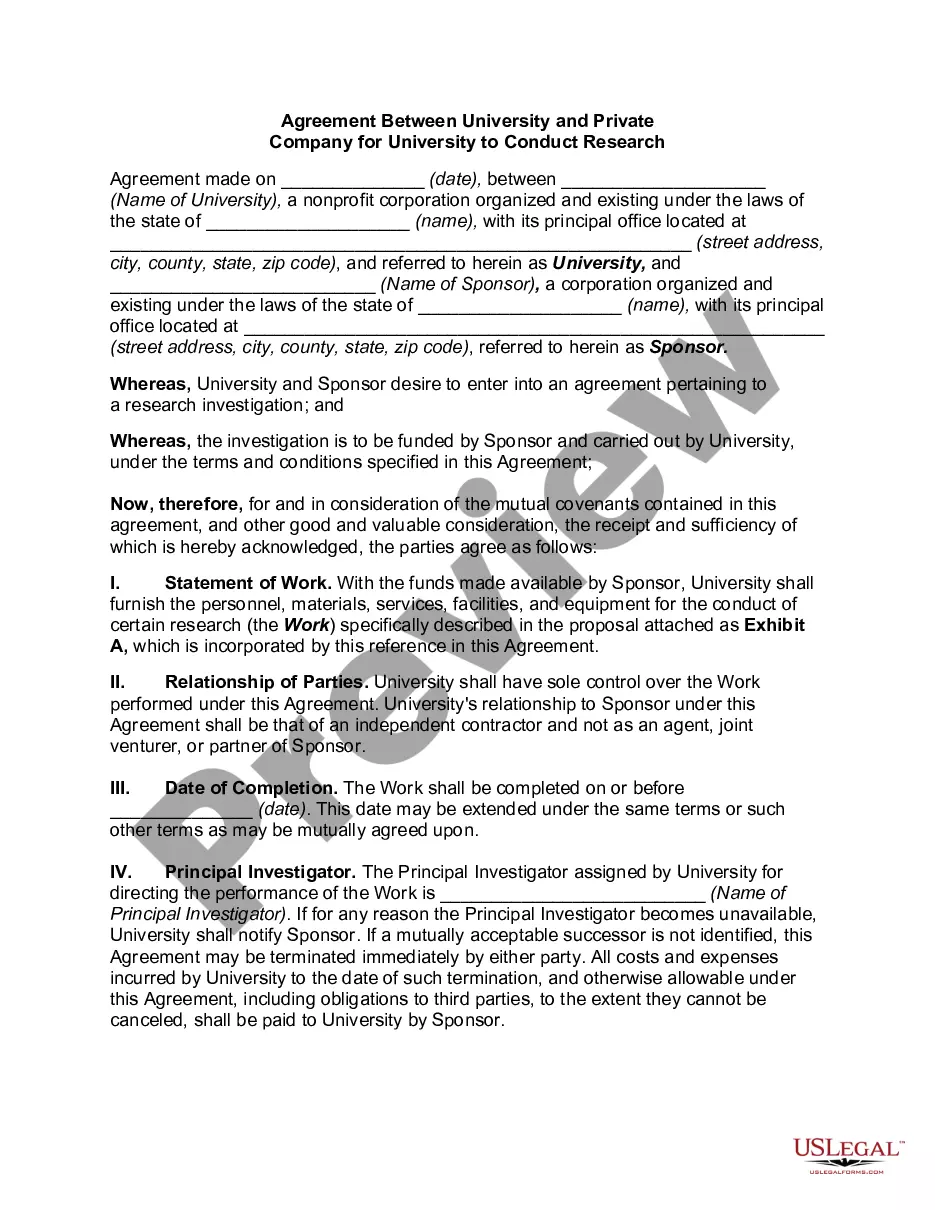

Virginia Research Agreement - Self-Employed Independent Contractor

Description

How to fill out Research Agreement - Self-Employed Independent Contractor?

You might spend hours online trying to locate the authentic document template that complies with the state and federal requirements you need.

US Legal Forms offers a plethora of legitimate forms that are reviewed by professionals.

You can easily download or print the Virginia Research Agreement - Self-Employed Independent Contractor from our service.

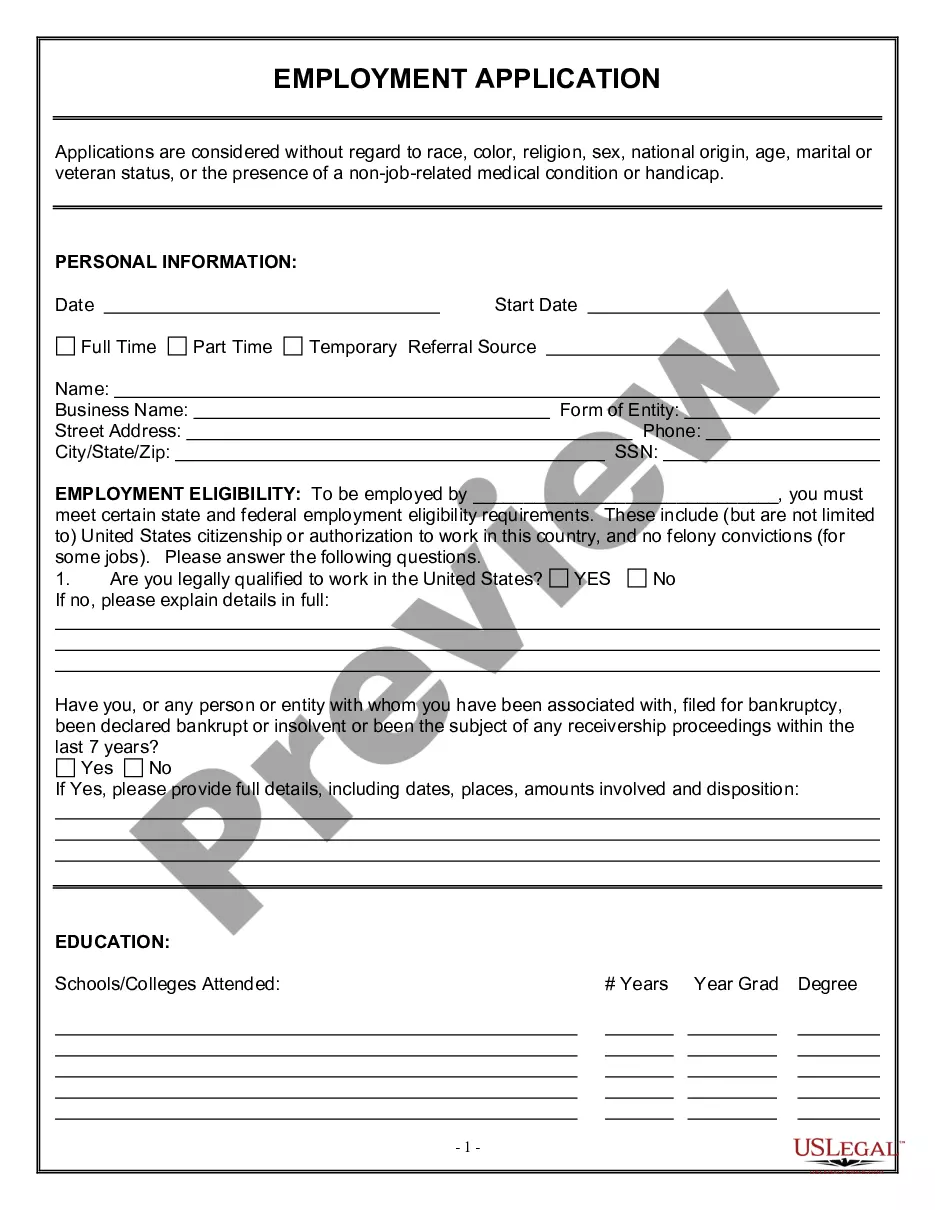

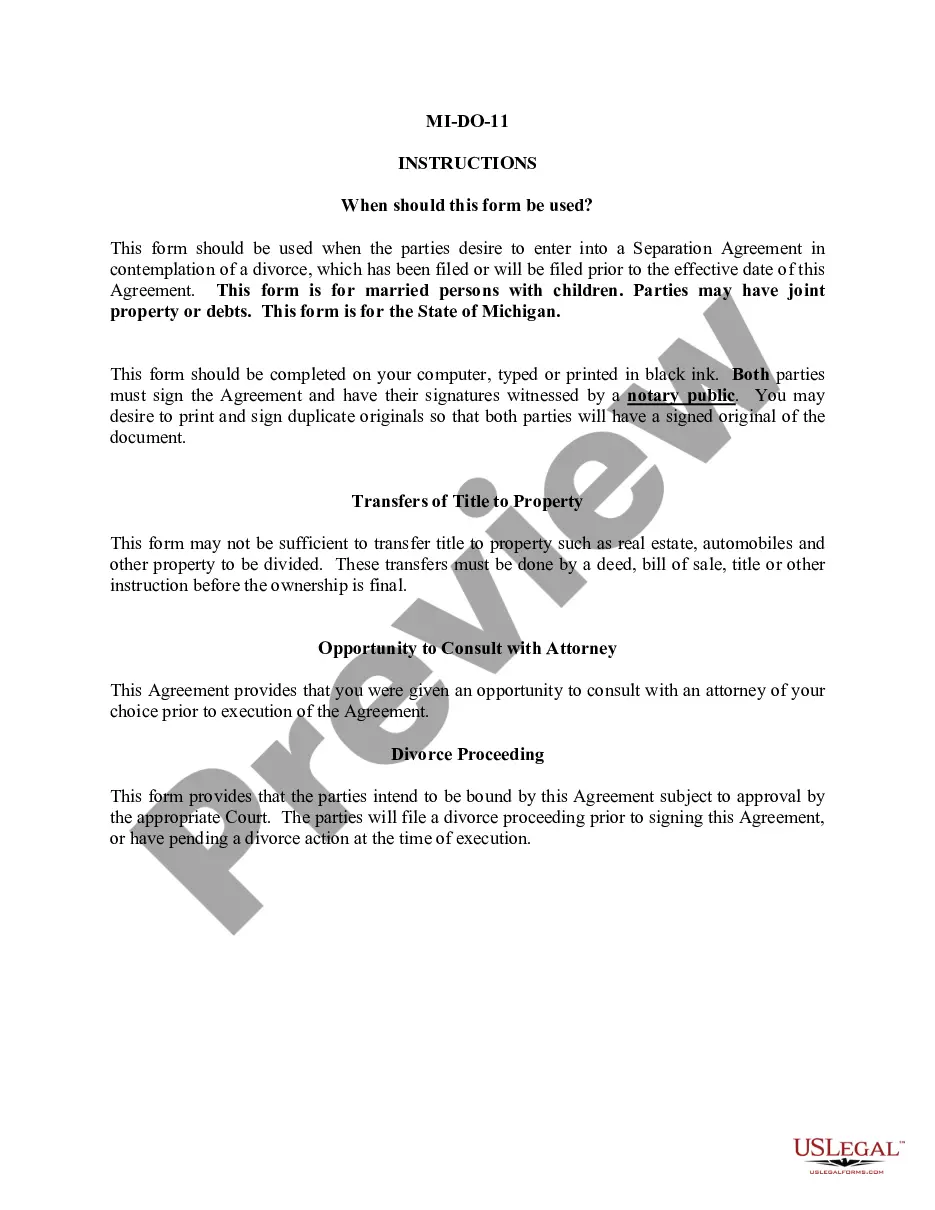

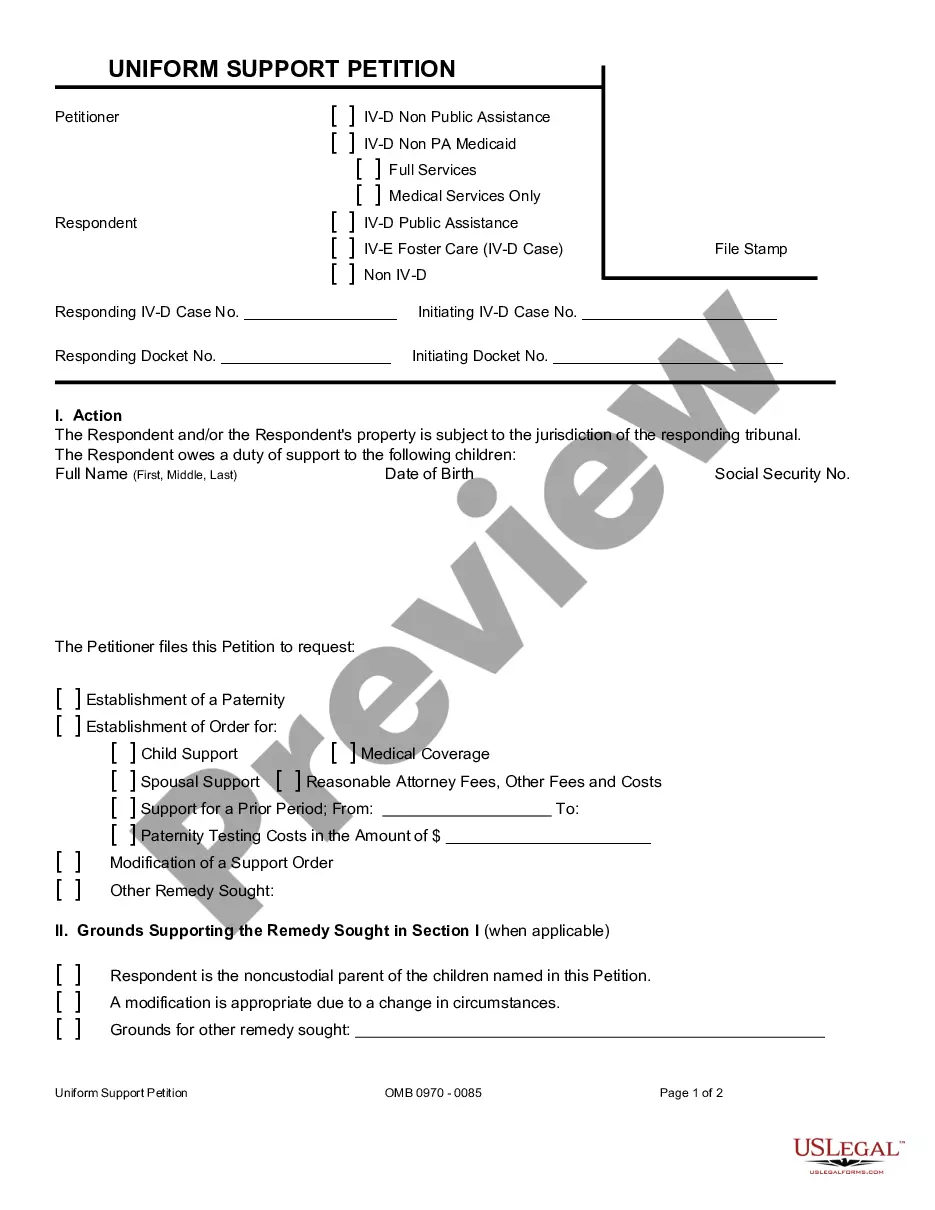

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Get button.

- Subsequently, you can complete, edit, print, or sign the Virginia Research Agreement - Self-Employed Independent Contractor.

- Every legal document template you obtain is yours indefinitely.

- To retrieve another copy of the purchased form, navigate to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have selected the accurate document template for the county/city of your choice.

- Review the form description to verify that you have chosen the correct form.

Form popularity

FAQ

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

VA Business License Requirements The good news is that Virginia isn't one of those states and doesn't have a statewide business license requirement. However, just like other states, Virginia does have license and/or certification requirements for specific business activities.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.