Virginia Computer Repairman Services Contract - Self-Employed

Description

How to fill out Computer Repairman Services Contract - Self-Employed?

Are you in a situation where you require documents for organization or personal reasons almost daily.

There are numerous legal document templates accessible online, but locating trustworthy versions can be challenging.

US Legal Forms provides a vast selection of form templates, including the Virginia Computer Repairman Services Contract - Self-Employed, designed to comply with state and federal requirements.

Once you find the appropriate form, click Purchase now.

Select the payment plan you prefer, fill out the required information to process your payment, and complete the transaction with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Virginia Computer Repairman Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

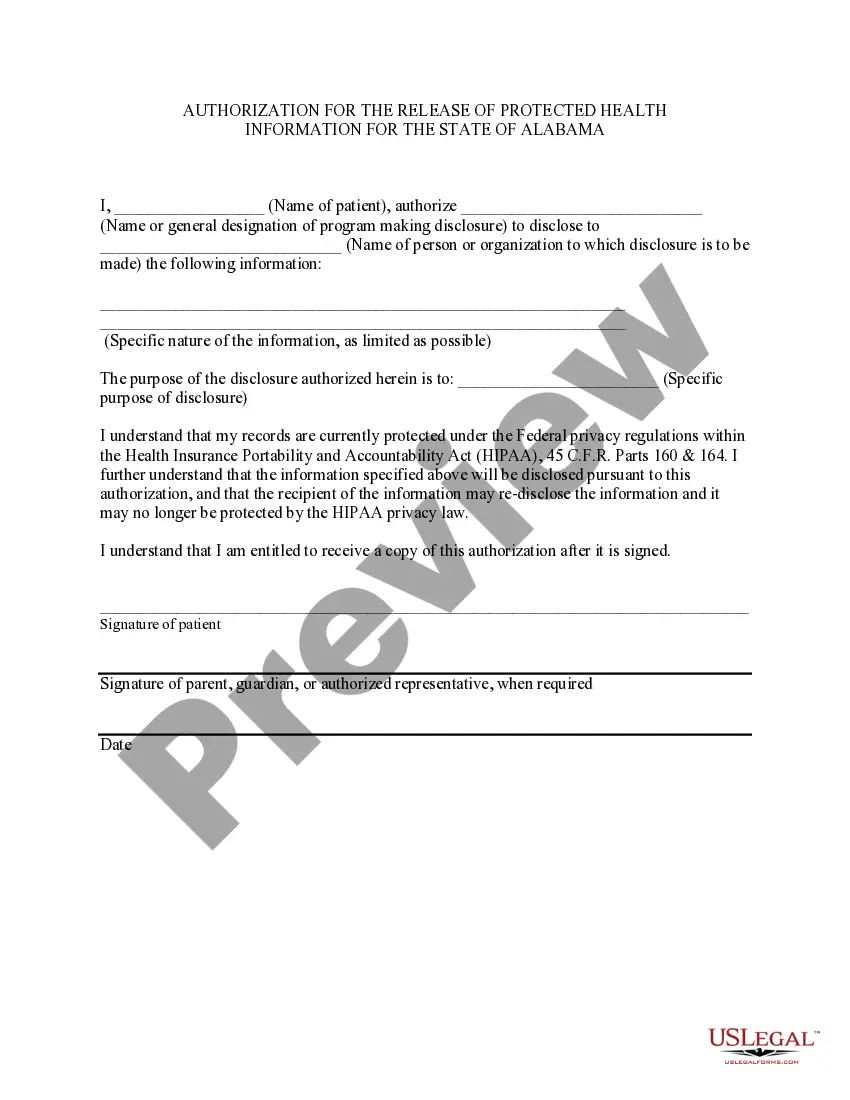

- Use the Preview button to review the form.

- Check the description to validate that you have chosen the right form.

- If the form is not what you are looking for, utilize the Lookup area to find the form that satisfies your needs.

Form popularity

FAQ

Yes, registering your business is crucial for independent contractors. This step ensures you comply with taxes and regulations while protecting your legal rights. By completing a Virginia Computer Repairman Services Contract - Self-Employed, you formalize your work relationship and clarify your responsibilities. Utilize resources such as uslegalforms to streamline your registration process efficiently.

To authorize yourself as an independent contractor in the US, you must first register your business with the appropriate state and local authorities. You may need to obtain necessary permits or licenses based on your industry. Completing a Virginia Computer Repairman Services Contract - Self-Employed reinforces your legitimacy and outlines your rights and obligations. Consider using platforms like uslegalforms for templates and guidance through this process.

Yes, independent contractors in Virginia typically need a business license to operate legally. The specific requirements can vary by locality, so it's essential to check your city's regulations. Having a valid business license helps you comply with local laws and builds trust with your clients. If you are working under a Virginia Computer Repairman Services Contract - Self-Employed, securing this license is a vital step in establishing credibility.

Yes, an independent contractor may need a business license in Virginia, depending on the nature of their services. Researching local regulations can provide clarity on what is required. This step is important as it legitimizes your work and protects your clients. Having a valid business license complements the Virginia Computer Repairman Services Contract - Self-Employed by demonstrating professionalism and adherence to local laws.

To write a self-employment contract, start by detailing the nature of the work, payment, and any specific terms relevant to the project. It’s important to maintain a clear structure to avoid confusion later on. You can find templates that can guide you, like the Virginia Computer Repairman Services Contract - Self-Employed from uslegalforms, which ensures legal compliance and clarity.

Yes, you can write your own legally binding contract as long as it meets specific legal requirements. Ensure it includes essential elements such as agreement, consideration, and the capacity of both parties. By using tools available on uslegalforms, you can create a Virginia Computer Repairman Services Contract - Self-Employed that adheres to legal standards, making it more credible.

To write a simple employment contract, clearly outline job duties, compensation, and duration of employment. Include confidentiality and non-compete clauses if necessary. Keep the language straightforward and ensure both parties understand the terms. A simple Virginia Computer Repairman Services Contract - Self-Employed provides a formal framework that protects both you and your client.

The new independent contractor law in Virginia simplifies the classification of workers. Under this law, it is easier for businesses to hire independent contractors without facing issues regarding employee classification. Understanding this law is vital for anyone involved in drafting a Virginia Computer Repairman Services Contract - Self-Employed. Being informed helps ensure compliance and minimizes legal risk.

When writing a contract for a 1099 employee, specify the tasks, payment schedule, and duration of the work. Also, clarify that the individual is an independent contractor and not an employee. This distinction is crucial for tax purposes. Utilizing a Virginia Computer Repairman Services Contract - Self-Employed ensures you cover all essential aspects and adhere to legal guidelines.

To write a self-employed contract, start by clearly stating the names and details of the parties involved. Include the scope of work, payment terms, and deadlines. Always make sure to outline the rights and responsibilities of each party to ensure clarity. A well-structured Virginia Computer Repairman Services Contract - Self-Employed can help prevent disputes and establish professional relationships.