Virginia Approval of Incentive Stock Option Plan

Description

How to fill out Approval Of Incentive Stock Option Plan?

Are you presently in the placement where you need papers for both organization or person purposes almost every time? There are a variety of authorized record templates available on the Internet, but discovering kinds you can trust is not simple. US Legal Forms gives thousands of form templates, just like the Virginia Approval of Incentive Stock Option Plan, which can be written to meet state and federal needs.

In case you are already knowledgeable about US Legal Forms site and get a merchant account, simply log in. Following that, you can down load the Virginia Approval of Incentive Stock Option Plan web template.

Should you not come with an account and want to begin to use US Legal Forms, adopt these measures:

- Find the form you want and make sure it is to the appropriate area/region.

- Make use of the Review key to examine the shape.

- See the information to ensure that you have selected the proper form.

- When the form is not what you`re seeking, take advantage of the Lookup area to obtain the form that meets your needs and needs.

- If you find the appropriate form, just click Get now.

- Select the rates prepare you want, complete the required information to create your account, and pay for the transaction making use of your PayPal or Visa or Mastercard.

- Decide on a convenient file formatting and down load your backup.

Discover all of the record templates you have bought in the My Forms menu. You can get a additional backup of Virginia Approval of Incentive Stock Option Plan anytime, if required. Just go through the needed form to down load or print the record web template.

Use US Legal Forms, by far the most considerable variety of authorized types, to save lots of time as well as stay away from errors. The support gives skillfully produced authorized record templates that can be used for a variety of purposes. Create a merchant account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

Equity compensation is non-cash pay that is offered to employees. Equity compensation may include options, restricted stock, and performance shares; all of these investment vehicles represent ownership in the firm for a company's employees.

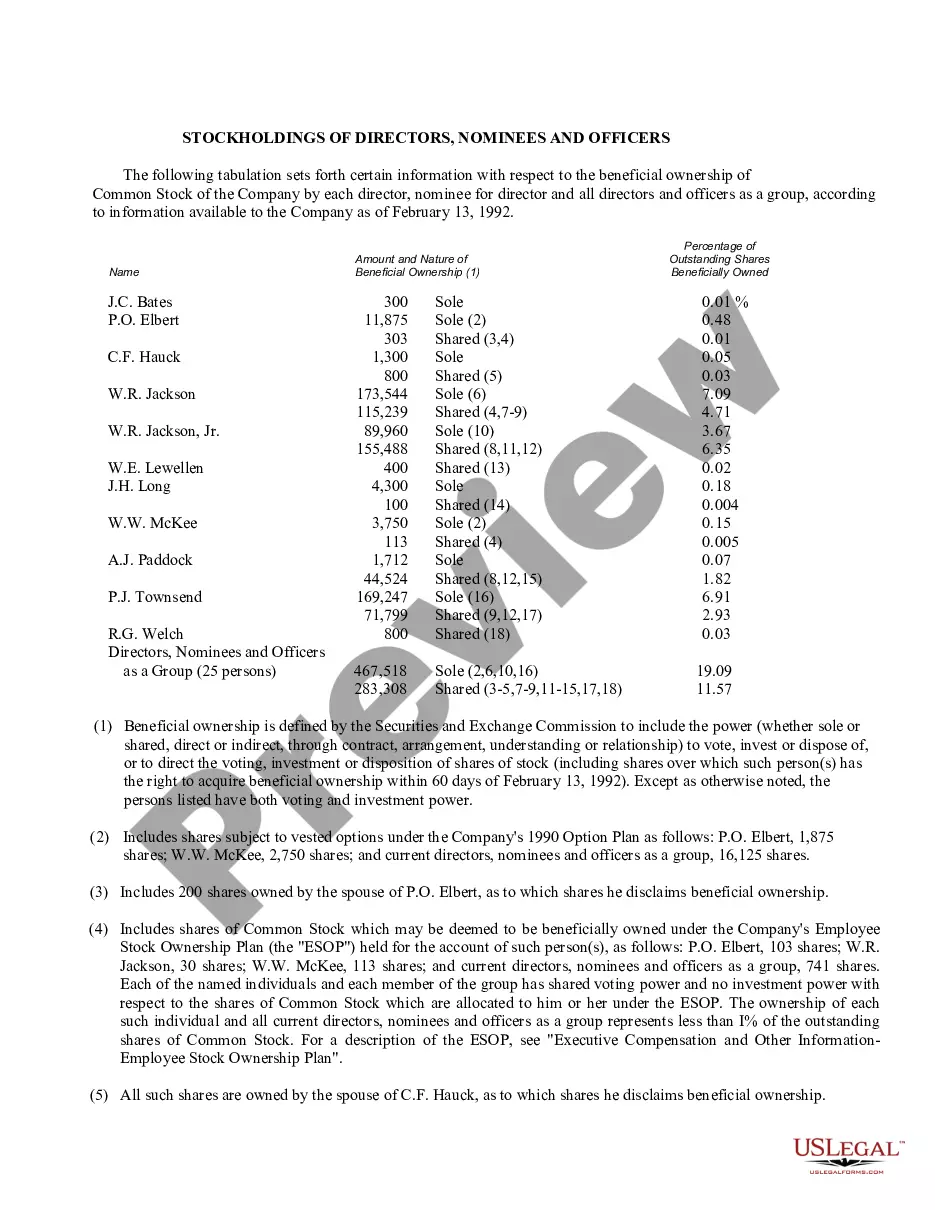

Board Approval The Company's board of directors must approve all stock option grants, including the name of the recipient, the number of shares, the vesting schedule and the exercise price. This can be done either in a board meeting or via unanimous written consent.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

Once you have a plan in place, you can simply make amendments to increase the number of shares in the option pool on an as-needed basis. The initial plan and any expansions must be approved by your board of directors and then by shareholders.

Stock Based Compensation (also called Share-Based Compensation or Equity Compensation) is a way of paying employees, executives, and directors of a company with equity in the business.

Failure to get board approval Let's start with an obvious one that founders routinely miss in the early days: Stock option grants must be approved by the board. If the board doesn't approve (either at a board meeting or by unanimous written consent), the stock options haven't actually been granted.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

The option plan must be approved by the stockholders within 12 months before or after the plan is adopted (see also Explanation: §423, Shareholder Approval Requirement) (IRC § 422(b)(1); Reg. §1.422-3).