Virginia Consulting Contract Questionnaire - Self-Employed

Description

How to fill out Consulting Contract Questionnaire - Self-Employed?

You may spend several hours online looking for the legal document template that complies with the state and federal requirements you need.

US Legal Forms offers a vast array of legal documents that have been evaluated by experts.

You can conveniently access or create the Virginia Consulting Contract Questionnaire - Self-Employed through our services.

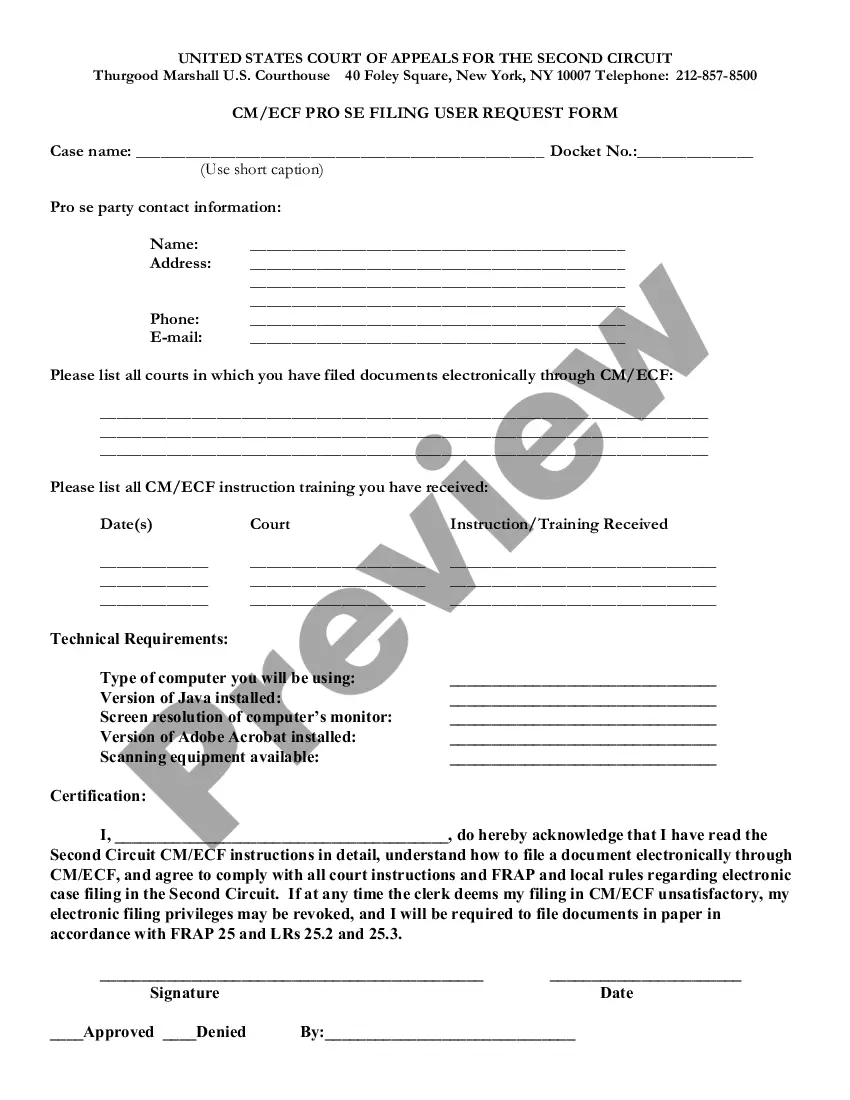

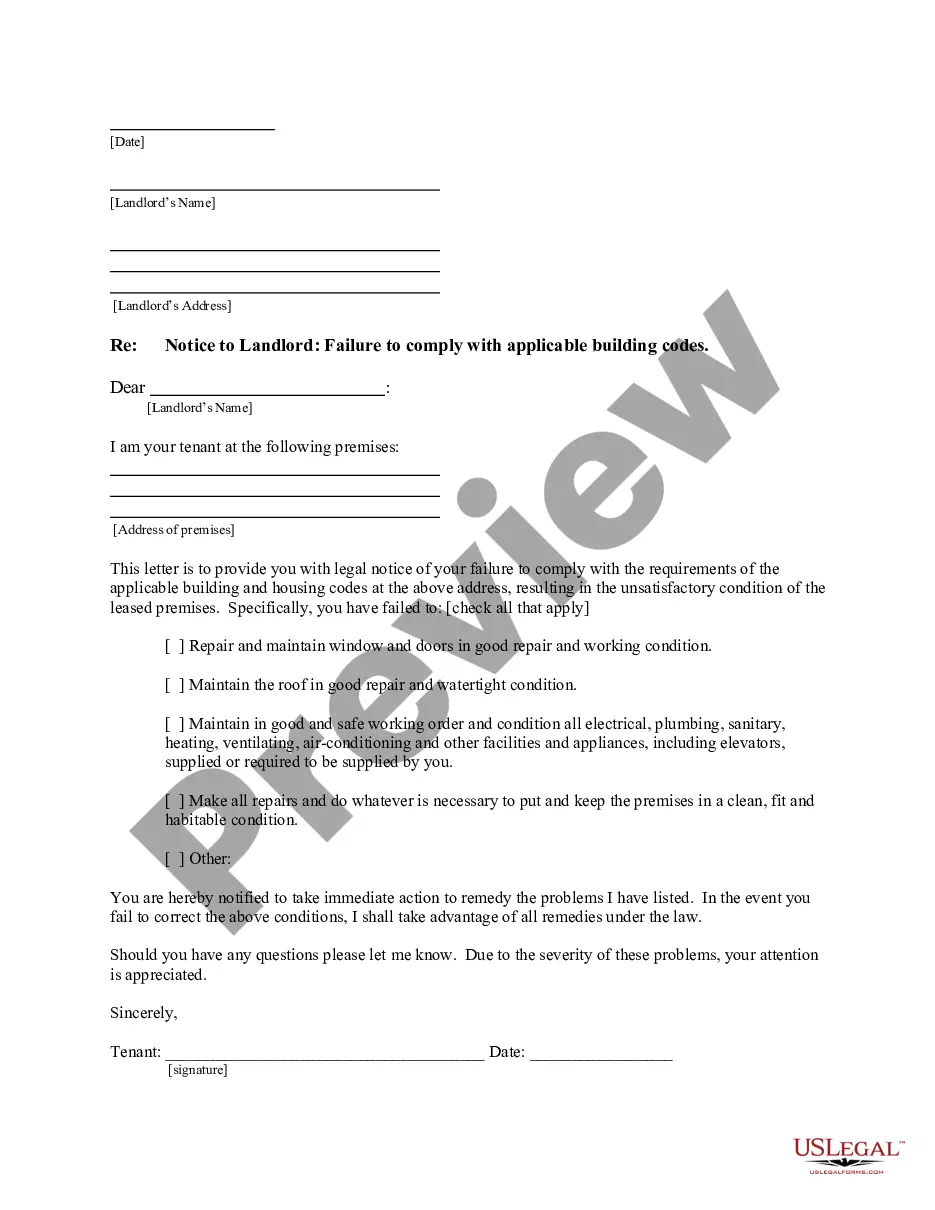

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can fill out, modify, print, or sign the Virginia Consulting Contract Questionnaire - Self-Employed.

- Every legal document template you purchase is yours permanently.

- To get another copy of any purchased form, go to the My documents tab and then click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions provided below.

- First, ensure that you have selected the correct document template for the state/city of your choosing.

- Read the form description to ensure you have chosen the correct form.

Form popularity

FAQ

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Contractors (sometimes called consultants) are self-employed people engaged for a specific task at an agreed price and with a specific goal in mind, often over a set period of time. They set their own hours of work and are paid a fee for completing each set assignment.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

A reputable contractor should be able to front the costs of most supplies without a large sum of money from you. A good rule of thumb is an initial deposit of no more than 10% down or $1,000, whichever is less.

As the homeowner who is commissioning the project, it's reasonable to withhold at least 10% as your final payment. Avoid paying in full upfront, and definitely avoid paying anything before the contractor has evaluated the project in person.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.