Virginia Profit Sharing Plan

Description

How to fill out Profit Sharing Plan?

You can invest hours on the web trying to find the legitimate record format that fits the state and federal specifications you will need. US Legal Forms provides 1000s of legitimate varieties that are evaluated by experts. It is simple to obtain or printing the Virginia Profit Sharing Plan from your services.

If you have a US Legal Forms profile, you can log in and click the Down load button. After that, you can comprehensive, change, printing, or indication the Virginia Profit Sharing Plan. Every single legitimate record format you buy is your own eternally. To obtain another duplicate for any obtained develop, visit the My Forms tab and click the related button.

If you are using the US Legal Forms site for the first time, keep to the straightforward recommendations beneath:

- Initial, ensure that you have selected the proper record format for that state/metropolis that you pick. Read the develop outline to make sure you have picked out the correct develop. If offered, take advantage of the Preview button to look through the record format too.

- If you wish to locate another version in the develop, take advantage of the Search area to find the format that suits you and specifications.

- When you have found the format you need, click Purchase now to carry on.

- Choose the rates strategy you need, enter your references, and sign up for a merchant account on US Legal Forms.

- Full the transaction. You may use your credit card or PayPal profile to cover the legitimate develop.

- Choose the structure in the record and obtain it to your device.

- Make changes to your record if required. You can comprehensive, change and indication and printing Virginia Profit Sharing Plan.

Down load and printing 1000s of record layouts utilizing the US Legal Forms web site, which provides the greatest assortment of legitimate varieties. Use skilled and express-specific layouts to tackle your organization or individual demands.

Form popularity

FAQ

The VRS retirement plan is a qualified 401(a) defined benefit plan which pays eligible members a lifetime benefit amount based on years of service, age, and compensation. VRS members may also participate in the Virginia Deferred Compensation Plan. Additional information can be found at .varetire.org.

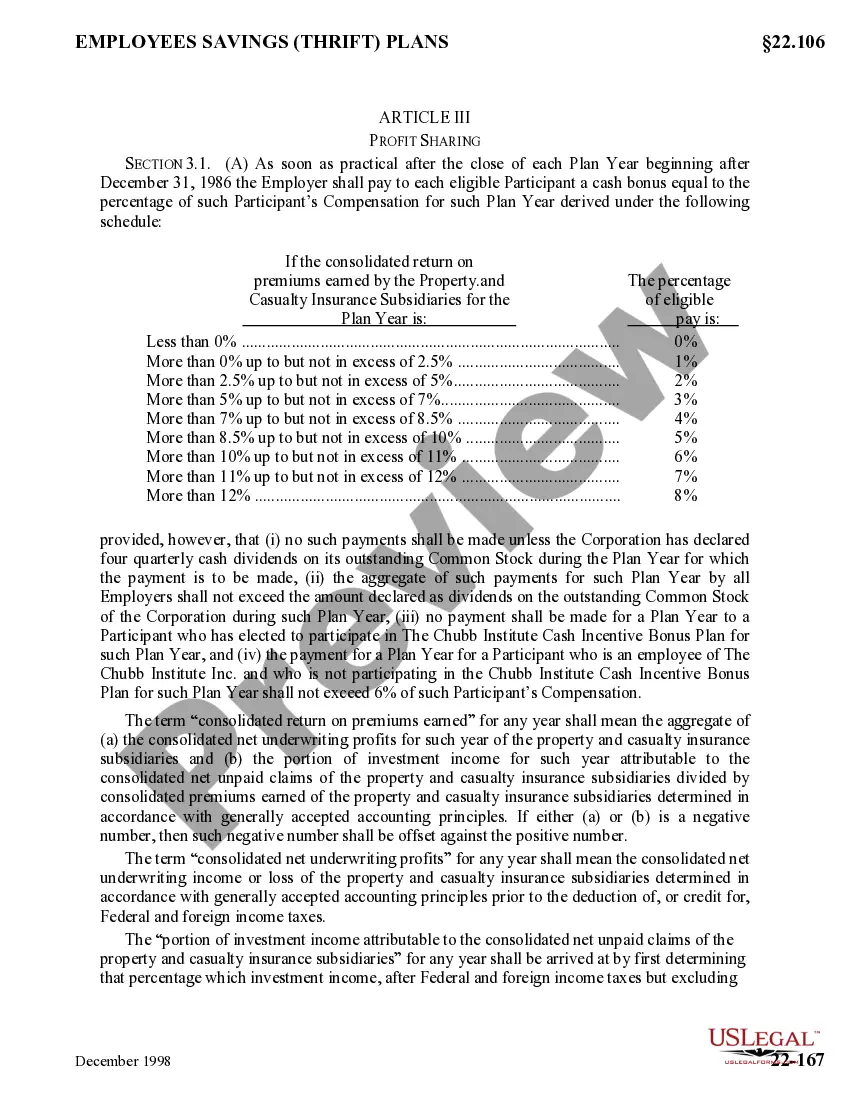

Contribution Limits This limit is the lesser of: ? 100 percent of the participant's compensation, or ? $61,000 for 2022 and $66,000 for 2023. If you, the employer, make contributions to a profit sharing plan, you can deduct up to 25 percent of the compensation paid during the taxable year to all participants.

Contribution limits The lesser of 100% of compensation or $66,000 for 2023 ($61,000 for 2022; $58,000 for 2021; $57,000 for 2020, subject to cost-of-living adjustments for later years).

The 401(k) contribution limit for 2023 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions. If you're age 50 or older, you're eligible for an additional $7,500 in catch-up contributions, raising your employee contribution limit to $30,000.

Limitations to profit sharing plans Employers can only deduct contributions to retirement plans of up to 25% of total employee compensation. Total contributions for each employee (including employer contributions and employee deferrals) may not exceed 100% of the employee's compensation.

sharing plan is a retirement plan that allows an employer or company owner to share the profits in the business, up to 25 percent of the company's payroll, with the firm's employees. The employer can decide how much to set aside each year, and any size employer can use the plan.

The simplest and most common is known as the comp-to-comp method, where contributions are based on the proportion of an employee's compensation to the total compensation of all employees of the organization. There's no required profit-sharing percentage, but experts recommend staying between 2.5% and 7.5%.

401(k) The key difference between a profit sharing plan and a 401(k) plan is that only employers contribute to a profit sharing plan. If employees can also make pre-tax, salary-deferred contributions, then the plan is a 401(k).