Virginia Software Specifications Agreement

Description

How to fill out Software Specifications Agreement?

You can spend numerous hours online searching for the official document template that meets the federal and state requirements you desire. US Legal Forms offers a vast array of legal forms that can be reviewed by professionals.

You can download or print the Virginia Software Specifications Agreement from our service. If you have an account with US Legal Forms, you may Log In and click on the Obtain option. After that, you can complete, modify, print, or sign the Virginia Software Specifications Agreement.

Every legal document template you receive is yours permanently. To obtain an additional copy of the purchased form, navigate to the My documents tab and click on the corresponding option. If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Obtain and print numerous document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- First, ensure you have selected the correct document template for your region/area of choice.

- Review the form description to confirm you have chosen the appropriate form.

- If available, use the Preview option to examine the document template as well.

- If you wish to find another version of the form, use the Look for field to locate the template that meets your needs and requirements.

- Once you have found the template you want, click Acquire now to proceed.

- Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal account to pay for the legal form.

- Choose the format of the document and download it to your device.

- Make changes to the document if necessary. You can complete, modify, and sign and print the Virginia Software Specifications Agreement.

Form popularity

FAQ

As mentioned, software maintenance in Virginia is taxable. This includes any updates, support, or other maintenance tasks related to software, as defined in the Virginia Software Specifications Agreement. Awareness of these tax obligations can aid in budgeting more effectively and ensuring compliance with state regulations.

Software maintenance services are considered taxable in Virginia. This taxation includes routine updates and support as part of the Virginia Software Specifications Agreement. It's beneficial for businesses to account for these costs in their financial planning to avoid any surprises during tax season.

Yes, software as a service is typically taxable in Virginia. Although SaaS solutions can offer great functionality for businesses, they fall under taxation according to the Virginia Software Specifications Agreement. Therefore, it's advisable to assess each agreement closely to determine any potential tax implications.

When it comes to software as a service (SaaS), Virginia generally imposes sales tax. However, this tax application may vary depending on how the service aligns with the Virginia Software Specifications Agreement. Understanding these nuances can help business owners evaluate their financial obligations effectively.

In Virginia, some services are exempt from sales tax. For instance, certain professional services, such as consulting and legal services related to the Virginia Software Specifications Agreement, often do not incur sales tax. This exemption is vital for businesses looking to minimize their tax liabilities while obtaining necessary services.

You can obtain an operating agreement for your LLC in Virginia by drafting it yourself or using an online legal service. Many platforms, including US Legal Forms, provide customizable templates to create an effective operating agreement. These tools ensure that you include all essential clauses tailored to your business needs. Additionally, integrating a Virginia Software Specifications Agreement can enhance the operational aspect of your agreement, especially for software-related ventures.

Virginia does not legally require an LLC to have an operating agreement, yet establishing one offers significant benefits. It helps to delineate each member's responsibilities and the operational procedures of the business. By integrating a Virginia Software Specifications Agreement within your operating agreement, you can ensure decisive guidelines, especially if software development is central to your business strategies.

Yes, an LLC can exist without an operating agreement, but this situation is not recommended. Without it, your LLC may face uncertainties regarding management and financial issues. It is wise to draft an agreement that outlines your collective responsibilities, rights, and organizational tactics. A thoughtful Virginia Software Specifications Agreement can complement this approach by ensuring clarity in software-related operations.

In Virginia, an operating agreement is not strictly required for LLCs; however, having one is highly beneficial. An operating agreement defines the internal structure and operational guidelines of your LLC. Creating one can prevent misunderstandings among members and provide clarity in legal matters. Thus, incorporating a Virginia Software Specifications Agreement can further enhance your operational clarity and establish standards.

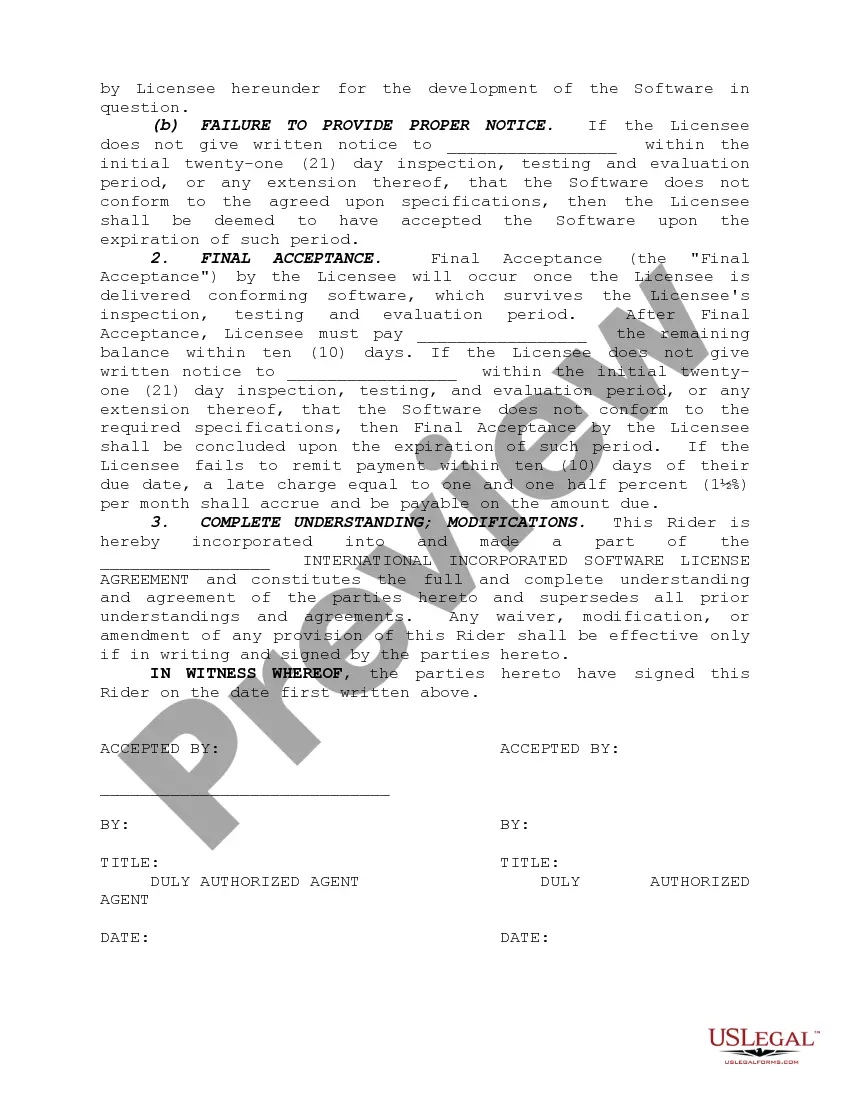

The three primary types of software contracts include licensing agreements, maintenance agreements, and development agreements. Licensing agreements are essential when you permit the use of your software under specific terms. Maintenance agreements ensure ongoing support and updates for your software. Additionally, a Virginia Software Specifications Agreement can detail the expectations and deliverables for software development projects.