Virginia Authorize Sale of fractional shares

Description

How to fill out Authorize Sale Of Fractional Shares?

Are you within a place where you need paperwork for both organization or person uses nearly every working day? There are a variety of legitimate papers templates available online, but finding types you can trust is not straightforward. US Legal Forms delivers 1000s of develop templates, like the Virginia Authorize Sale of fractional shares, which are composed to fulfill federal and state specifications.

Should you be already familiar with US Legal Forms site and also have a free account, merely log in. Following that, you can download the Virginia Authorize Sale of fractional shares design.

If you do not come with an profile and wish to begin to use US Legal Forms, abide by these steps:

- Get the develop you need and make sure it is for that proper town/region.

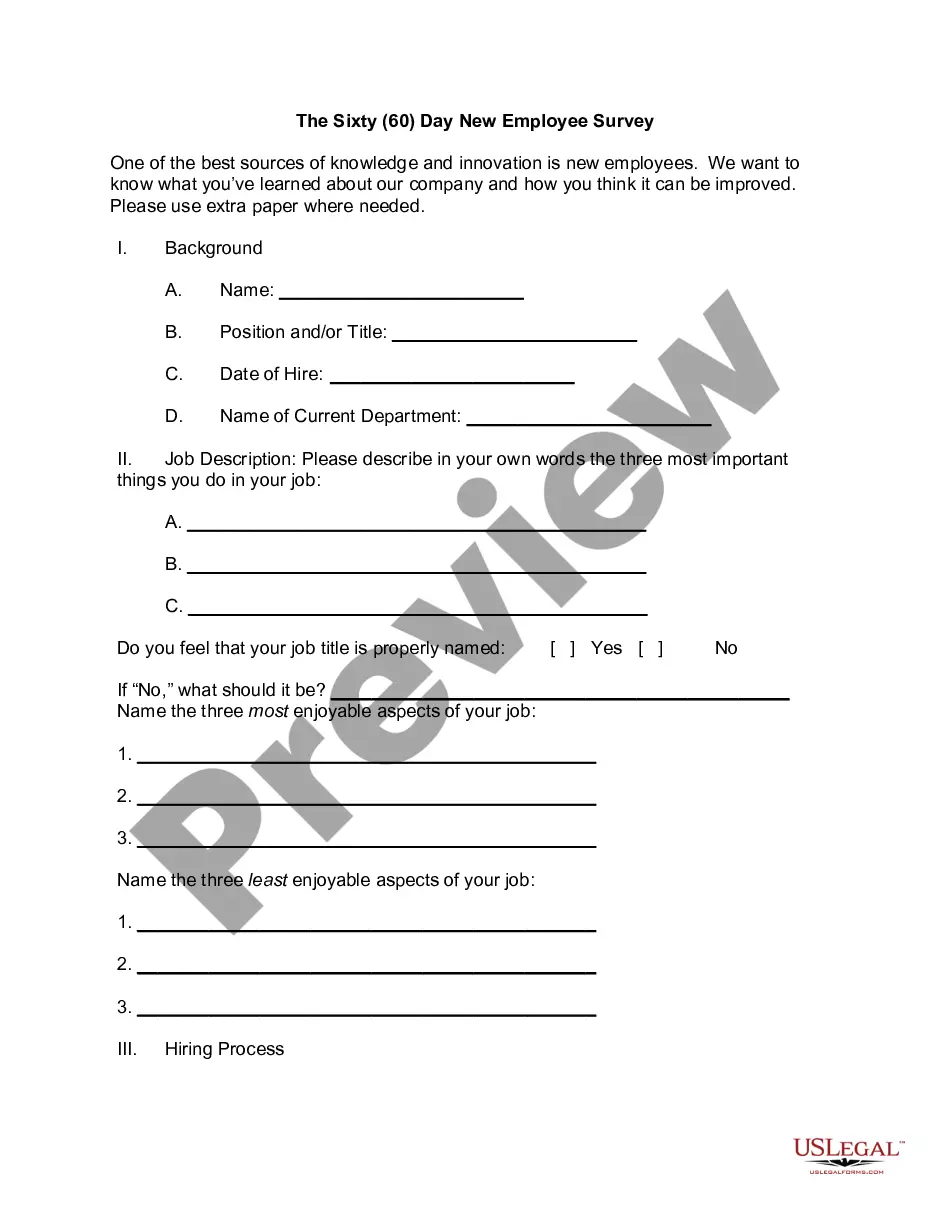

- Make use of the Review key to analyze the form.

- Read the explanation to actually have selected the appropriate develop.

- In the event the develop is not what you`re seeking, use the Lookup discipline to discover the develop that meets your needs and specifications.

- If you find the proper develop, click Buy now.

- Choose the pricing program you would like, fill in the specified information to produce your money, and purchase your order utilizing your PayPal or credit card.

- Decide on a practical file file format and download your version.

Locate all the papers templates you possess bought in the My Forms menus. You may get a extra version of Virginia Authorize Sale of fractional shares whenever, if required. Just click the necessary develop to download or print the papers design.

Use US Legal Forms, one of the most extensive selection of legitimate forms, to conserve efforts and prevent mistakes. The services delivers professionally made legitimate papers templates that can be used for an array of uses. Produce a free account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

Less than one full share of equity is called a fractional share. Such shares may be the result of stock splits, dividend reinvestment plans (DRIPs), or similar corporate actions. Typically, fractional shares aren't available from the stock market, and while they have value to investors, they are also difficult to sell.

For the purpose of taxes, fractional share rewards are considered in the same way as all of your other investments in your Public account. What that means is that if you sell your free slices of stock and realize a capital gain, that must be reported as taxable income.

The only way to sell fractional shares is through a major brokerage firm, which can join them with other fractional shares until a whole share is attained. If the selling stock does not have a high demand in the marketplace, selling the fractional shares might take longer than hoped.

Some may only allow fractional share investing in stocks, while others may offer stocks and exchange-traded funds (ETFs). Some brokerage firms may also limit the type of stocks and ETFs available for fractional shares.

There are no major drawbacks to fractional shares. But it is worth taking into account the fact that this does not really increase profit potential by itself. A larger investment in a single share that goes up in value is of more benefit than a smaller one in multiple stocks that do not go anywhere or that go down.

Shares issued by a corporation that equal less than one full share of stock. Fractional shares are often issued in connection with stock-for-stock mergers, stock dividends, reverse stock splits, and other similar corporate actions. Corporations may, but are not required, to issue fractional shares.