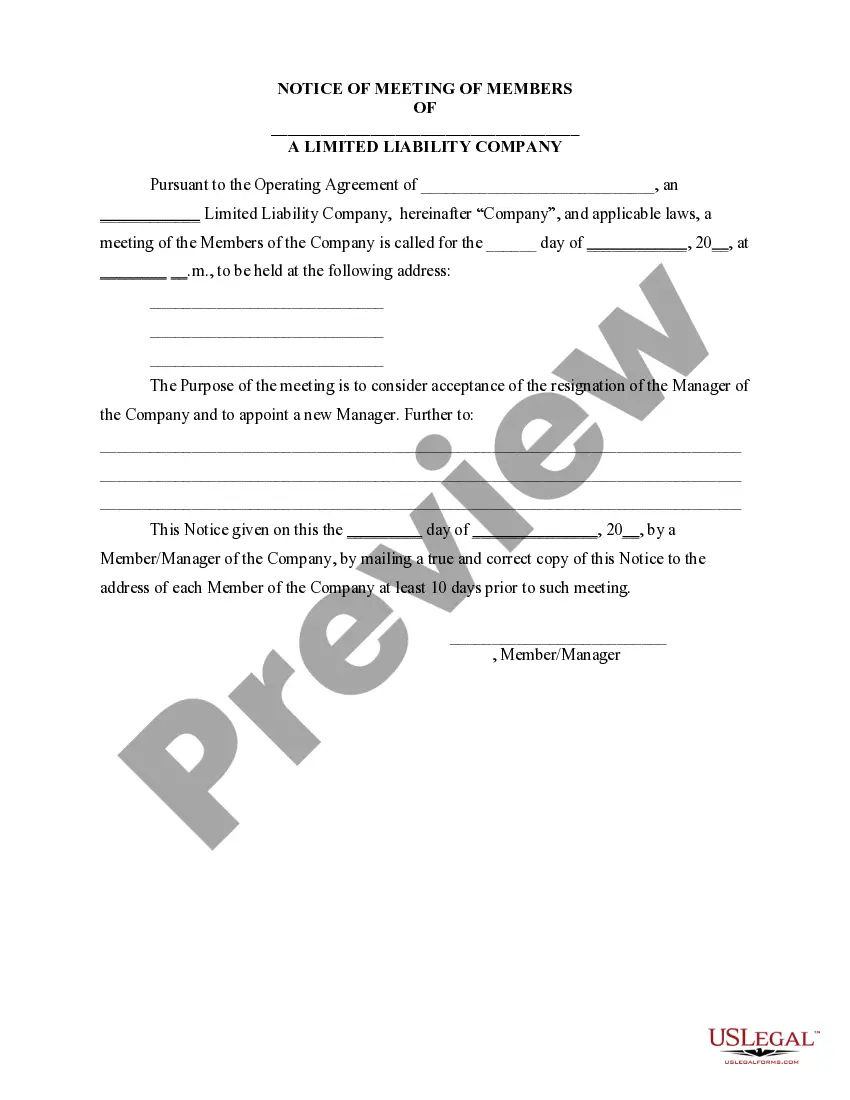

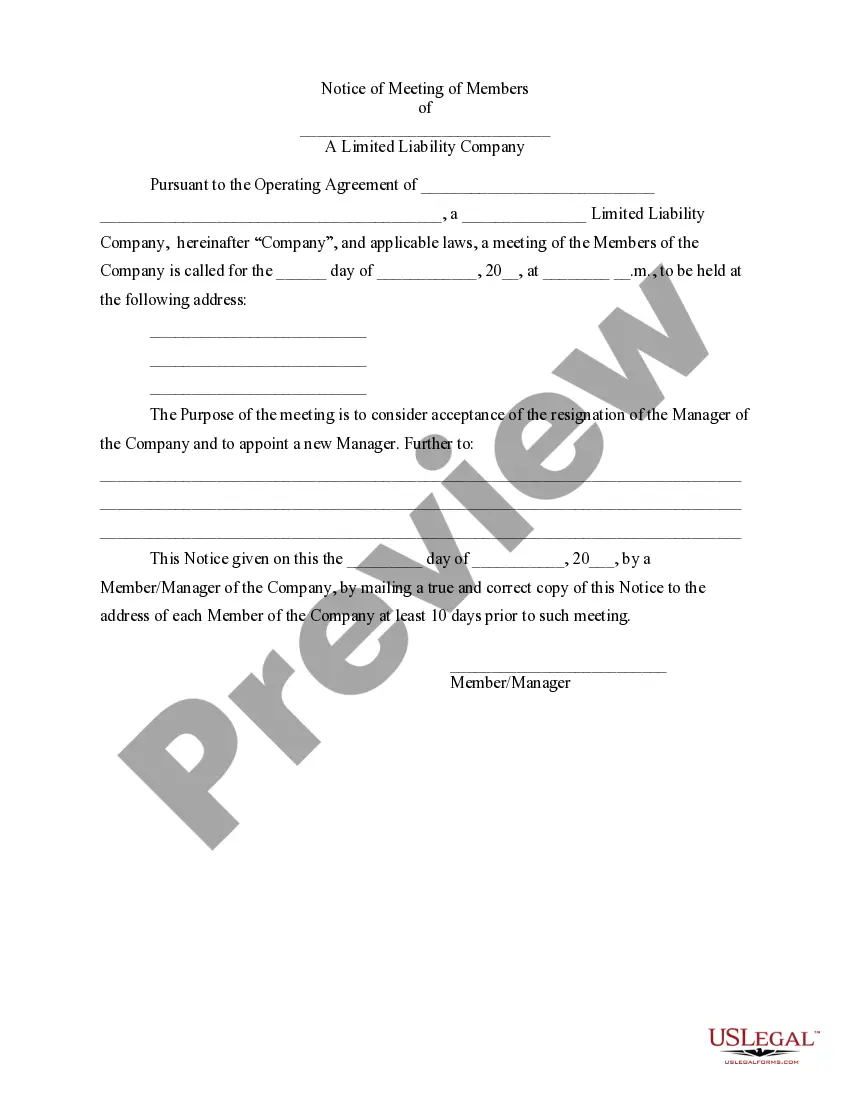

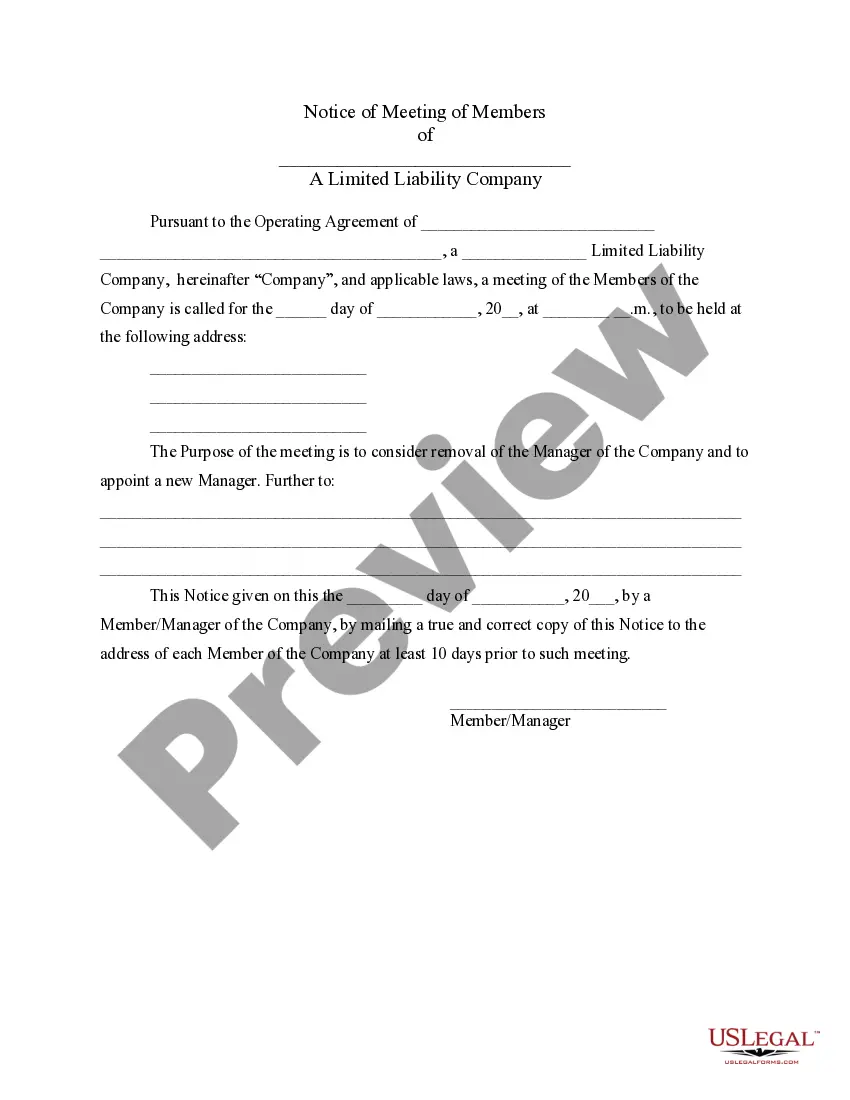

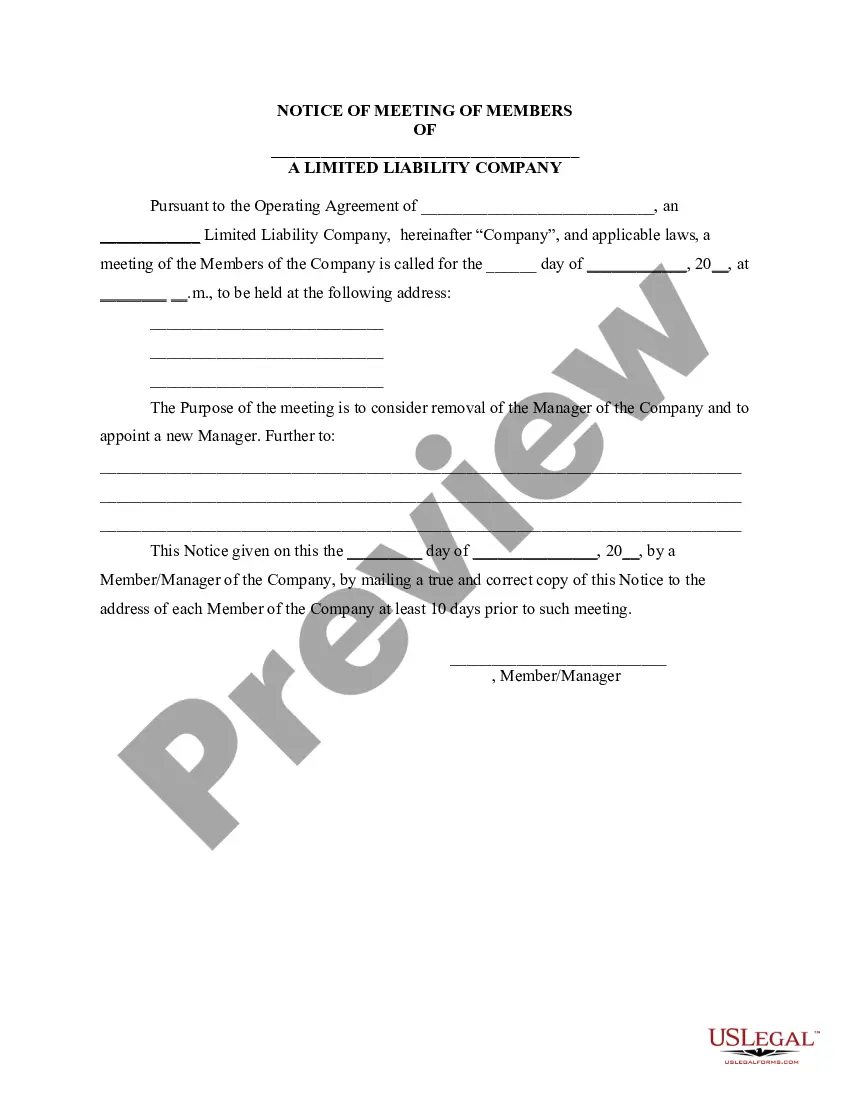

Virginia Notice of Meeting of LLC Members To Consider Removal of the Manager of the Company and Appoint a New Manager

Description

How to fill out Notice Of Meeting Of LLC Members To Consider Removal Of The Manager Of The Company And Appoint A New Manager?

You can spend hours online trying to locate the official document format that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal templates that are reviewed by experts.

You can download or print the Virginia Notice of Meeting of LLC Members To Consider Removal of the Manager of the Company and Appoint a New Manager from the service.

If you wish to obtain another version of the form, use the Search field to find the format that meets your needs and specifications.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain option.

- Then, you can complete, modify, print, or sign the Virginia Notice of Meeting of LLC Members To Consider Removal of the Manager of the Company and Appoint a New Manager.

- Every legal document format you purchase is yours indefinitely.

- To get another version of the acquired form, navigate to the My documents tab and select the appropriate option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the county/area of your choice.

- Review the form description to verify you have chosen the right form.

- If available, use the Review option to browse through the document format as well.

Form popularity

FAQ

In a member-managed LLC, all members (owners) are involved in decision-making. If you are a single-member LLC, youthe ownerare the manager. Major decisions, such as loans and contracts, require a majority of the vote for approval.

Personal guaranties. This happens when the shareholders/members undertake to personally guarantee the corporation's obligations to the extent specified in a guarantee. It is common for small business owners to sign limited or unlimited personal guarantees for their business to borrow money.

Owners of an LLC are called members. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities.

LLC members and managers are generally not liable for the LLC's debts and other liabilities. However, California Corporations Code Section 17703.04 establishes specific instances in which members or managers may be held personally liable for company debts and other liabilities.

Your LLC's Liability for Members' Personal Debtsgetting a court to order that the LLC pay to the creditor all the money due to the LLC owner/debtor from the LLC (this is called a "charging order") foreclosing on the owner/debtor's LLC ownership interest, or. getting a court to order the LLC to be dissolved.

A member of the LLC should have an ethical responsibility to meet the obligations of the firm. They should have duty of care.

LLC members and managers are generally not liable for the LLC's debts and other liabilities. However, California Corporations Code Section 17703.04 establishes specific instances in which members or managers may be held personally liable for company debts and other liabilities.

Those LLC members who operate the business owe the fiduciary duties of loyalty and reasonable care to the non-managing LLC owners. Depending upon your state, LLC members may be able to revise, broaden, or eliminate these fiduciary duties by contract or under the conditions of their LLC operating agreement.

A corporation is an incorporated entity designed to limit the liability of its owners (called shareholders). Generally, shareholders are not personally liable for the debts of the corporation. Creditors can only collect on their debts by going after the assets of the corporation.

Under all LLC statutes, the general rule is that the members of the LLC are not personally liable for obligations of the LLC, subject to such exceptions as personal guarantees or piercing of the organizational veil.