trust is not simple. US Legal Forms provides 1000s of develop themes, just like the Virginia Partial Release of Easement and Agreement (Pipeline Easement), that happen to be published to satisfy state and federal demands.

In case you are previously familiar with US Legal Forms web site and also have a merchant account, just log in. After that, you are able to down load the Virginia Partial Release of Easement and Agreement (Pipeline Easement) format.

Unless you provide an profile and need to start using US Legal Forms, adopt these measures:

- Obtain the develop you require and make sure it is for that proper metropolis/state.

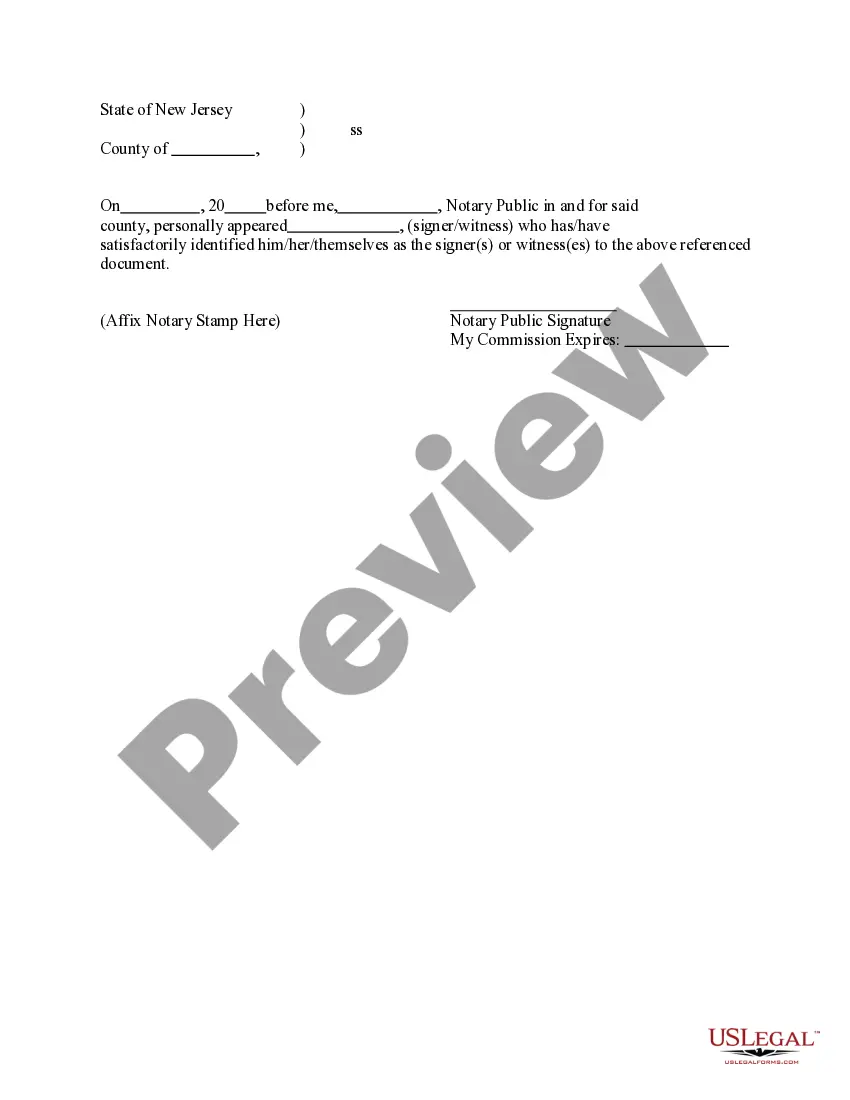

- Utilize the Preview option to analyze the shape.

- Browse the outline to actually have chosen the correct develop.

- When the develop is not what you are trying to find, make use of the Look for industry to discover the develop that suits you and demands.

- Once you obtain the proper develop, just click Get now.

- Choose the rates prepare you want, fill in the specified information and facts to create your account, and buy the order utilizing your PayPal or bank card.

- Select a practical paper structure and down load your duplicate.

Discover each of the file themes you might have purchased in the My Forms menus. You can obtain a further duplicate of Virginia Partial Release of Easement and Agreement (Pipeline Easement) at any time, if necessary. Just select the required develop to down load or print the file format.

Use US Legal Forms, one of the most extensive collection of lawful kinds, to conserve time as well as stay away from errors. The support provides expertly created lawful file themes which you can use for an array of purposes. Create a merchant account on US Legal Forms and initiate generating your life easier.

Form popularity

FAQ

This agreement is to be recorded in the office of the clerk of the circuit court in the county or city where the easement is located ( 55-50). An easement deed should be in writing and should contain the terms of the agreement, the duration and scope of the easement, and a description.

Grants or sales of limited easements are usually not treated as taxable sales of property. Instead, amounts received from such transfers are subtracted from the basis of the property. Any amounts received in excess of basis are treated as taxable gain.

An easement appurtenant is when an easement runs with one parcel of land but benefits another. The parcel that benefits is called the dominant tenement, or the dominant estate, and the other parcel on which the easement exists is called the servient tenement, or sometimes the servient estate.

Yes. That said, the landowner should contact ESLT before conveying the easement by will to ensure that ESLT will accept the donation. If the easement qualifies under federal tax law, its value is subtracted from the landowner's taxable estate, reducing estate taxes for heirs.

What is a Pipeline Easement? Generally, an easement is a legal interest that allows someone the right to use another's property for a certain purpose. A pipeline easement specifically gives the easement holder the right to build and maintain a pipeline on a landowner's property.

Updated for Tax Year 2023 ? October 19, 2023 AM. OVERVIEW. Under a conservation easement, a property's owner gives up the right to make certain changes to that property, to preserve it for future generations. Such an easement usually limits the usefulness of the property and lowers its value.

Payments for anticipated surface damages (as opposed to payments for loss of surface use) are taxable as ordinary rental income. Easement/right-of-way payments: The tax treatment of these payments can vary depending on the nature of the easement.

Under common law, the owner of a property that gets its access by way of the easement has a duty to maintain the easement, but need only maintain the easement to the degree that the owner deems necessary for access to their own property.