Virginia Form of Indemnification Agreement by Kyle Technology Corp.

Description

How to fill out Form Of Indemnification Agreement By Kyle Technology Corp.?

Discovering the right authorized file web template might be a have difficulties. Obviously, there are a lot of themes available online, but how do you discover the authorized form you want? Take advantage of the US Legal Forms website. The support provides a large number of themes, including the Virginia Form of Indemnification Agreement by Kyle Technology Corp., which can be used for organization and personal demands. Every one of the types are inspected by experts and fulfill federal and state requirements.

Should you be currently registered, log in to your bank account and then click the Obtain switch to obtain the Virginia Form of Indemnification Agreement by Kyle Technology Corp.. Utilize your bank account to search throughout the authorized types you may have purchased previously. Proceed to the My Forms tab of your respective bank account and acquire an additional copy from the file you want.

Should you be a brand new customer of US Legal Forms, listed here are easy guidelines for you to stick to:

- Initial, ensure you have chosen the correct form for your personal area/county. You may check out the shape while using Review switch and browse the shape information to make certain it will be the right one for you.

- When the form is not going to fulfill your expectations, make use of the Seach industry to discover the correct form.

- When you are sure that the shape is acceptable, go through the Get now switch to obtain the form.

- Opt for the pricing plan you want and enter the essential info. Build your bank account and pay for your order with your PayPal bank account or Visa or Mastercard.

- Opt for the submit structure and down load the authorized file web template to your system.

- Total, revise and print and sign the received Virginia Form of Indemnification Agreement by Kyle Technology Corp..

US Legal Forms will be the biggest library of authorized types that you will find a variety of file themes. Take advantage of the company to down load skillfully-created documents that stick to status requirements.

Form popularity

FAQ

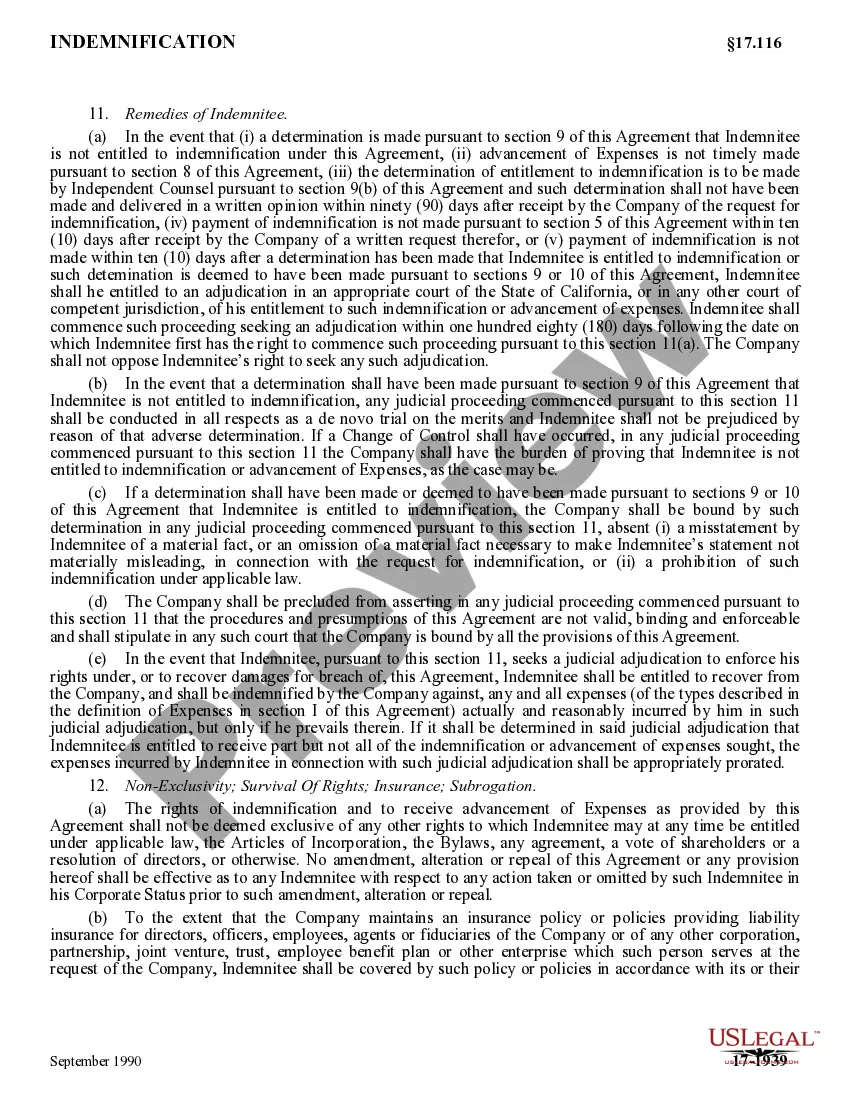

All indemnification agreements should detail how the indemnitee should notify the indemnitor of a dispute or claim. It should also spell out how the indemnitor can defend against a claim.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

Most jurisdictions do not require notarization for an Indemnity Agreement to be valid. However, you can reinforce the validity of the parties' signatures if you choose to notarize the document.

On this page you'll find 61 synonyms, antonyms, and words related to indemnification, such as: compensation, indemnity, restitution, benefit, counterclaim, and coverage.

An indemnity agreement is a contract that protects one party of a transaction from the risks or liabilities created by the other party of the transaction.

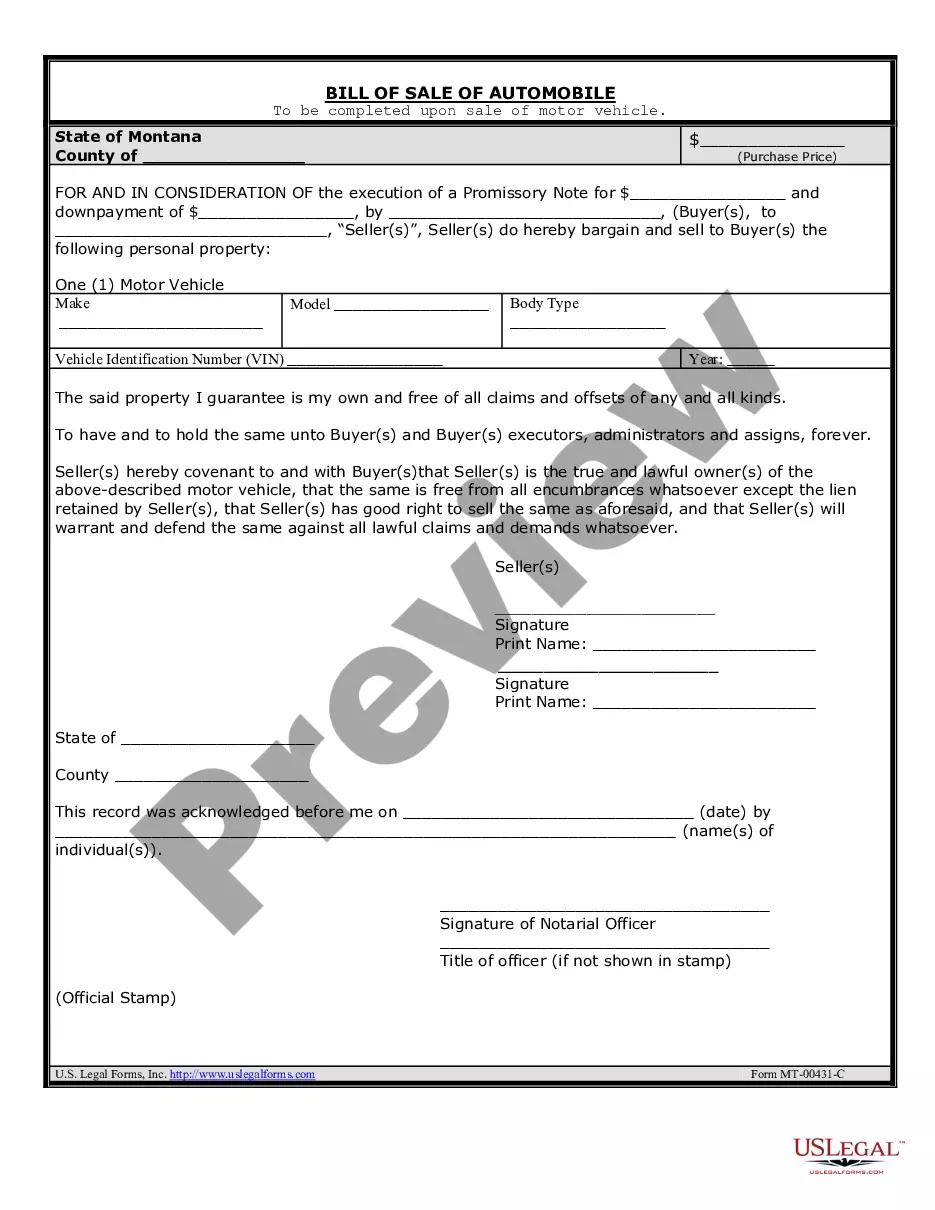

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

The most common example of indemnity in the financial sense is an insurance contract. For instance, in the case of home insurance, homeowners pay insurance to an insurance company in return for the homeowners being indemnified if the worst were to happen.

Example: Indemnify and Hold Harmless Clause The supplier agrees to indemnify and hold harmless the customer against all claims arising in respect of any injury, death, sickness or ill-health caused to or suffered by the customer and its personnel as a result of performance or non-performance of this Agreement.