Virginia Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

How to fill out Payroll Specialist Agreement - Self-Employed Independent Contractor?

Selecting the appropriate legitimate document format can be a challenge.

Clearly, numerous templates are available online, but how can you acquire the authentic document you require.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Virginia Payroll Specialist Agreement - Self-Employed Independent Contractor, suitable for both business and personal purposes.

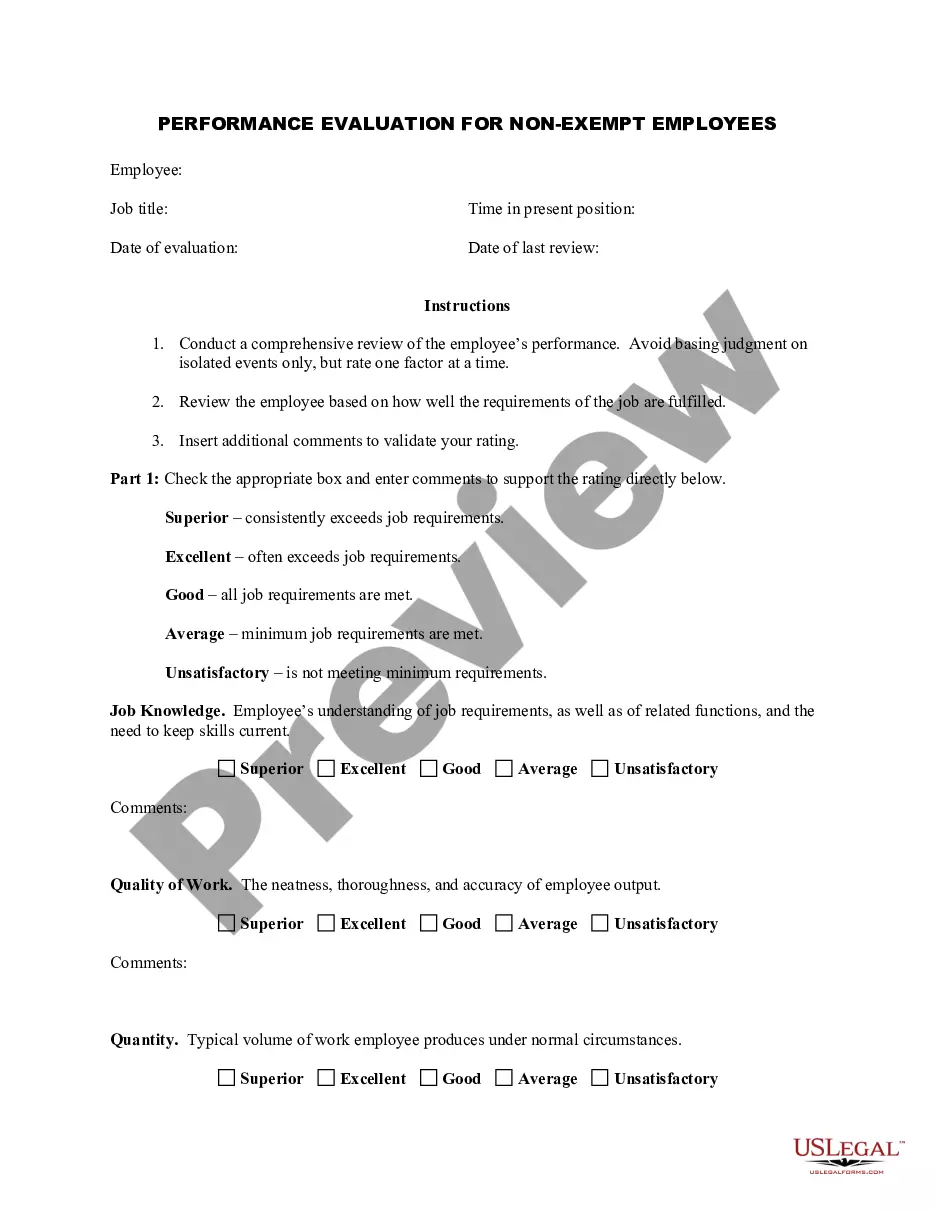

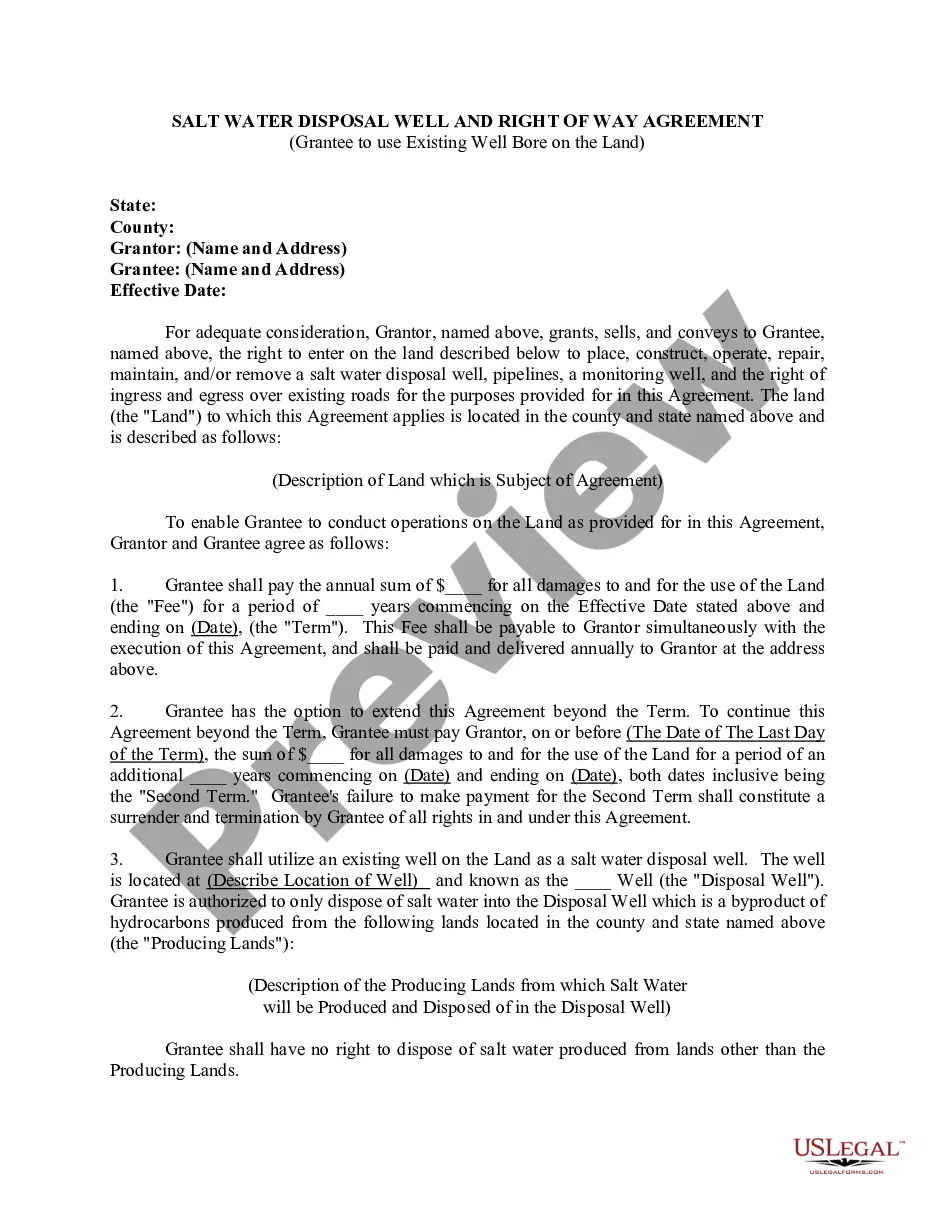

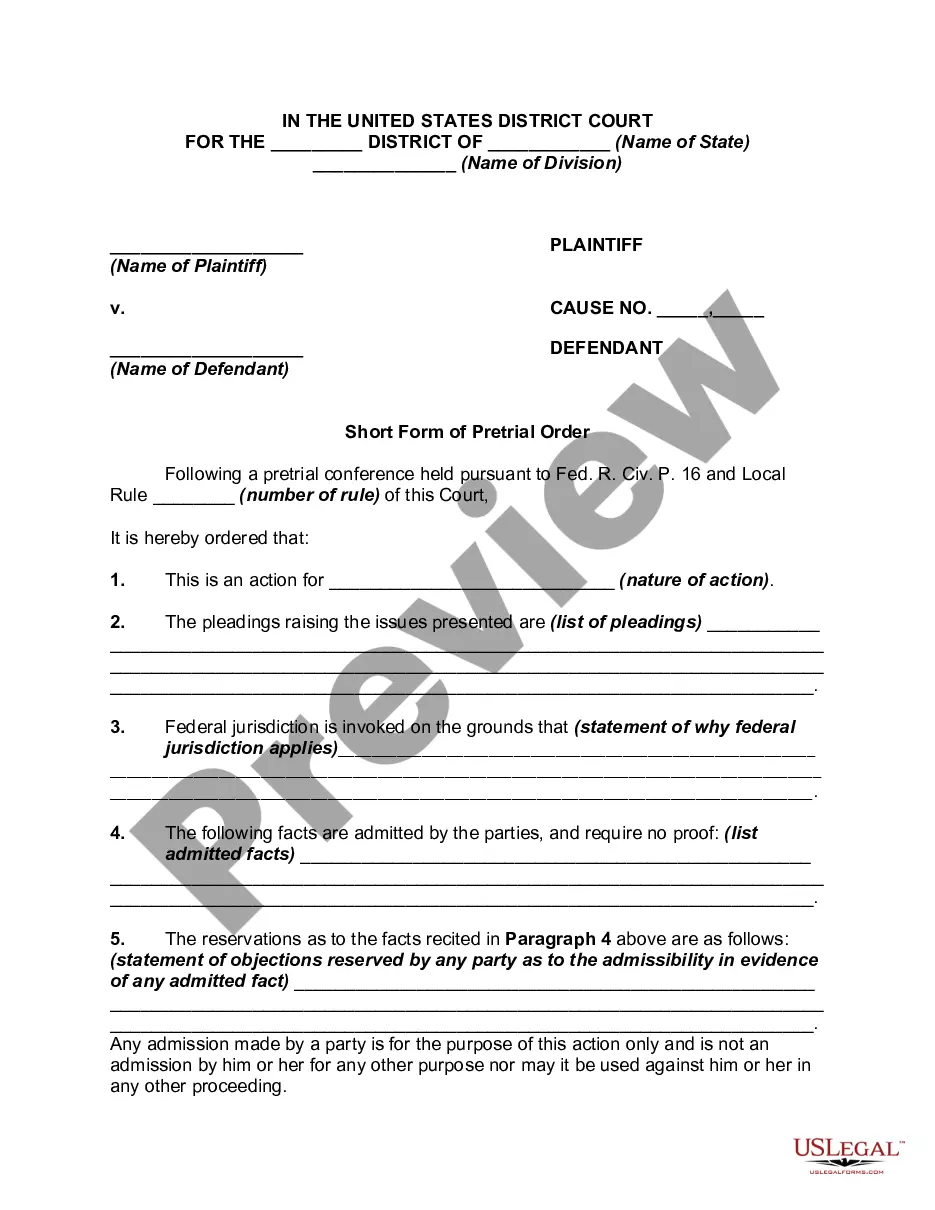

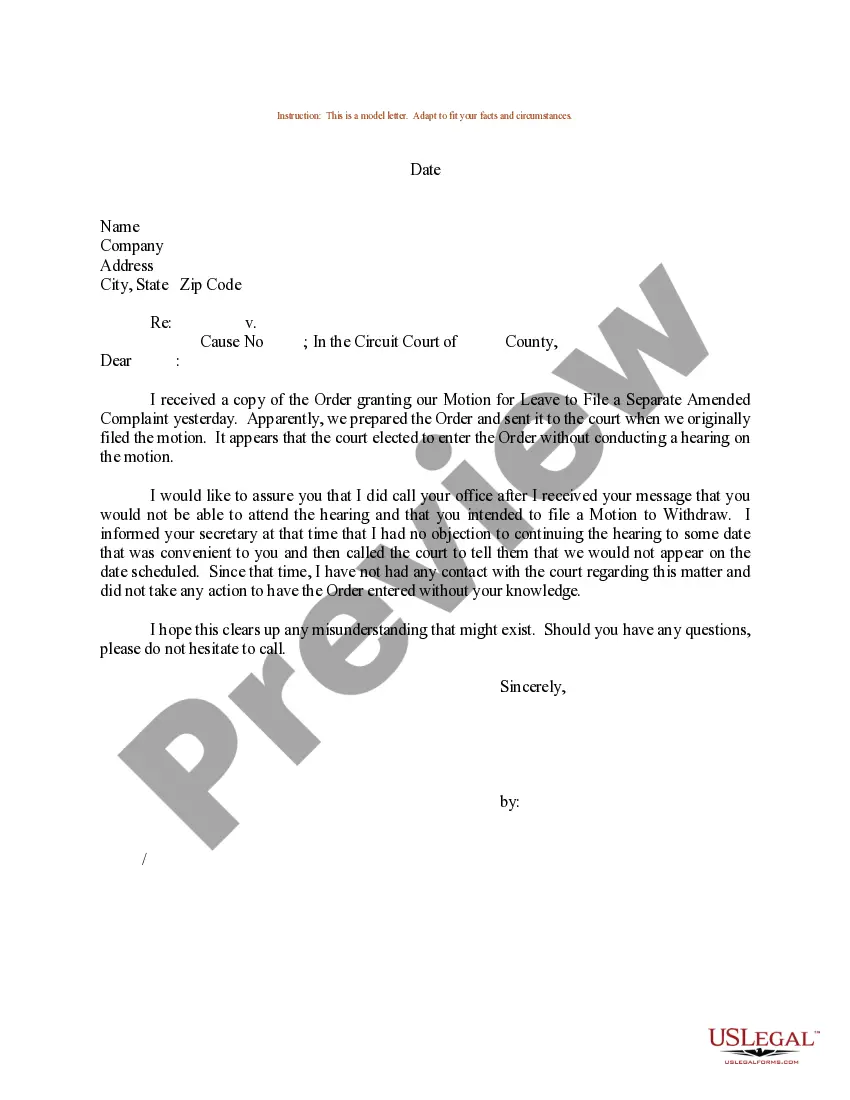

You can preview the form using the Preview button and check the form details to confirm its suitability for your needs.

- All templates are verified by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Virginia Payroll Specialist Agreement - Self-Employed Independent Contractor.

- Use your account to review the legitimate templates you have previously purchased.

- Navigate to the My documents section in your account to acquire another copy of the necessary document.

- If you are a first-time user of US Legal Forms, here are simple steps for you to follow.

- First, ensure that you have selected the correct document for your city/state.

Form popularity

FAQ

The new independent contractor law in Virginia aims to clarify the classification of workers. It increases protections for independent contractors while outlining their rights and responsibilities. This legislation emphasizes the importance of having a clear Virginia Payroll Specialist Agreement - Self-Employed Independent Contractor to define the working relationship. Staying informed about these changes can ensure compliance and protect your business.

To do payroll for independent contractors, start by confirming how much you owe them based on your agreement. Process their payments promptly using direct deposit or checks. Document the payments and keep accurate records for tax reporting. Utilizing a service like uslegalforms can help you manage this easily along with crafting solid contracts.

Filling out an independent contractor agreement involves outlining the terms of the work relationship. Start by detailing the scope of services, payment terms, and deadlines. Include clauses for confidentiality and termination to protect both parties. Using a template for a Virginia Payroll Specialist Agreement - Self-Employed Independent Contractor can simplify this process.

To set up payroll for 1099 employees, you first need to gather their tax information. You can use a Virginia Payroll Specialist Agreement - Self-Employed Independent Contractor to clarify the terms of the arrangement. Next, determine their compensation structure and payment intervals. Finally, ensure you report payments correctly using IRS Form 1099 at the end of the year.

Legal requirements for independent contractors vary by state, but they generally include having a valid business license and understanding tax obligations. For a Virginia Payroll Specialist Agreement - Self-Employed Independent Contractor, it's important to comply with local laws regarding payments and project completion. Familiarizing yourself with these legal aspects helps ensure a smooth working relationship.

Deciding whether to be on payroll or 1099 depends on your personal circumstances and preferences. Being on payroll offers benefits such as health insurance and retirement plans, while 1099 status allows for more flexibility, especially for a Virginia Payroll Specialist Agreement - Self-Employed Independent Contractor. Consider your financial situation, desired work-life balance, and long-term goals before making a choice.

When employing an independent contractor, you typically need a written agreement outlining the project's scope, payment terms, and other responsibilities. A Virginia Payroll Specialist Agreement - Self-Employed Independent Contractor provides a clear framework that protects both parties. Additionally, you might need to collect a W-9 form for tax reporting purposes.

No, independent contractors are generally not considered employees on payroll. Instead, they operate under a separate payment structure, often receiving a 1099 form at tax time. When you engage a Virginia Payroll Specialist Agreement - Self-Employed Independent Contractor, you manage payments differently than traditional payroll processes, which can simplify financial management for both parties.

Yes, Non-Disclosure Agreements (NDAs) can apply to independent contractors. If you hire a Virginia Payroll Specialist Agreement - Self-Employed Independent Contractor, they may have access to sensitive company information. Therefore, implementing an NDA helps protect your business's confidential information and ensures that your contractor understands the importance of privacy.

To write an independent contractor agreement, start with a clear outline that defines the scope of work, payment terms, and deadlines. Use straightforward language to specify the rights and responsibilities of both parties. It's crucial to include clauses related to confidentiality, dispute resolution, and termination. For a comprehensive and tailored solution, consider utilizing the Virginia Payroll Specialist Agreement - Self-Employed Independent Contractor available on the US Legal Forms platform.