Virginia Authorization to purchase corporation's outstanding common stock

Description

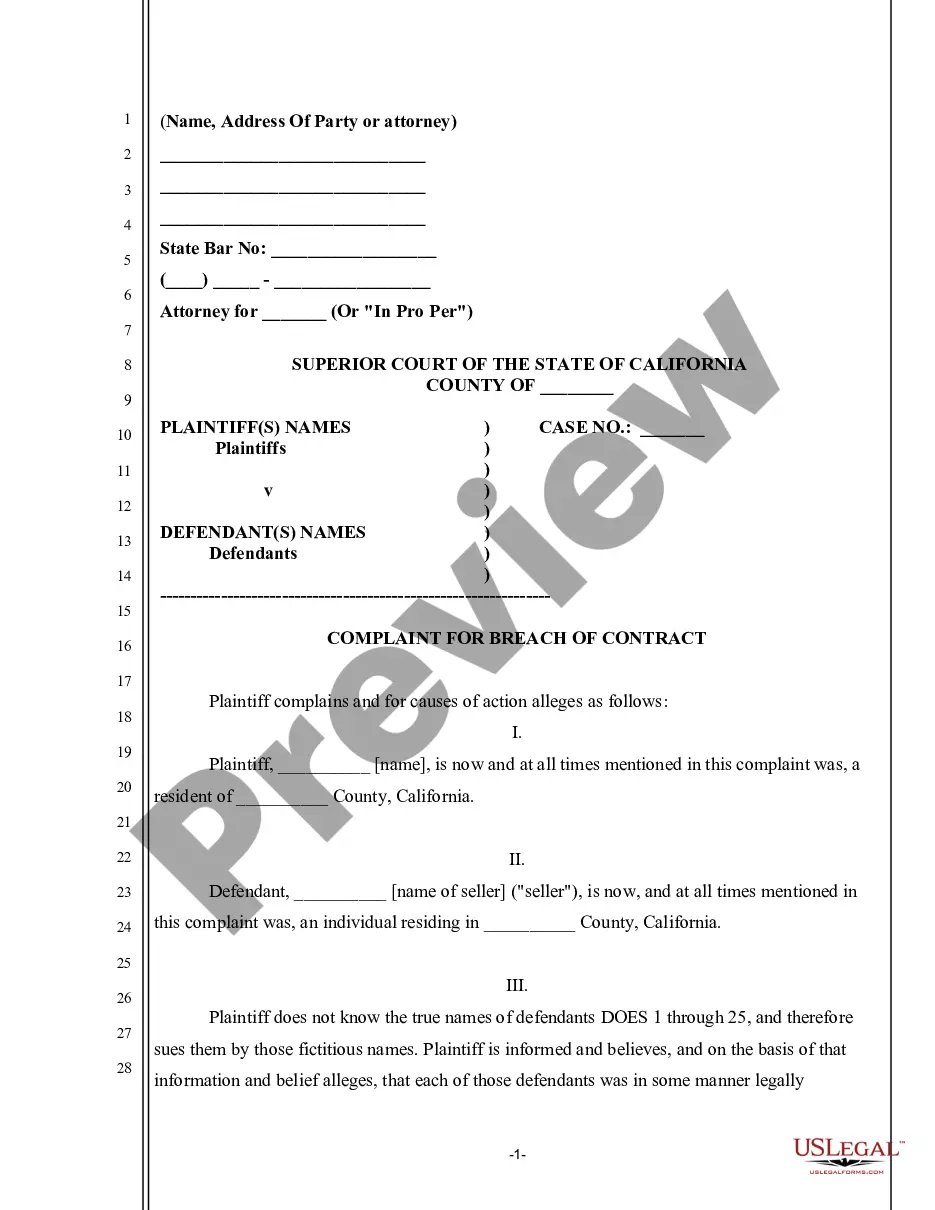

How to fill out Authorization To Purchase Corporation's Outstanding Common Stock?

US Legal Forms - among the greatest libraries of legitimate kinds in the United States - offers an array of legitimate papers layouts it is possible to acquire or printing. While using website, you can get a large number of kinds for organization and individual uses, sorted by classes, claims, or keywords and phrases.You will discover the latest types of kinds like the Virginia Authorization to purchase corporation's outstanding common stock in seconds.

If you already have a membership, log in and acquire Virginia Authorization to purchase corporation's outstanding common stock in the US Legal Forms local library. The Obtain key will appear on every develop you perspective. You get access to all earlier saved kinds inside the My Forms tab of your own account.

If you would like use US Legal Forms the first time, listed below are basic recommendations to get you started:

- Be sure to have selected the right develop for your personal town/state. Click on the Review key to examine the form`s articles. Browse the develop explanation to actually have selected the right develop.

- In the event the develop doesn`t satisfy your demands, use the Search industry towards the top of the display to find the one that does.

- Should you be content with the shape, verify your selection by clicking on the Acquire now key. Then, pick the costs program you want and supply your qualifications to sign up to have an account.

- Approach the transaction. Utilize your credit card or PayPal account to finish the transaction.

- Pick the file format and acquire the shape on your product.

- Make alterations. Load, modify and printing and indicator the saved Virginia Authorization to purchase corporation's outstanding common stock.

Each format you put into your money does not have an expiry day and it is yours for a long time. So, in order to acquire or printing another backup, just go to the My Forms segment and then click about the develop you will need.

Get access to the Virginia Authorization to purchase corporation's outstanding common stock with US Legal Forms, the most extensive local library of legitimate papers layouts. Use a large number of skilled and status-distinct layouts that meet up with your small business or individual requires and demands.

Form popularity

FAQ

A stock corporation has authorized capital stock divided into shares of stock either with or without par value. It's engaged in income-generating activities and authorized to declare dividends. A non-stock corporation has no authorized capital stock.

Stock corporations are usually formed to generate a profit for the shareholders. Nonstock corporations are usually organized for not-for-profit purposes, such as a tax-exempt, charitable organization or a property owners' association.

Any corporation shall have power to make any further indemnity, including indemnity with respect to a proceeding by or in the right of the corporation, and to make additional provision for advances and reimbursement of expenses, to any director or officer that may be authorized by the articles of incorporation or any ...

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders. No matter which entity you choose, both entities offer big benefits to your business. Incorporating a business allows you to establish credibility and professionalism.

Action without meeting. A. Action required or permitted by this chapter to be taken at a shareholders' meeting may be taken without a meeting if the action is taken by all the shareholders entitled to vote on the action, in which case no action by the board of directors shall be required.

One or more classes or series of shares, which may be the same class or classes or series as those with voting rights, that together are entitled to receive the net assets of the corporation upon dissolution.

What Are Stock Corporations? Stock corporations are for-profit organizations that issue shares of stock to shareholders (also known as stockholders) to raise capital, with each share representing partial ownership of the corporation and granting shareholders certain ownership rights that shape company policies.

Visit to file articles of dissolution and/or termination of a Virginia Stock Corporation in real time. Questions? P.O. Box 1197 Richmond, VA 23219 Richmond, VA 23218-1197 Pay online with a credit card or eCheck. No additional processing fees apply for filing online.