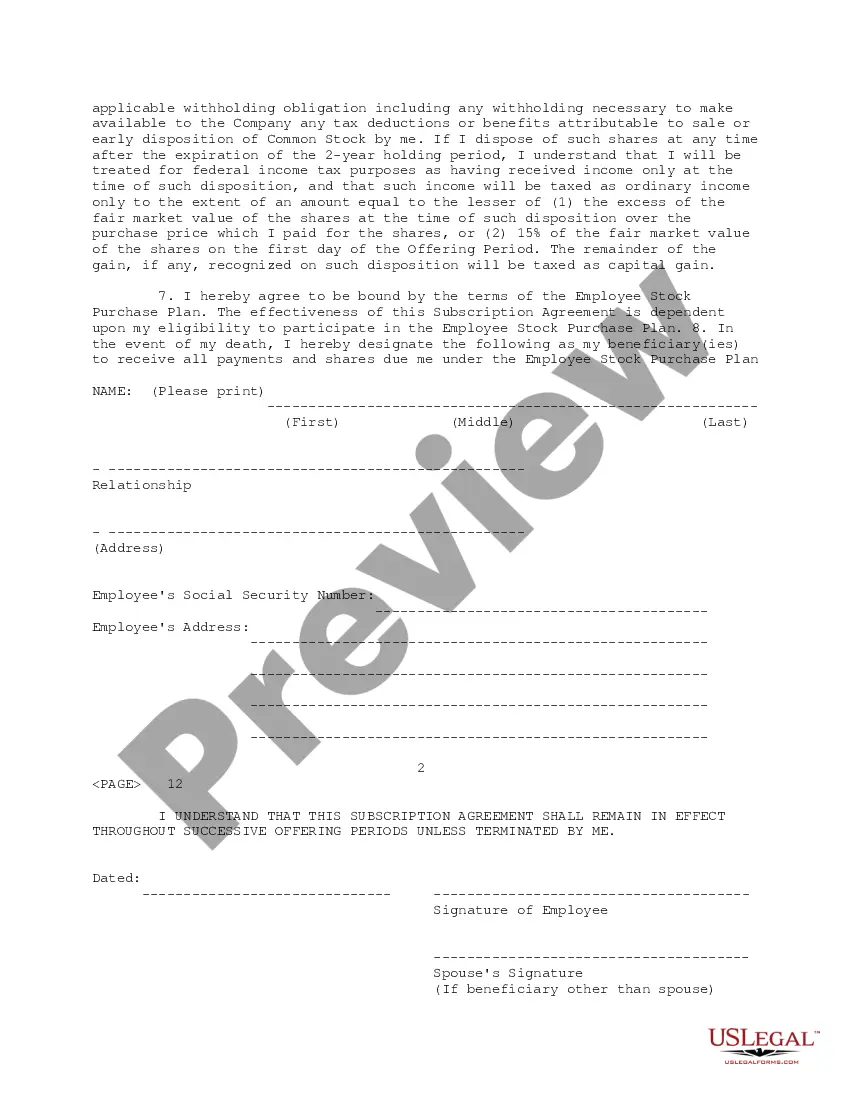

Virginia Subscription Agreement for Employee Stock Purchase Plan of Gadzoox Networks, Inc.

Description

How to fill out Subscription Agreement For Employee Stock Purchase Plan Of Gadzoox Networks, Inc.?

You may devote hrs on the web trying to find the legitimate papers format which fits the federal and state demands you will need. US Legal Forms provides 1000s of legitimate varieties that are evaluated by experts. It is possible to obtain or produce the Virginia Subscription Agreement for Employee Stock Purchase Plan of Gadzoox Networks, Inc. from our service.

If you already have a US Legal Forms bank account, you may log in and click the Acquire button. Following that, you may complete, change, produce, or sign the Virginia Subscription Agreement for Employee Stock Purchase Plan of Gadzoox Networks, Inc.. Each legitimate papers format you purchase is the one you have permanently. To obtain one more backup of any purchased type, visit the My Forms tab and click the related button.

Should you use the US Legal Forms internet site for the first time, keep to the straightforward guidelines listed below:

- Initial, be sure that you have selected the proper papers format to the area/city of your liking. See the type description to ensure you have chosen the appropriate type. If accessible, utilize the Preview button to check through the papers format also.

- If you want to discover one more version of the type, utilize the Look for industry to get the format that suits you and demands.

- When you have discovered the format you would like, click Purchase now to move forward.

- Select the pricing strategy you would like, enter your credentials, and sign up for an account on US Legal Forms.

- Full the purchase. You may use your Visa or Mastercard or PayPal bank account to purchase the legitimate type.

- Select the structure of the papers and obtain it in your system.

- Make modifications in your papers if needed. You may complete, change and sign and produce Virginia Subscription Agreement for Employee Stock Purchase Plan of Gadzoox Networks, Inc..

Acquire and produce 1000s of papers themes utilizing the US Legal Forms website, which provides the biggest assortment of legitimate varieties. Use skilled and express-specific themes to deal with your organization or personal needs.

Form popularity

FAQ

The ESOP vs 401K Plan With a 401(k), the employer's contributions are tax-deferred, meaning that the money is taken out of each paycheck before taxes, and those wages are not taxed until withdrawal. Whereas with an ESOP, employees also do not pay taxes on the shares in their account until distribution. ESOP vs 401K Plan | Exit Promise exitpromise.com ? ... exitpromise.com ? ...

Limited Liquidity: In some cases, ESPPs may have restrictions on when employees can sell their shares, making it difficult to access the funds in an emergency or for other purposes. This lack of liquidity can be a drawback, especially for employees who may need to sell their shares quickly. Employer Stock Purchase Plan (ESPP): The Pros and The Cons agwealthm.com ? post ? employer-stock-pur... agwealthm.com ? post ? employer-stock-pur...

A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts. Subscription Agreement - Overview, How It Works, Regulation corporatefinanceinstitute.com ? resources ? equities corporatefinanceinstitute.com ? resources ? equities

An employee stock purchase plan (ESPP) is a company-run program in which participating employees can purchase company stock directly, at a discounted price. Employees contribute to the plan through payroll deductions which build up between the offering date and the purchase date. Employee Stock Purchase Plan (ESPP): What It Is and How It ... Investopedia ? terms ? espp Investopedia ? terms ? espp

An ESPP is a program in which employees can purchase company stock at a discounted price. Income or loss from the sale of shares you purchased through an ESPP is generally taxed as a capital gain or loss, though there are holding period requirements. Employee Stock Purchase Plan (ESPP): What It Is and How It Works investopedia.com ? terms ? espp investopedia.com ? terms ? espp

If your company offers one, why should you invest in an ESPP? Since you are acquiring stock, that would otherwise not be available, at a discounted price it is generally a good idea to participate. ESPPs offer an easy, cost-efficient way to pursue a disciplined savings plan. Is ESPP Worth It? | Global Shares globalshares.com ? academy ? espp-is-it-wo... globalshares.com ? academy ? espp-is-it-wo...