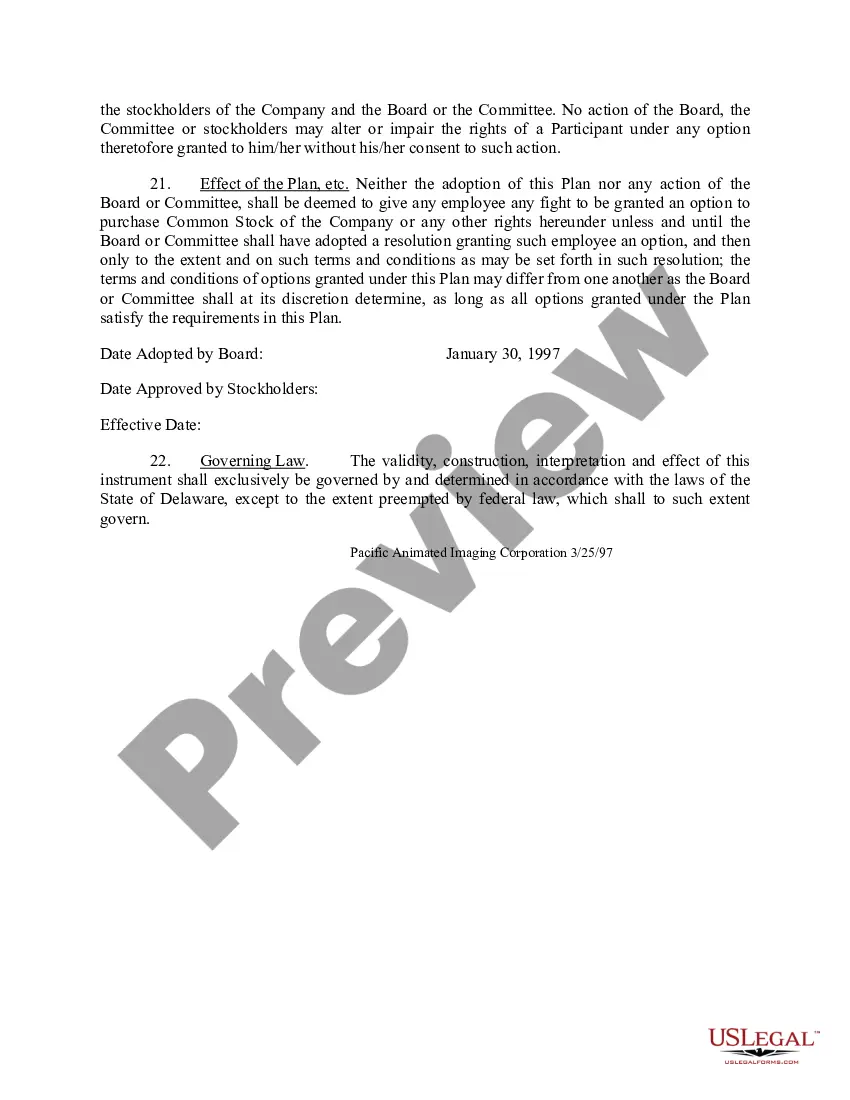

Virginia Stock Option Plan to approve Incentive Stock Option Plan of Pacific Animated Imaging Corp.

Description

How to fill out Stock Option Plan To Approve Incentive Stock Option Plan Of Pacific Animated Imaging Corp.?

If you want to total, download, or produce lawful record themes, use US Legal Forms, the most important assortment of lawful kinds, that can be found on-line. Use the site`s easy and hassle-free search to get the documents you require. A variety of themes for company and specific purposes are categorized by groups and claims, or keywords. Use US Legal Forms to get the Virginia Stock Option Plan to approve Incentive Stock Option Plan of Pacific Animated Imaging Corp. in a few click throughs.

When you are presently a US Legal Forms buyer, log in for your accounts and then click the Down load key to get the Virginia Stock Option Plan to approve Incentive Stock Option Plan of Pacific Animated Imaging Corp.. Also you can entry kinds you formerly acquired in the My Forms tab of your own accounts.

Should you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Make sure you have selected the shape to the right metropolis/region.

- Step 2. Make use of the Preview choice to examine the form`s content material. Never neglect to see the information.

- Step 3. When you are unsatisfied using the kind, take advantage of the Research discipline near the top of the screen to locate other variations in the lawful kind design.

- Step 4. Upon having discovered the shape you require, click on the Buy now key. Choose the rates plan you prefer and add your credentials to register on an accounts.

- Step 5. Approach the deal. You may use your credit card or PayPal accounts to finish the deal.

- Step 6. Find the file format in the lawful kind and download it on the gadget.

- Step 7. Comprehensive, change and produce or sign the Virginia Stock Option Plan to approve Incentive Stock Option Plan of Pacific Animated Imaging Corp..

Each and every lawful record design you get is your own property for a long time. You possess acces to every single kind you acquired in your acccount. Click the My Forms segment and select a kind to produce or download once again.

Contend and download, and produce the Virginia Stock Option Plan to approve Incentive Stock Option Plan of Pacific Animated Imaging Corp. with US Legal Forms. There are millions of specialist and state-distinct kinds you can use for the company or specific demands.

Form popularity

FAQ

The option plan must be approved by the stockholders within 12 months before or after the plan is adopted (see also Explanation: §423, Shareholder Approval Requirement) (IRC § 422(b)(1); Reg. §1.422-3).

An incentive stock option is a type of compensation in the form of an agreement between an employer and an employee that allows the employee to purchase shares of the employer's stock at a specified price (i.e., the ?strike price?).

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

Summary of ISO vs. NSO Differences Incentive Stock Options (ISOs)Non-Qualified Stock Options (NSOs)Eligible RecipientsEmployees onlyAny service provider (e.g. employees, advisors, consultants, directors)Tax at GrantNo tax eventNo tax event10 more rows

A stock option provides an employee with the opportunity to purchase a set number of shares of company stock at a certain price within a certain period of time. The price is called the ?grant price? or ?strike price.? This price is usually based on a discounted price of the stock at the time of hire.

Incentive or statutory stock options are offered by some companies to encourage employees to remain long-term with a company and contribute to its growth and development and to the subsequent rise in its stock price.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.