Virginia Shipping Reimbursement

Description

How to fill out Shipping Reimbursement?

You can spend hours online searching for the legal document template that fulfills the federal and state requirements you have.

US Legal Forms offers a vast collection of legal forms that have been reviewed by experts.

You can easily download or print the Virginia Shipping Reimbursement from their service.

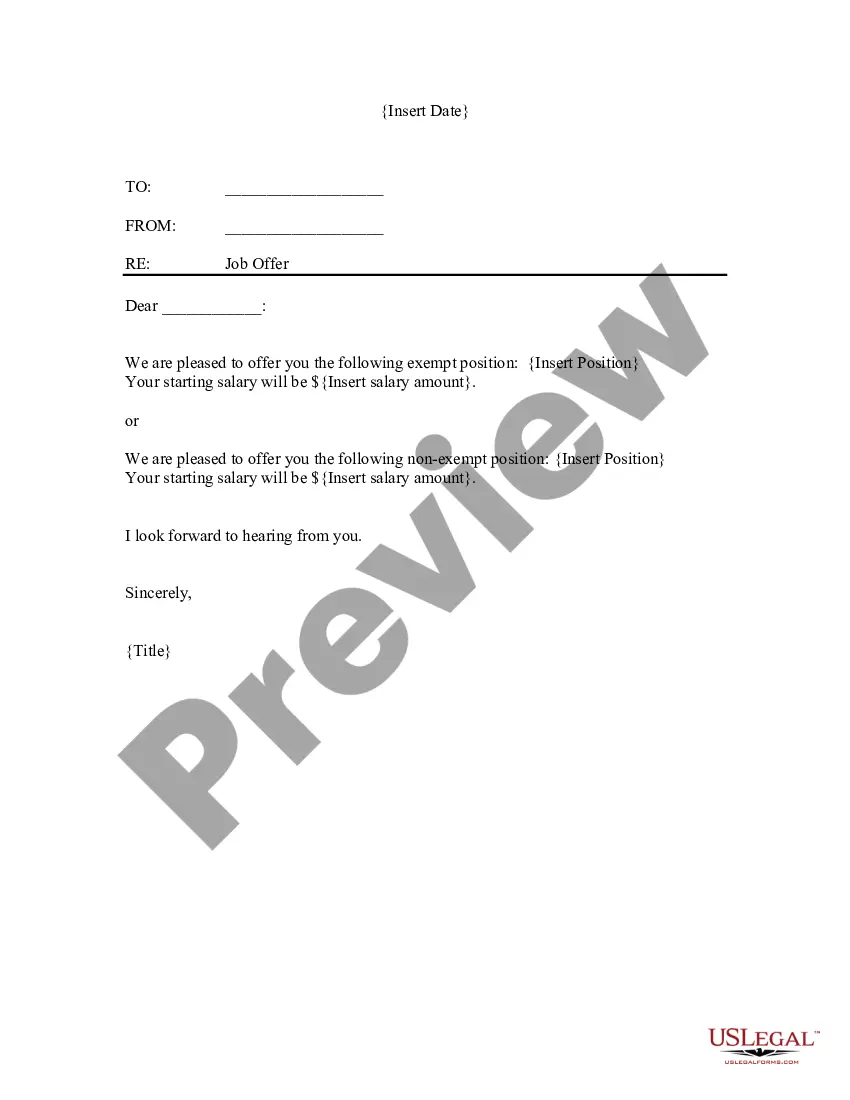

If available, utilize the Preview option to look through the document template as well. If you want to find another version of the document, use the Search feature to locate the template that meets your needs and requirements.

- If you own a US Legal Forms account, you can Log In and click the Download button.

- Then, you can fill out, edit, print, or sign the Virginia Shipping Reimbursement.

- Every legal document template you obtain is yours permanently.

- To get another copy of the downloaded form, visit the My documents section and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Review the document description to make sure you've chosen the right form.

Form popularity

FAQ

For the most part, if you ship taxable items, then all shipping charges are taxable. And if you ship all non-taxable items in a parcel, then the shipping charges for that parcel are non-taxable.

Goods that are subject to sales tax in Virginia include physical property, like furniture, home appliances, and motor vehicles. The purchase of both prescription and non-prescription medicine and gasoline are tax-exempt.

Customer Returns and Refunds Under Federal Law While many retailers have decided this makes for the best business practice, they aren't legally required to accept returns. Rather, retailers are required to accept returns only if the sold good is defective or if they otherwise break the sales contract.

In Virginia, qualified items that fall into the tax-free category include $20 or less per qualified supplies, those are your basics like pencils, pens, papers and notebooks, as well as $100 or less per item when it comes to clothing and footwear.

Virginia: Separately stated shipping charges, including postage, are generally exempt from Virginia sales tax, but handling charges are always taxable. Shipping charges are taxable when not separately stated on the invoice, or if they're combined with handling or other fees as a single charge.

Can a Store Refuse to Give a Refund According to Federal Law? There are no federal laws that require a merchant to refund money unless the product they sell turns out to be defective, despite the federal consumer protection regulation enforced by the Federal Trade Commission (FTC).

In Virginia, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Several exceptions to the state sales tax are certain types of protective clothing, certain assistive medical devices, any learning institute's textbooks, and any software and data center equipment.

In Virginia, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Several exceptions to the state sales tax are certain types of protective clothing, certain assistive medical devices, any learning institute's textbooks, and any software and data center equipment.

In the state of Virginia, legally sales tax is required to be collected from tangible, physical products being sold to a consumer. Several exceptions to this tax are certain types of protective clothing, certain assistive medical devices, learning institute's textbooks, and software and data center equipment.