Virginia Notice of Meeting of Members of LLC Limited Liability Company to accept resignation of manager and appoint new manager

Description

How to fill out Notice Of Meeting Of Members Of LLC Limited Liability Company To Accept Resignation Of Manager And Appoint New Manager?

Are you presently within a situation in which you will need files for both enterprise or specific reasons just about every day time? There are plenty of legitimate file templates available online, but finding kinds you can rely isn`t simple. US Legal Forms provides 1000s of type templates, just like the Virginia Notice of Meeting of Members of LLC Limited Liability Company to accept resignation of manager and appoint new manager, that happen to be created to fulfill federal and state requirements.

In case you are previously acquainted with US Legal Forms web site and also have your account, merely log in. Following that, you are able to download the Virginia Notice of Meeting of Members of LLC Limited Liability Company to accept resignation of manager and appoint new manager design.

If you do not offer an account and would like to begin using US Legal Forms, follow these steps:

- Get the type you require and make sure it is for your correct metropolis/state.

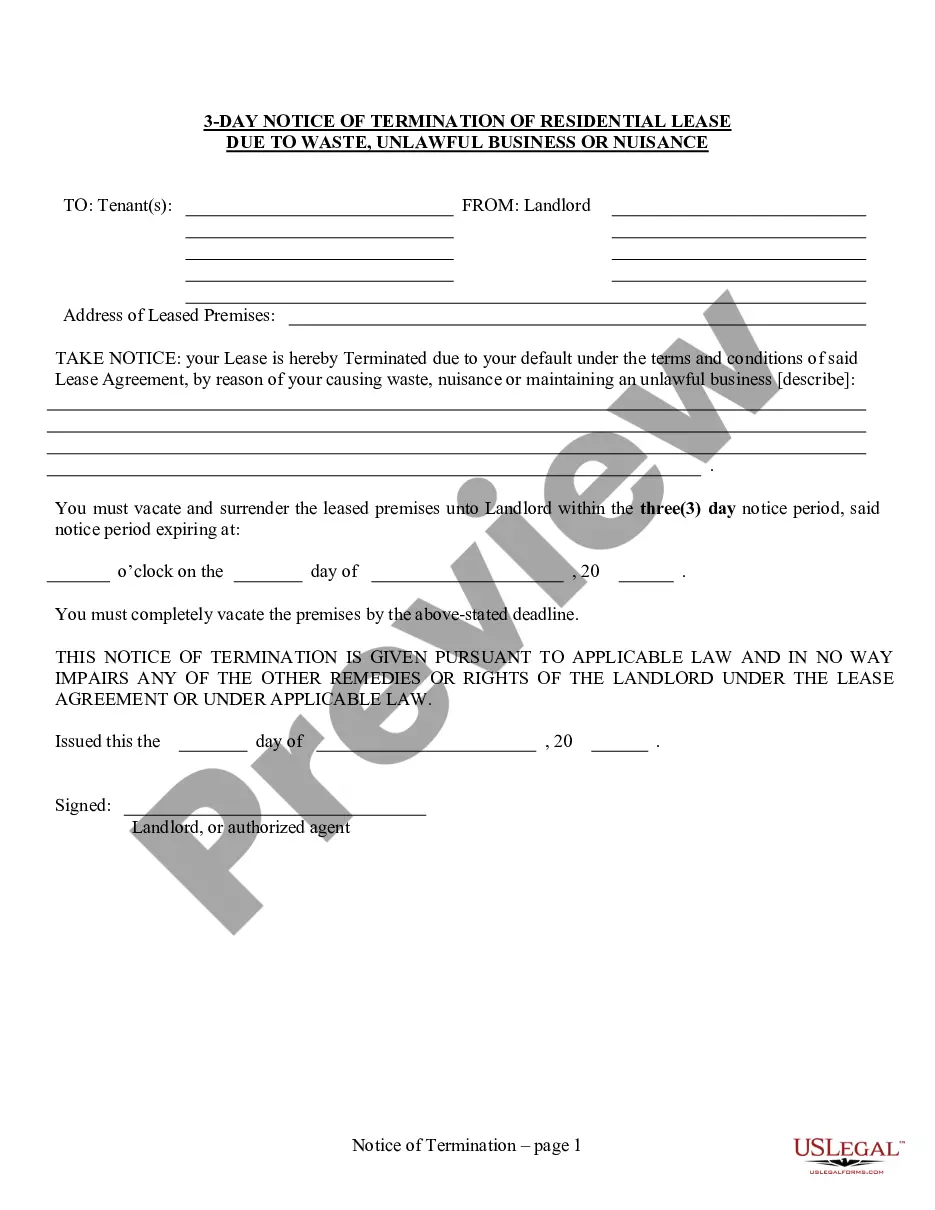

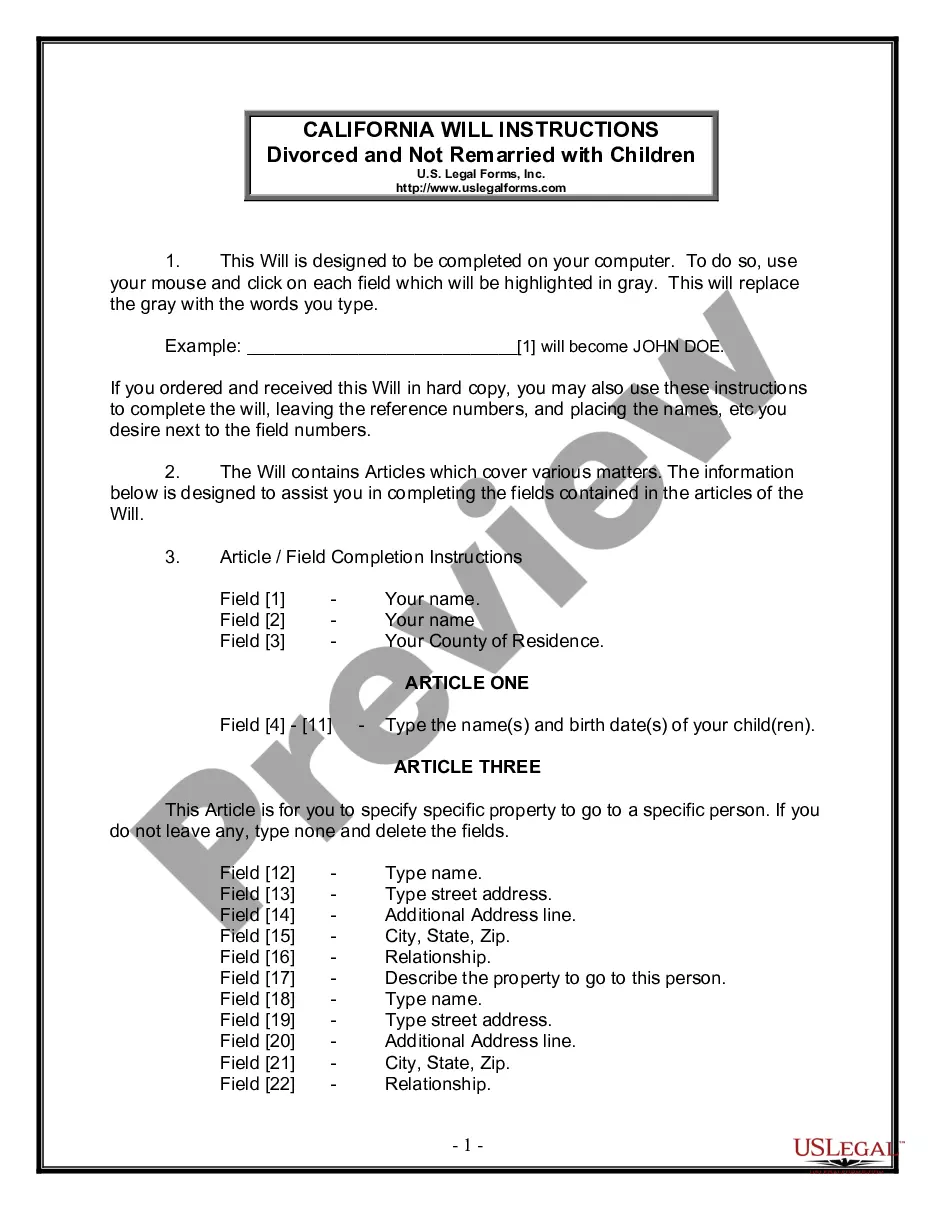

- Take advantage of the Preview switch to check the shape.

- Read the description to actually have chosen the right type.

- If the type isn`t what you`re looking for, take advantage of the Lookup discipline to find the type that meets your needs and requirements.

- Whenever you find the correct type, click on Buy now.

- Opt for the pricing strategy you would like, fill in the necessary info to produce your account, and purchase the transaction using your PayPal or Visa or Mastercard.

- Select a handy paper structure and download your copy.

Discover all of the file templates you may have purchased in the My Forms menu. You can get a more copy of Virginia Notice of Meeting of Members of LLC Limited Liability Company to accept resignation of manager and appoint new manager any time, if required. Just go through the necessary type to download or produce the file design.

Use US Legal Forms, probably the most comprehensive collection of legitimate varieties, to conserve time as well as prevent mistakes. The support provides expertly manufactured legitimate file templates which can be used for a variety of reasons. Make your account on US Legal Forms and initiate generating your way of life a little easier.

Form popularity

FAQ

There could be one manager or multiple, and the manager could be a member (but need not be). If the manager isn't a member, they are called a professional manager. The managers act as a board of directors would for a corporation. Manager management is appropriate when an LLC has investors.

A manager may be removed at any time by the consent of a majority of the members without cause, subject to the rights, if any, of the manager under any service contract with the limited liability company.

As the owner of a single-member LLC, you don't get paid a salary or wages. Instead, you pay yourself by taking money out of the LLC's profits as needed. That's called an owner's draw. You can simply write yourself a check or transfer the money from your LLC's bank account to your personal bank account.

If you are a member of a limited liability company and wish to leave the membership voluntarily, you cannot simply walk away. There are procedures to follow that include methods of notification of the remaining membership, how assets are handled, and what the provisions of withdrawal are for each LLC.

If you want to remove your name from a partnership, there are three options you may pursue:Dissolve your business. If there is no language in your operating agreement stating otherwise, this will be your only name-removal option.Change your business's name.Use a doing business as (DBA) name.

The only possible ways for a partnership or LLP to divorce a partner are through expulsion or de-listing. There is the option of resigning from the partnership, as described in the partnership agreement, and there is also the option of leaving voluntarily, as described in the partnership agreement.

This is one of the benefits of having an LLC because it allows a Manager to run the business without fear of personal liability. But, a Manager may be held personally liable for criminal action and intentional actions that are outside the scope of its authority.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others.

managed LLC is when all of the LLC owners (Members) have a right to bind the LLC in agreements and they regularly make business decisions and run the day to day activities. The key term in Membermanaged LLCs is all, meaning that all of the LLC Members have the ability to bind the LLC.

Right to bind the LLC On the other hand, a member in a manager-managed LLC is not an agent of the LLC and cannot bind itonly a manager can. In many states this agency is statutory. The LLC act specifically says that a member in a member-managed LLC and a manager in a manager-managed LLC is an agent of the LLC.