Virginia New Company Benefit Notice

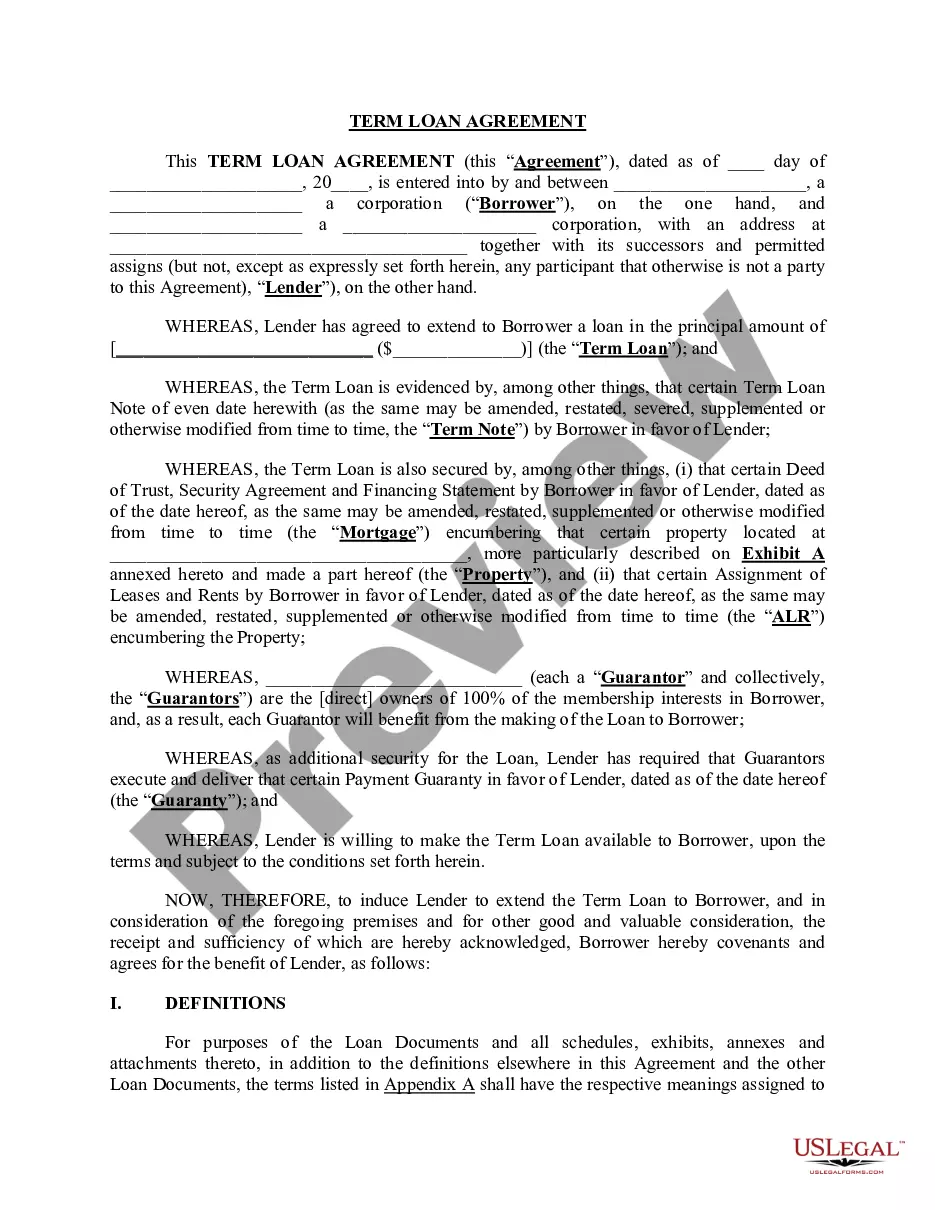

Description

How to fill out New Company Benefit Notice?

If you aim to finalize, acquire, or generate sanctioned document formats, utilize US Legal Forms, the most extensive collection of legal templates, accessible online.

Leverage the site’s simple and user-friendly search function to locate the documents you need.

Numerous templates for professional and personal applications are arranged by categories and states, or keywords.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded within your account. Click the My documents section and select a form to print or download again.

Compete and acquire, and print the Virginia New Company Benefit Notice with US Legal Forms. There are thousands of professional and state-specific templates available for your business or personal needs.

- Use US Legal Forms to retrieve the Virginia New Company Benefit Notice with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click on the Acquire button to get the Virginia New Company Benefit Notice.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are unhappy with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. After locating the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Virginia New Company Benefit Notice.

Form popularity

FAQ

Eligibility Requirements for Virginia Unemployment BenefitsYou must be unemployed through no fault of your own, as defined by Virginia law.You must have earned at least a minimum amount in wages before you were unemployed.You must be able and available to work, and you must be actively seeking employment.

You will be disqualified if the deputy determines that you quit your job without good cause, or you were fired from your job for misconduct in connection with your work. You and your employer have the right to appeal the deputy's determination if either of you disagrees with the results.

Examples of acceptable documents workers may submit to show proof of employment Recent pay stubs or vouchers.Earnings Statements.Recent bank records showing payroll direct deposits.2019 Federal Income Tax Statement.

Benefits under the PUA and FPUC programs are federally funded and are no longer authorized after September 4, 2021. There would be no additional compensation available to you at this time.

To collect unemployment benefits under Virginia law, there is a threshold requirement that you worked for the employer for at least 30 days, and for a minimum of 240 hours. There are several situations that will disqualify you for unemployment compensation in Virginia.

This can be done by traditional UI claimants calling the interactive voice response line at 1-800-897-5630 or through your online account at or . Weekly filing for PUA claimants can be done through your Gov2Go account.

To register and immediately receive a VEC Account Number, go to iReg, our new online registration process. You can also contact a VEC Local Office or download the form VEC-FC-27 from the Employer Services page on this website.

Proof of Employment Documentation Requirement for PUA Claimants - Unemployment Insurancestate or Federal employer identification numbers,business licenses,tax returns or 1099s,business receipts, and.signed affidavits from persons verifying the individual's self-employment.

If you applied for PUA in 2020 and are still collecting in 2021, you just need a single document that shows you were working at some point between January 2019 and your application for PUA. It could be pay stubs, tax documents, contracts, business licenses, letters, etc.

The VEC will begin making an initial payment of PUA benefits in approximately two weeks, following the acceptance of the PUA application. The VEC may require additional documentation to validate your claim, reprocess your monetary determination, or to investigate fraud.