Virginia Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks

Description

How to fill out Registration Rights Agreement Between ObjectSoft Corp. And Investors Regarding Sale And Purchase Of 6% Series G Convertible Preferred Stocks?

Are you currently in the position the place you require files for possibly enterprise or individual uses almost every day? There are tons of authorized record web templates accessible on the Internet, but finding ones you can depend on isn`t easy. US Legal Forms delivers thousands of kind web templates, just like the Virginia Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks, that happen to be written to fulfill federal and state demands.

Should you be previously informed about US Legal Forms site and also have a merchant account, simply log in. Next, you are able to download the Virginia Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks design.

Unless you provide an bank account and would like to start using US Legal Forms, follow these steps:

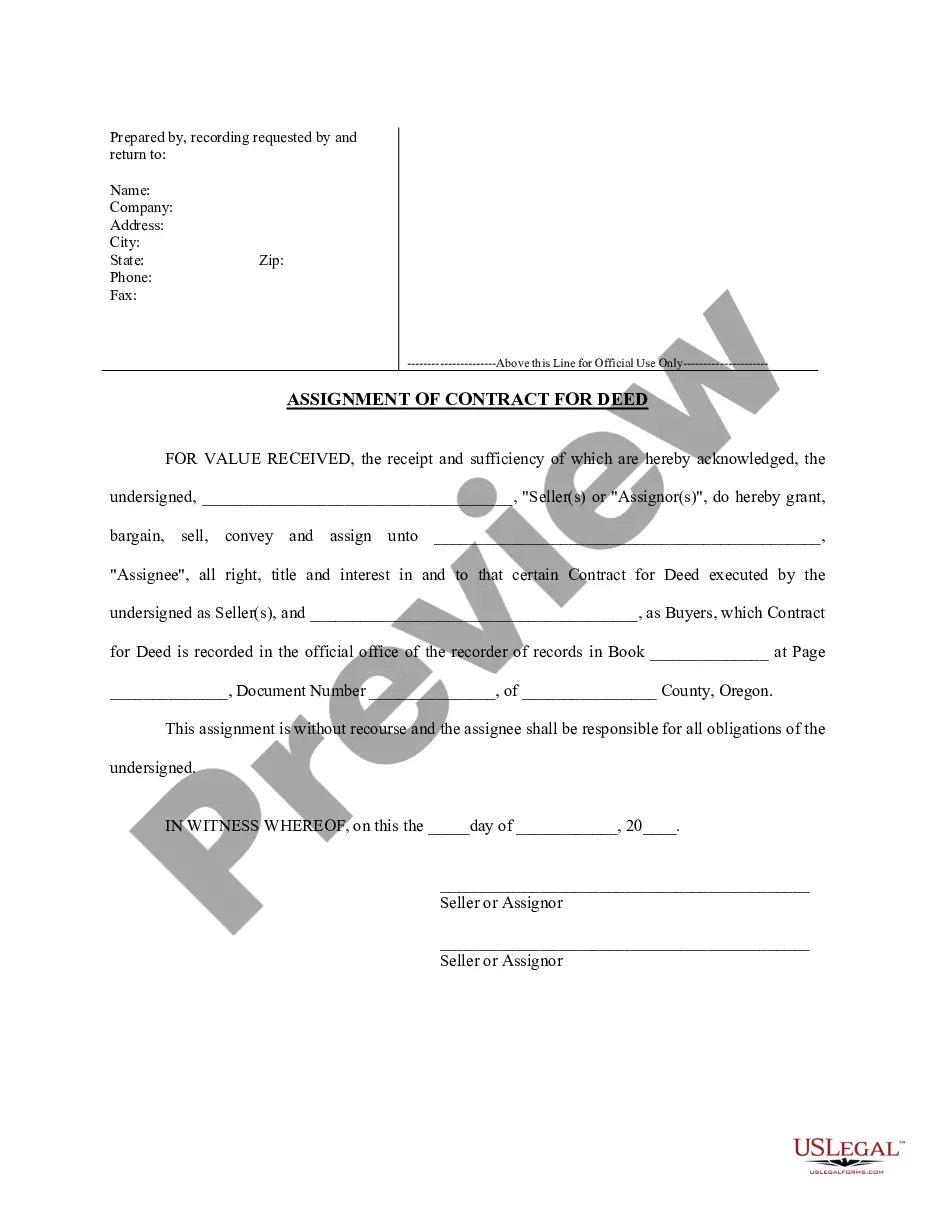

- Find the kind you require and ensure it is for your correct metropolis/state.

- Make use of the Preview option to review the shape.

- Read the explanation to ensure that you have chosen the correct kind.

- In case the kind isn`t what you are trying to find, take advantage of the Search industry to get the kind that meets your requirements and demands.

- If you find the correct kind, click on Buy now.

- Pick the costs prepare you want, fill out the desired info to generate your money, and pay for an order with your PayPal or Visa or Mastercard.

- Decide on a handy data file formatting and download your backup.

Discover every one of the record web templates you possess bought in the My Forms menu. You may get a additional backup of Virginia Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks whenever, if necessary. Just click on the essential kind to download or print the record design.

Use US Legal Forms, by far the most extensive selection of authorized varieties, in order to save time as well as avoid blunders. The services delivers skillfully manufactured authorized record web templates which you can use for an array of uses. Produce a merchant account on US Legal Forms and initiate producing your way of life a little easier.

Form popularity

FAQ

Demand registration rights, where an investor can force a company to file a registration statement to register the holder's securities so the investor can sell them in the public market without restriction.

3 registration gives investors the right to demand that a company registers their shares using Form 3. Form 3 is a shorter registration form than Form 1, which is used in an initial stock launch or IPO. Form 3 can be used by a company one year after an IPO.

If the seller complies with Rule 144, the sale will not violate the registration requirements of the Securities Act. Rule 144 imposes certain holding period, informational, volume, manner of sale and notice obligations in certain situations and for certain stockholders.

Registration rights are a form of control provision that enables investors to force companies to file a registration document, to serve purposes of both transparency and audit. The document must be filed with the Securities and Exchange Commission (SEC), complying with the Securities Act of 1933.

A registration right is a right entitling an investor who owns restricted stock to require that a company list the shares publicly so that the investor can sell them. Registration rights, if exercised, can force a privately-held company to become a publicly-traded company.