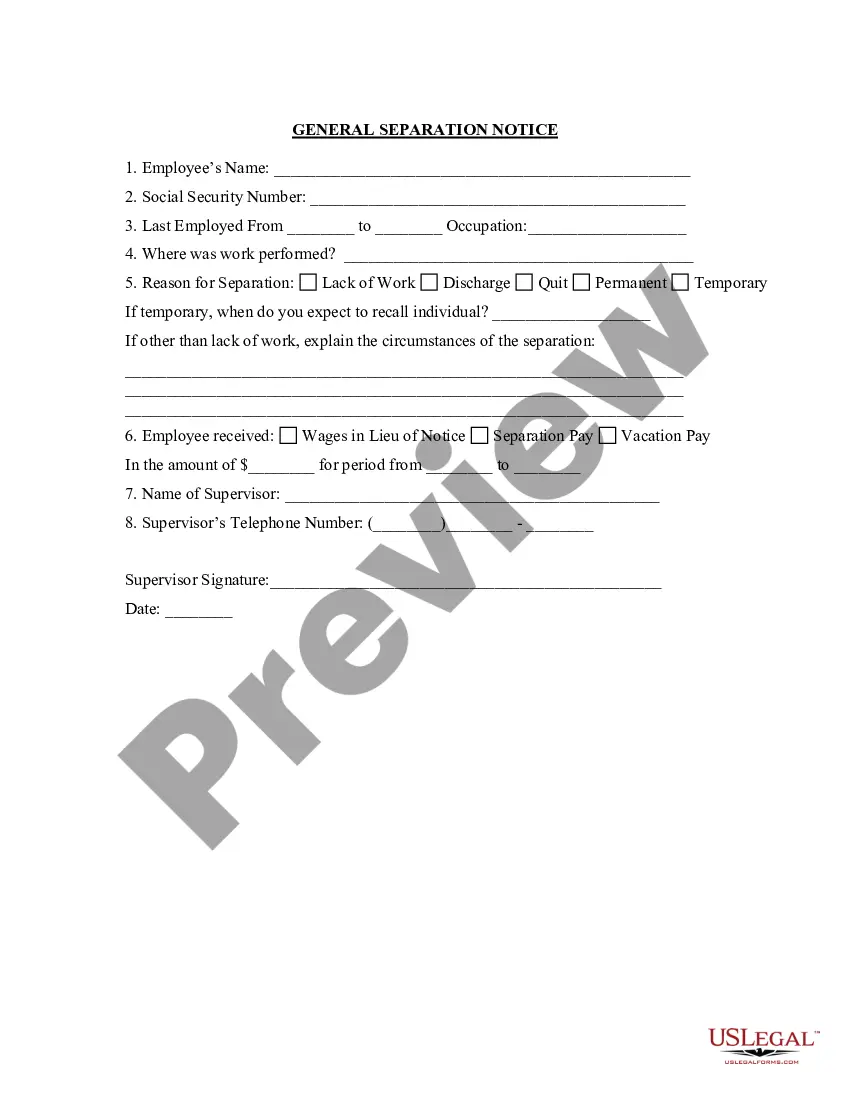

Virginia Separation Notice for 1099 Employee

Description

How to fill out Separation Notice For 1099 Employee?

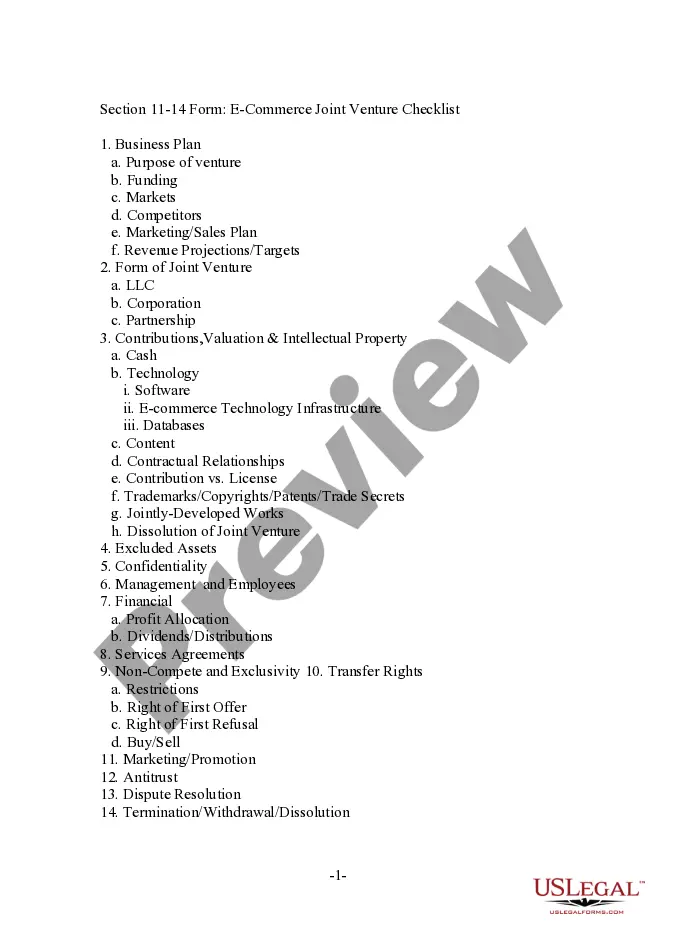

If you need to finalize, obtain, or create valid document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's straightforward and practical search feature to find the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Select the pricing plan you prefer and enter your details to create an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the purchase.

- Utilize US Legal Forms to get the Virginia Separation Notice for 1099 Employee in just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Download button to receive the Virginia Separation Notice for 1099 Employee.

- You can also access forms you have previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/state.

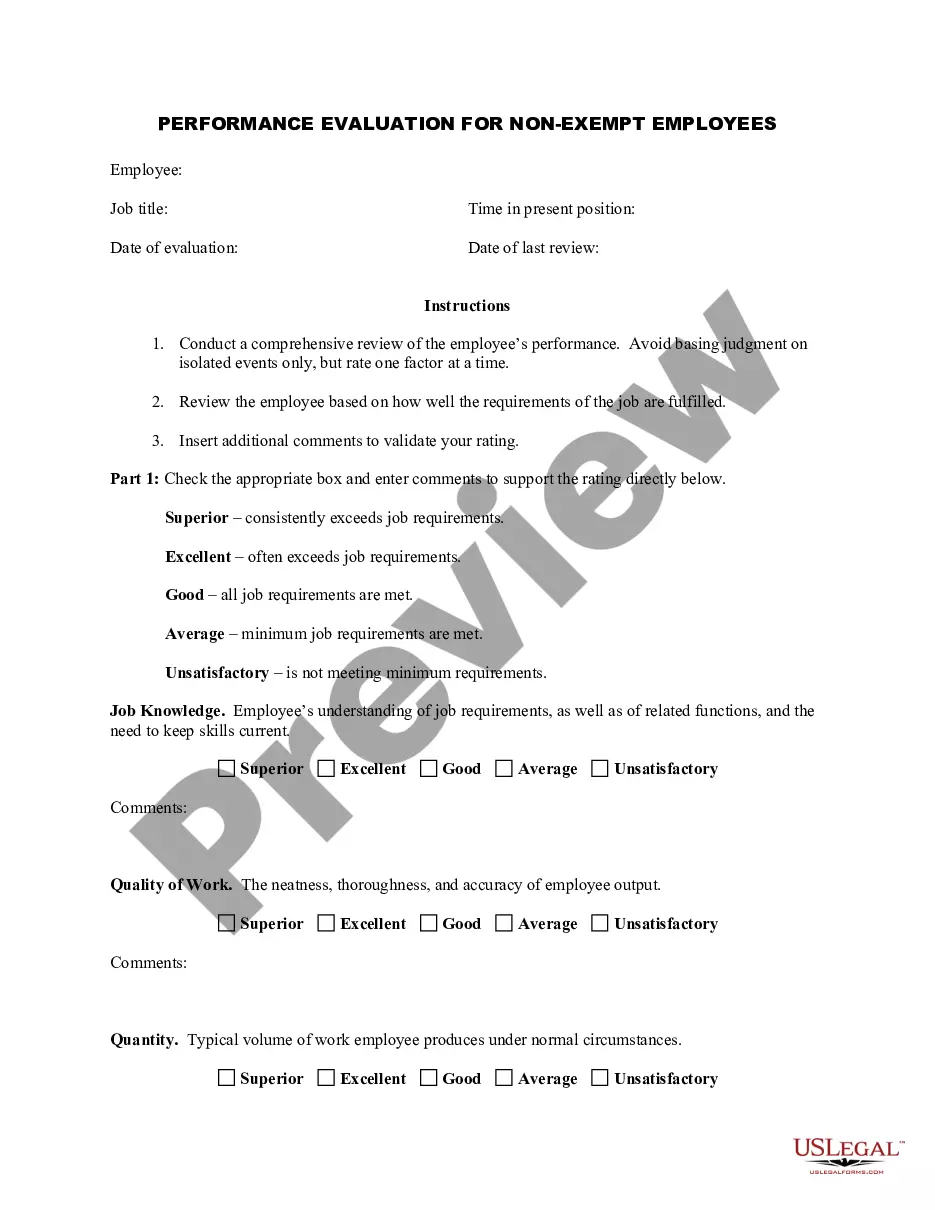

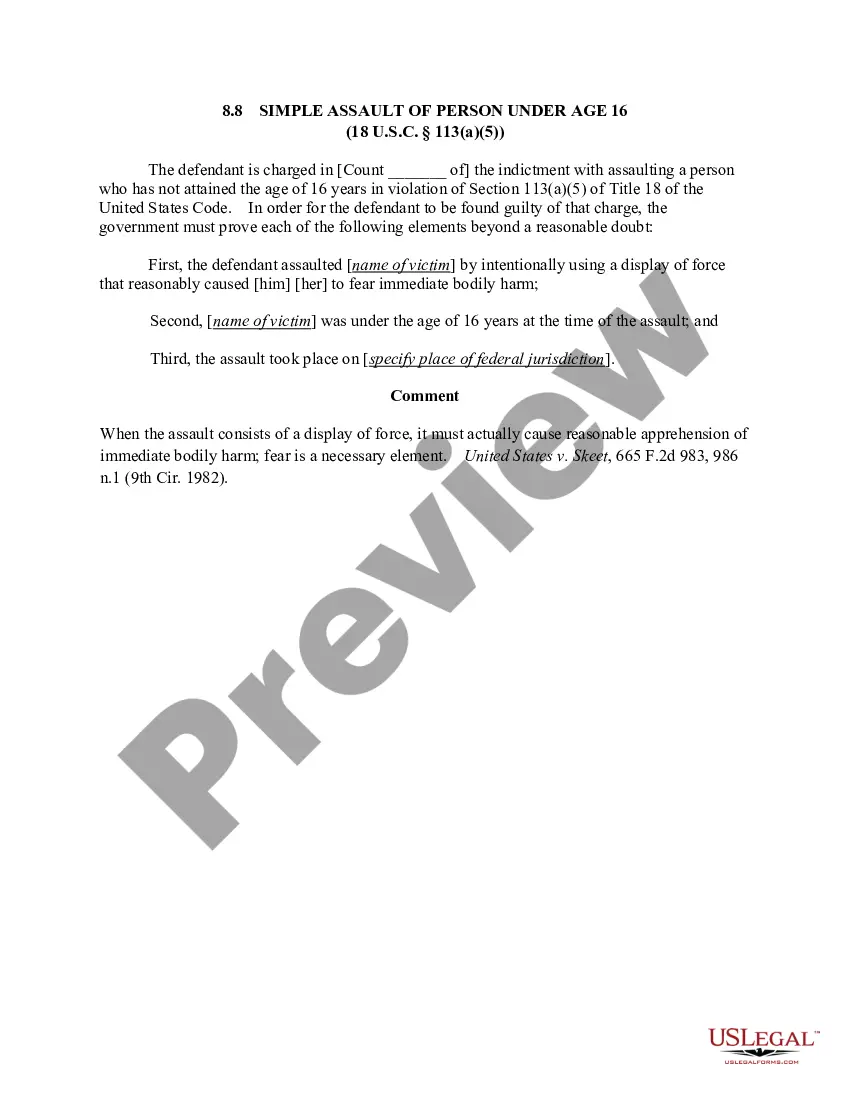

- Step 2. Use the Preview option to review the form’s details. Remember to read the information carefully.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

You will use the online portal to file the weekly claim or call the interactive voice response number.File Your Weekly Continued Claim by Internet. English. Spanish.File Your Weekly Continued Claim by Telephone: 1-800-897-5630.

In most cases, businesses do not withhold taxes from any payments to an independent contractor. If, however, backup withholding applies, employers may be required to deduct a portion of the individual's earnings and send it to the IRS directly.

Freelancers, self-employed workers now eligible for unemployment benefits in Virginia. Under the CARES Act, self-employed workers and independent contractors can apply for temporary unemployment benefits.

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

Working as an independent contractor gives you a number of freedoms that include allowing you to end a working relationship if you don't like your client.

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

Short answer: No. Longer answer: You can get rid of an independent contractor if they're not holding up their end of the contract. But it's not firing because independent contractors don't work for you, they work for themselves.

The only problem is that it is often illegal. There is no such thing as a 1099 employee. The 1099 part of the name refers to the fact that independent contractors receive a form 1099 at the end of the year, which reports to the IRS how much money was paid to the contractor.

Because independent contractors pay self-employment tax, employers typically do not have to withhold taxes from their wages. There is, however, an exception known as backup withholding.

How To Resign From a Contract Position With GraceCommunicate with your recruiting partner. There are a lot of reasons why you might want to move on, most of which are perfectly understandable.Give proper notice.Keep the stakes in mind.Leave the job better than you found it.