Virginia Employment of Executive with Stock Options and Rights in Discoveries

Description

How to fill out Employment Of Executive With Stock Options And Rights In Discoveries?

Are you currently in a situation where you require documents for either business or personal purposes on a daily basis.

There are numerous genuine document templates accessible online, but locating ones you can trust is not simple.

US Legal Forms provides a vast collection of document templates, including the Virginia Employment of Executive with Stock Options and Rights in Discoveries, which are designed to meet federal and state requirements.

Once you find the appropriate document, click Buy now.

Choose the pricing plan you desire, fill in the required information to create your account, and process the transaction using your PayPal or credit card. Select a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents section. You can obtain another copy of Virginia Employment of Executive with Stock Options and Rights in Discoveries whenever needed. Click on the desired document to download or print the template. Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid errors. The service offers professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Virginia Employment of Executive with Stock Options and Rights in Discoveries template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it corresponds to the right area/state.

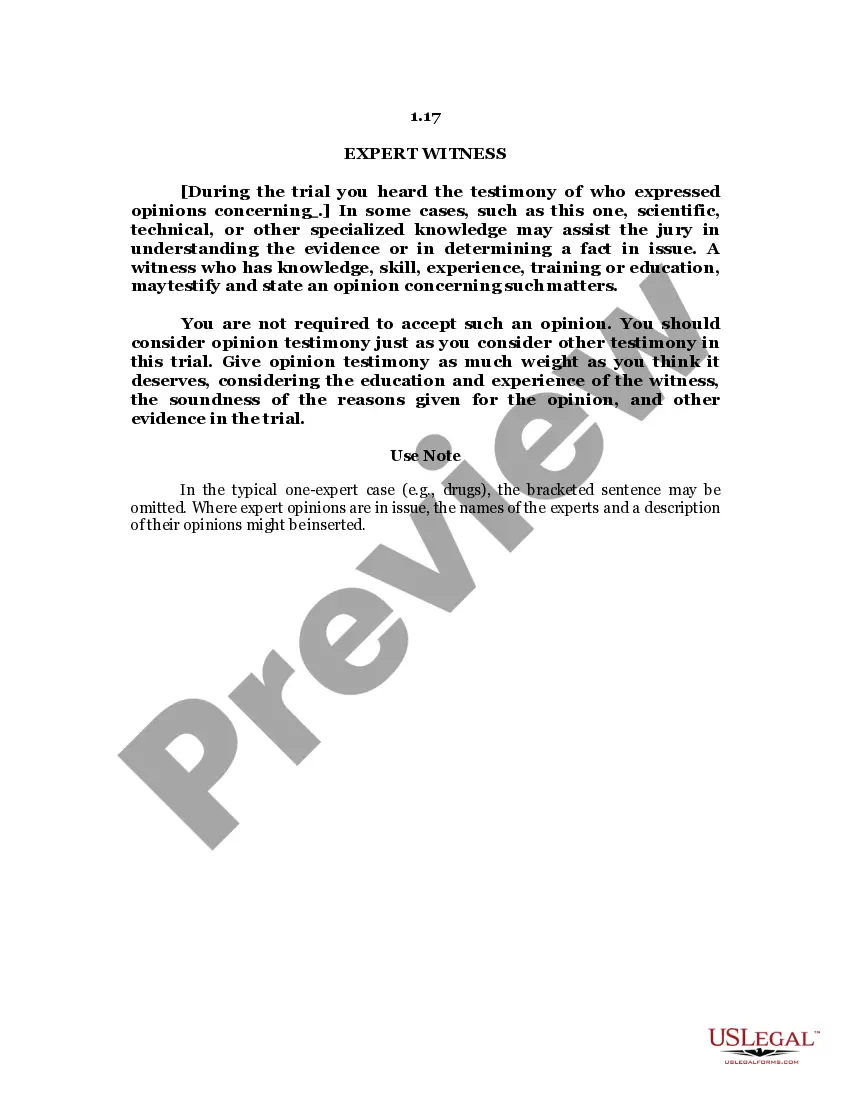

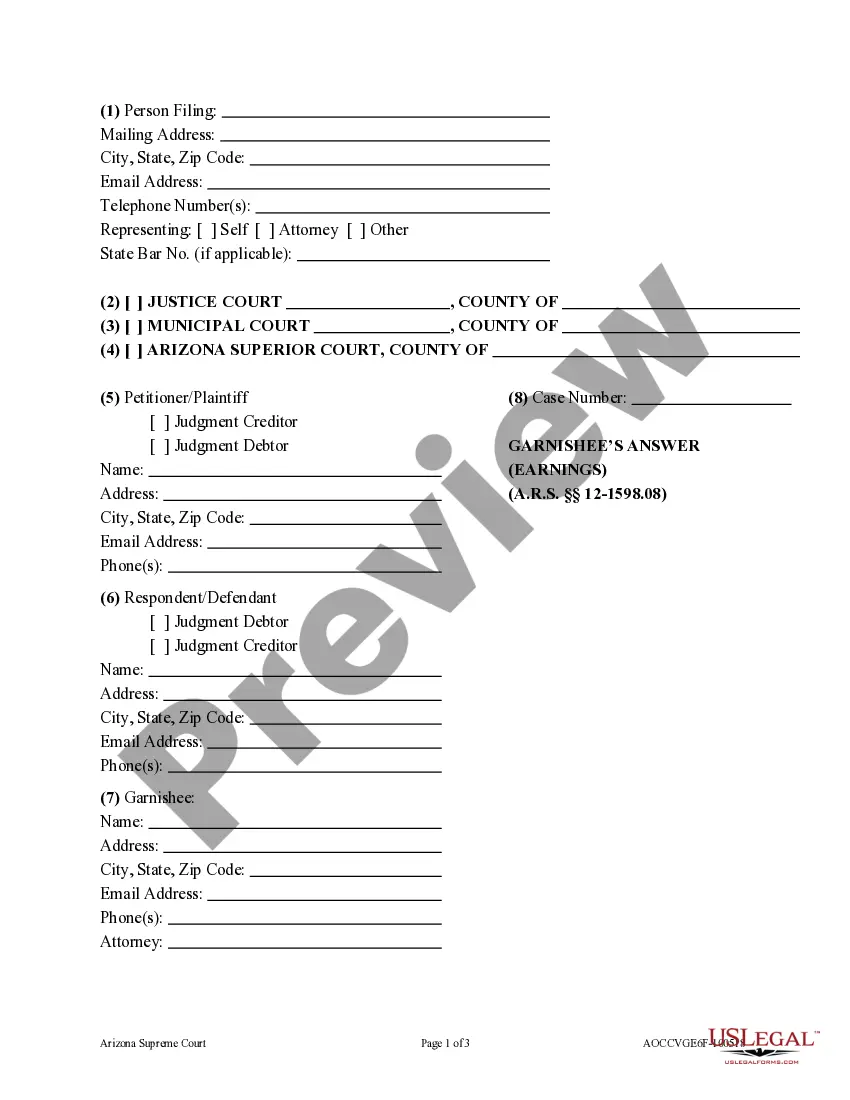

- Utilize the Preview option to review the document.

- Read the description to confirm you have selected the correct document.

- If the document is not what you are looking for, make use of the Search field to find the document that suits your needs.

Form popularity

FAQ

Exercising a stock option means purchasing the issuer's common stock at the price set by the option (grant price), regardless of the stock's price at the time you exercise the option. See About Stock Options for more information.

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying assetthe company's stockat a specified price for a finite period of time.

Stock Options and Equity Are Wages: 4th 610, the California Supreme Court held that stocks are wages under California law.

Your W-2 includes income from any other compensation sources you may have, such as stock options, restricted stock, restricted stock units, employee stock purchase plans, and cash bonuses.

What Is a Stock Option? A stock option gives an investor the right, but not the obligation, to buy or sell a stock at an agreed-upon price and date. There are two types of options: puts, which is a bet that a stock will fall, or calls, which is a bet that a stock will rise.

With NSOs, you pay ordinary income taxes when you exercise the options, and capital gains taxes when you sell the shares. With ISOs, you only pay taxes when you sell the shares, either ordinary income or capital gains, depending on how long you held the shares first.

You will usually need to pay taxes when you exercise or sell stock options. What you pay will depend on what kind of options you have and how long you wait between exercising and selling.

The Pay-to-Performance Link. The main goal in granting stock options is, of course, to tie pay to performanceto ensure that executives profit when their companies prosper and suffer when they flounder.

The statute does not apply because its words read literally and in light of its purposes do not apply stock options are not wages. Wages are defined by the statute as all amounts for labor performed by employees of every description, whether the amount is fixed or ascertained by the standard of time, task, piece,

Typically, stock options expire within 90 days of leaving the company, so you could lose them if you don't exercise your options. Most companies accept this as standard practice based on IRS regulations around ISOs' tax treatment after employment ends.