Virginia Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes

Description

How to fill out Affidavit That All The Estate Assets Have Been Distributed To Devisees By Executor Or Estate Representative With Statement Concerning Debts And Taxes?

Finding the right legal document template can be quite a have difficulties. Needless to say, there are a lot of layouts accessible on the Internet, but how will you get the legal type you need? Use the US Legal Forms internet site. The assistance provides a large number of layouts, including the Virginia Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes, that you can use for organization and personal requires. Every one of the varieties are examined by specialists and meet up with federal and state needs.

If you are already listed, log in to the account and click on the Obtain option to get the Virginia Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes. Utilize your account to look from the legal varieties you possess purchased in the past. Visit the My Forms tab of your own account and have yet another duplicate of your document you need.

If you are a brand new customer of US Legal Forms, here are straightforward recommendations so that you can comply with:

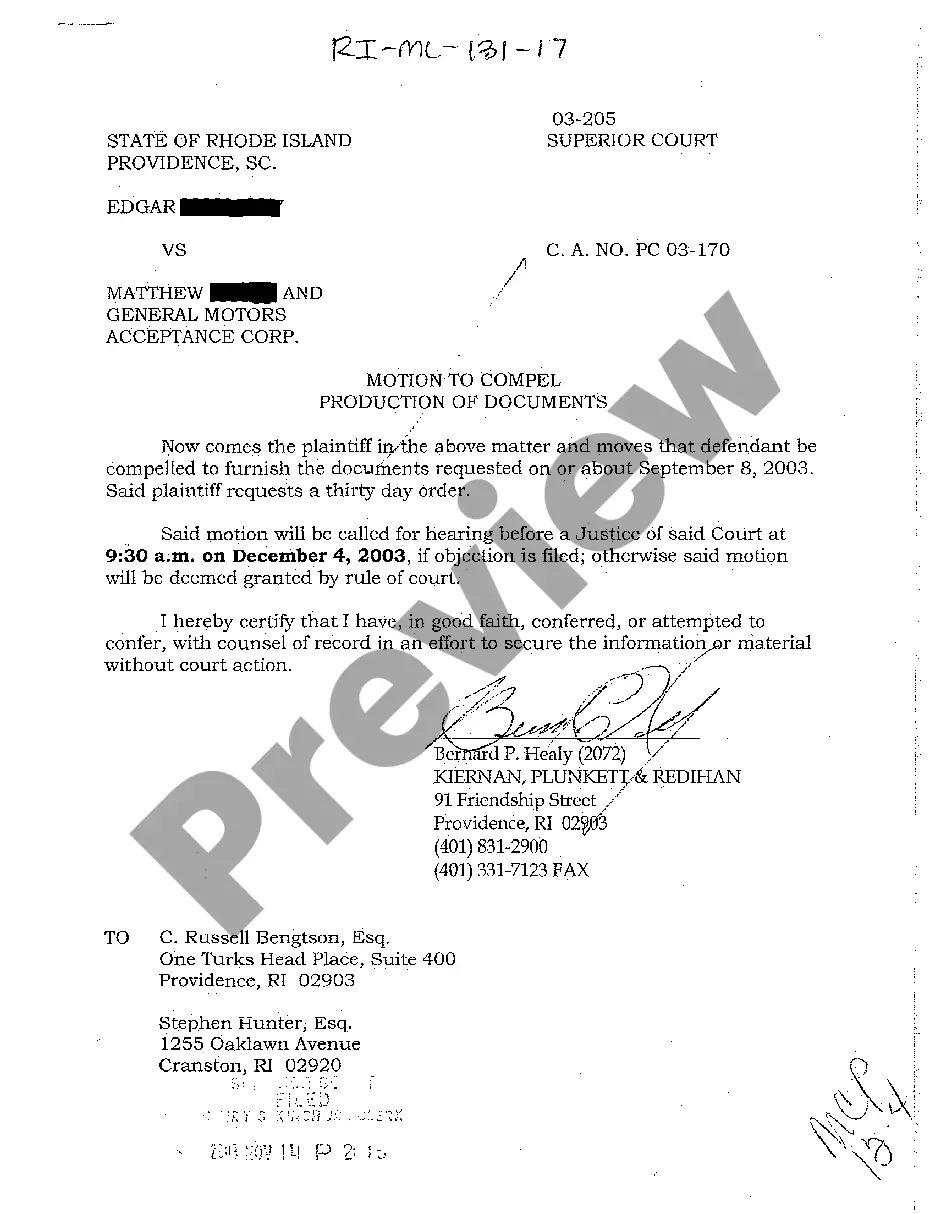

- Initially, make sure you have chosen the proper type to your city/state. You may check out the shape while using Review option and look at the shape outline to make sure it will be the best for you.

- If the type is not going to meet up with your needs, use the Seach field to find the proper type.

- Once you are sure that the shape is acceptable, click on the Buy now option to get the type.

- Opt for the pricing program you desire and enter the required information and facts. Build your account and pay for an order making use of your PayPal account or Visa or Mastercard.

- Pick the document format and down load the legal document template to the product.

- Complete, revise and printing and signal the obtained Virginia Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes.

US Legal Forms will be the largest collection of legal varieties in which you can find different document layouts. Use the service to down load skillfully-produced paperwork that comply with status needs.

Form popularity

FAQ

The timeframe for settling an estate in Virginia depends on several factors, such as the size and complexity of the deceased's assets and whether any disputes arise. Generally, probate takes at least six months after opening. However, many estates can take much longer.

In Virginia, the applicable statute of limitations for credit card debts, mortgage debts, and medical debts is five years. After the statute of limitations has expired, a creditor or debt collector can no longer file a collection lawsuit related to that debt.

The Executor or Administrator is not personally liable for debts of the estate when administered properly, nor are any beneficiaries under a Will. It is, however, important that Executors and Administrators follow the legal scheme for distribution to avoid becoming personally liable for some debts.

It is the role of the executor of the estate to pay the deceased person's outstanding bills. If you are the executor, you may want to consult with a lawyer about your state's probate process and laws. There may be specific regulations on the order that the debts should be paid.

Length and Commitment of Process A person can expect for the probate process in Virginia to take anywhere from six months up to a year or more. Generally, there is a creditor period, so an estate cannot be completely distributed and closed prior to the expiration of the six-month period.

Also, unlike most states, in Virginia there is no deadline for creditors to make claims against an estate other than the normal statute of limitations for a given debt.

What's Included in A Small Estate Affidavit? Provide the name of the person who died and the date of the death. State that the value of the assets in the estate is less than $50,000. State that at least 60 days have passed since the death. State that no application to appoint a personal representative has been granted.