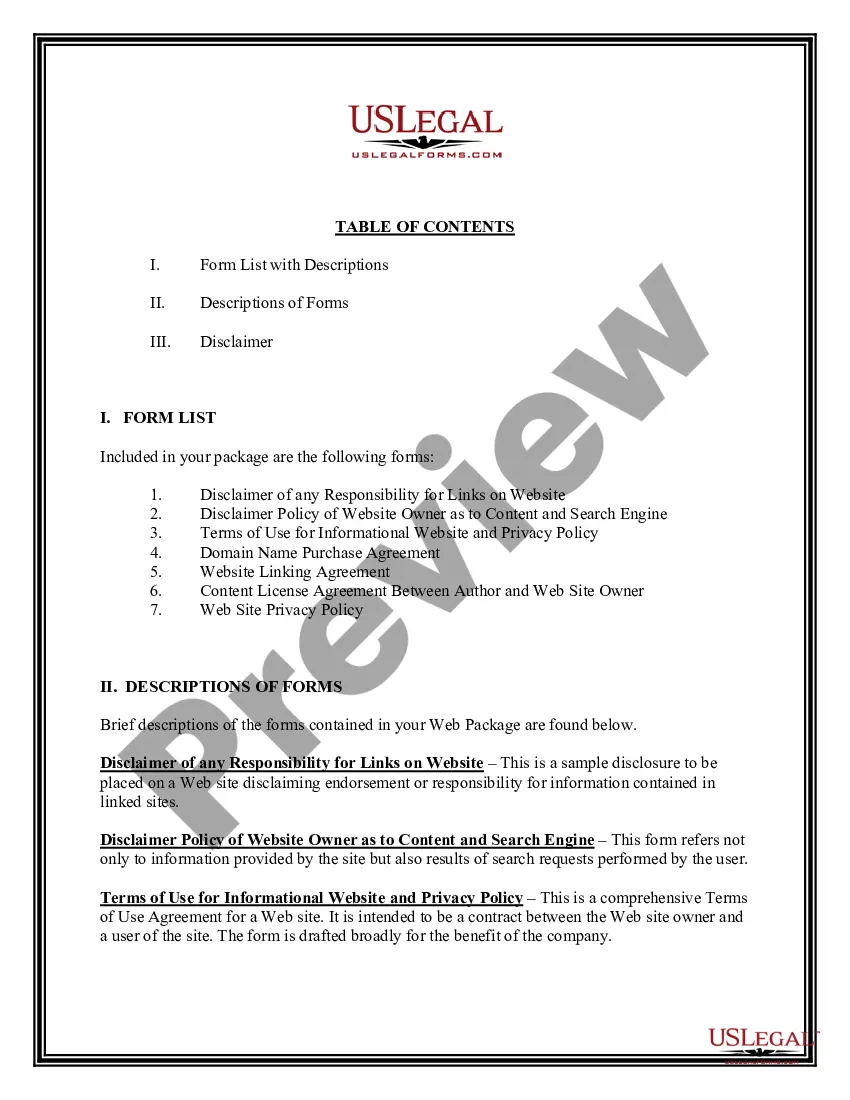

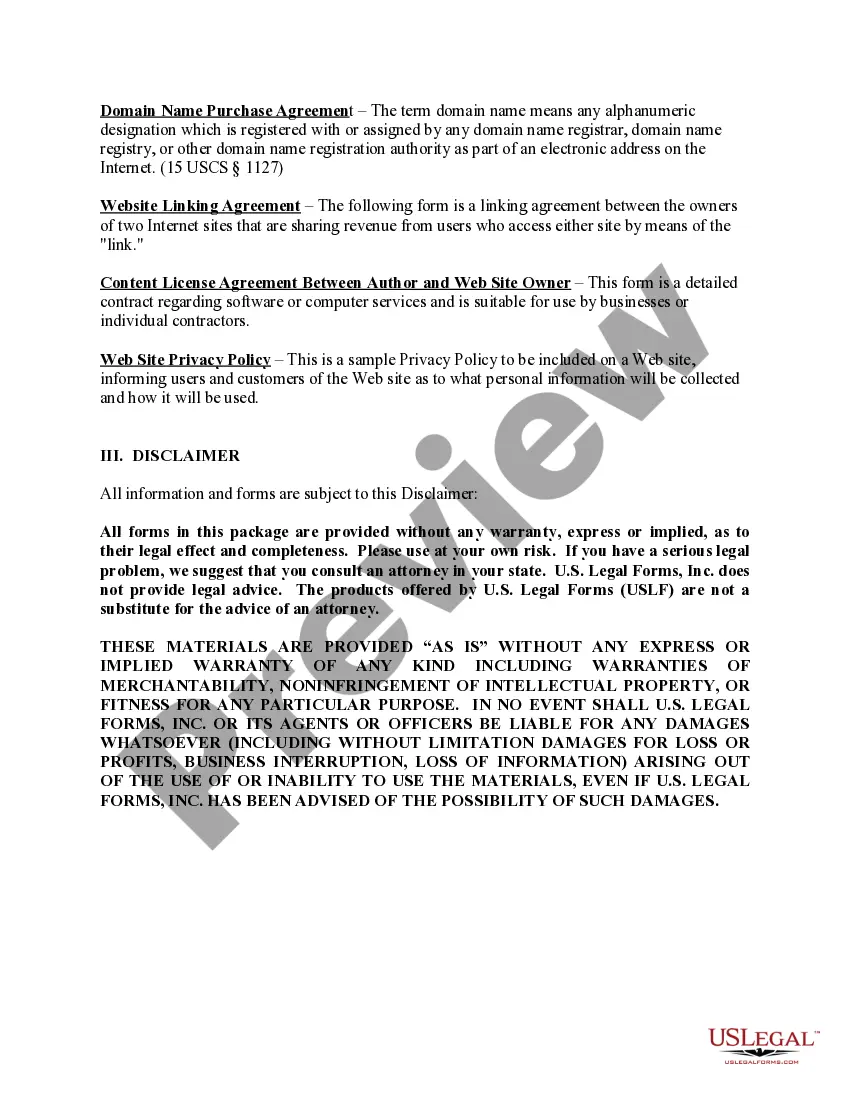

Virginia Web Package

Description

How to fill out Web Package?

US Legal Forms - one of the greatest libraries of authorized kinds in the USA - offers a wide range of authorized record templates you may down load or print out. Using the web site, you can find a large number of kinds for company and specific purposes, sorted by groups, states, or search phrases.You can find the most recent types of kinds much like the Virginia Web Package within minutes.

If you already possess a registration, log in and down load Virginia Web Package from the US Legal Forms collection. The Obtain switch can look on each and every type you look at. You have access to all formerly delivered electronically kinds from the My Forms tab of the profile.

In order to use US Legal Forms the first time, allow me to share simple guidelines to help you get began:

- Be sure to have chosen the proper type for the town/area. Go through the Preview switch to examine the form`s content material. Browse the type outline to ensure that you have selected the proper type.

- In the event the type doesn`t match your demands, take advantage of the Lookup industry on top of the screen to obtain the one who does.

- When you are satisfied with the shape, affirm your selection by clicking the Acquire now switch. Then, select the pricing plan you prefer and give your references to sign up for an profile.

- Procedure the deal. Make use of bank card or PayPal profile to perform the deal.

- Find the file format and down load the shape in your device.

- Make modifications. Fill out, modify and print out and indicator the delivered electronically Virginia Web Package.

Each and every web template you included in your bank account lacks an expiration day and is the one you have for a long time. So, if you wish to down load or print out yet another version, just proceed to the My Forms section and then click around the type you require.

Gain access to the Virginia Web Package with US Legal Forms, probably the most substantial collection of authorized record templates. Use a large number of skilled and state-particular templates that meet up with your small business or specific requires and demands.

Form popularity

FAQ

Families and friends have the opportunity to order various snack/food, hygiene, and clothing items to be sent directly to an inmate. The orders can be done fully online through Access Securepak by The Keefe Group, The Henrico County Regional Jail's supplier of commissary.

Payments are already being sent to eligible Virginians. Depending on available tax filing information, payments will be issued via check or direct deposit. The Virginia Department of Taxation says you can check your eligibility using its rebate lookup tool.

(updated ) We issue most refunds in less than 21 calendar days. However, if you filed a paper return and expect a refund, it could take four weeks or more to process your return. Where's My Refund?

Virginia law conforms to the federal definition of income subject to withholding. Virginia withholding is generally required on any payment for which federal withholding is required. This includes most wages, pensions and annuities, gambling winnings, vacation pay, bonuses, and certain expense reimbursements.

General refund processing times during filing season: Electronically filed returns: Within 2 weeks. Paper filed returns: Up to 8 weeks or longer.

If you're eligible and filed your taxes before July 1, we are required to issue your rebate by November 30. However, we anticipate issuing most rebates by early November. Eligible taxpayers must have filed their 2022 individual income tax return by November 1, 2023 to receive the rebate.

Virginians are able to check their eligibility on the Commonwealth's tax rebate webpage. To be eligible, taxpayers must have had 2022 tax liability and must file their taxes no later than Wednesday, November 1 of this year.

You can check the status of your Virginia refund 24 hours a day, 7 days a week using our ?Where's My Refund?? tool or by calling our automated phone line at 804.367.2486. Tax Tips - Where Is My Virginia Refund?