Virginia Proposal to Approve Adoption of Employees' Stock Option Plan

Description

How to fill out Proposal To Approve Adoption Of Employees' Stock Option Plan?

US Legal Forms - among the biggest libraries of lawful forms in the United States - offers a variety of lawful file themes you are able to acquire or print. Using the site, you can find 1000s of forms for organization and personal purposes, categorized by classes, claims, or keywords.You can find the most recent models of forms just like the Virginia Proposal to Approve Adoption of Employees' Stock Option Plan in seconds.

If you already have a registration, log in and acquire Virginia Proposal to Approve Adoption of Employees' Stock Option Plan from your US Legal Forms catalogue. The Acquire switch will appear on each type you view. You have accessibility to all earlier delivered electronically forms inside the My Forms tab of your own bank account.

If you would like use US Legal Forms initially, listed here are straightforward recommendations to help you get began:

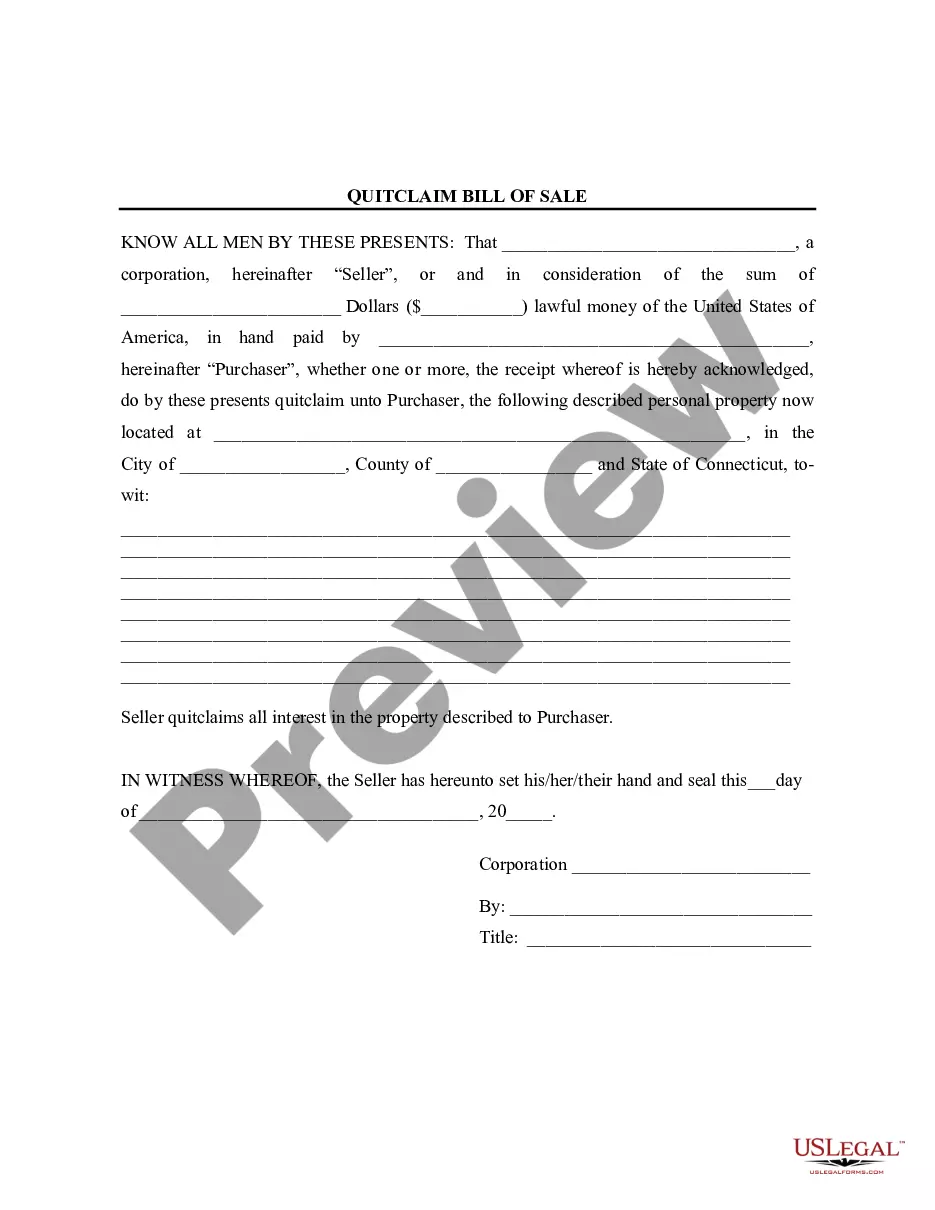

- Ensure you have picked out the right type for your personal area/state. Go through the Preview switch to analyze the form`s content. Browse the type outline to actually have selected the right type.

- If the type doesn`t suit your requirements, utilize the Look for area on top of the display to find the the one that does.

- In case you are satisfied with the form, confirm your decision by clicking on the Buy now switch. Then, opt for the costs strategy you want and supply your accreditations to register on an bank account.

- Approach the financial transaction. Utilize your charge card or PayPal bank account to finish the financial transaction.

- Select the format and acquire the form on your device.

- Make adjustments. Complete, modify and print and indication the delivered electronically Virginia Proposal to Approve Adoption of Employees' Stock Option Plan.

Each and every web template you included with your money does not have an expiry particular date and is yours permanently. So, if you wish to acquire or print yet another backup, just go to the My Forms segment and click on around the type you will need.

Obtain access to the Virginia Proposal to Approve Adoption of Employees' Stock Option Plan with US Legal Forms, one of the most extensive catalogue of lawful file themes. Use 1000s of specialist and state-distinct themes that satisfy your company or personal needs and requirements.

Form popularity

FAQ

An incentive stock option must be granted within 10 years from the date that the plan under which it is granted is adopted or the date such plan is approved by the stockholders, whichever is earlier. To grant incentive stock options after the expiration of the 10-year period, a new plan must be adopted and approved.

To receive the incentive, you must hold (keep) ISOs for at least one year after exercise and two years after the grant date. If you hold your stock for at least a year after purchase, you will pay the lower capital gains tax rate on the increase in value.

If, immediately before an option is granted, an individual does own (or is treated as owning) stock accounting for 10% or more of the total combined voting power of all classes of stock, options granted to the individual cannot qualify as ISOs unless the strike price is at least 110% of the fair market value (FMV) with ...

The term employee stock option (ESO) refers to a type of equity compensation granted by companies to their employees and executives. Rather than granting shares of stock directly, the company gives derivative options on the stock instead.

An incentive stock option must be granted within 10 years from the date that the plan under which it is granted is adopted or the date such plan is approved by the stockholders, whichever is earlier. To grant incentive stock options after the expiration of the 10-year period, a new plan must be adopted and approved.

So start off right: Plan ahead. Your first step is planning. ... Manage your equity. ... Set some guidelines for stock options. ... Get a 409A valuation. ... Use the 409A to set the strike price. ... Adopt your vesting and cliff schedule. ... Set an expiration timeline. ... Create an ESO agreement and get your board's approval.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.

The 10-year deadline is required by the Internal Revenue Code. It's actually a five-year deadline to grant an incentive stock option to someone who's a 10% stockholder. For non-qualified stock options, 10 years is not required by the Internal Revenue Code, but it's almost universally the maximum term that you see.