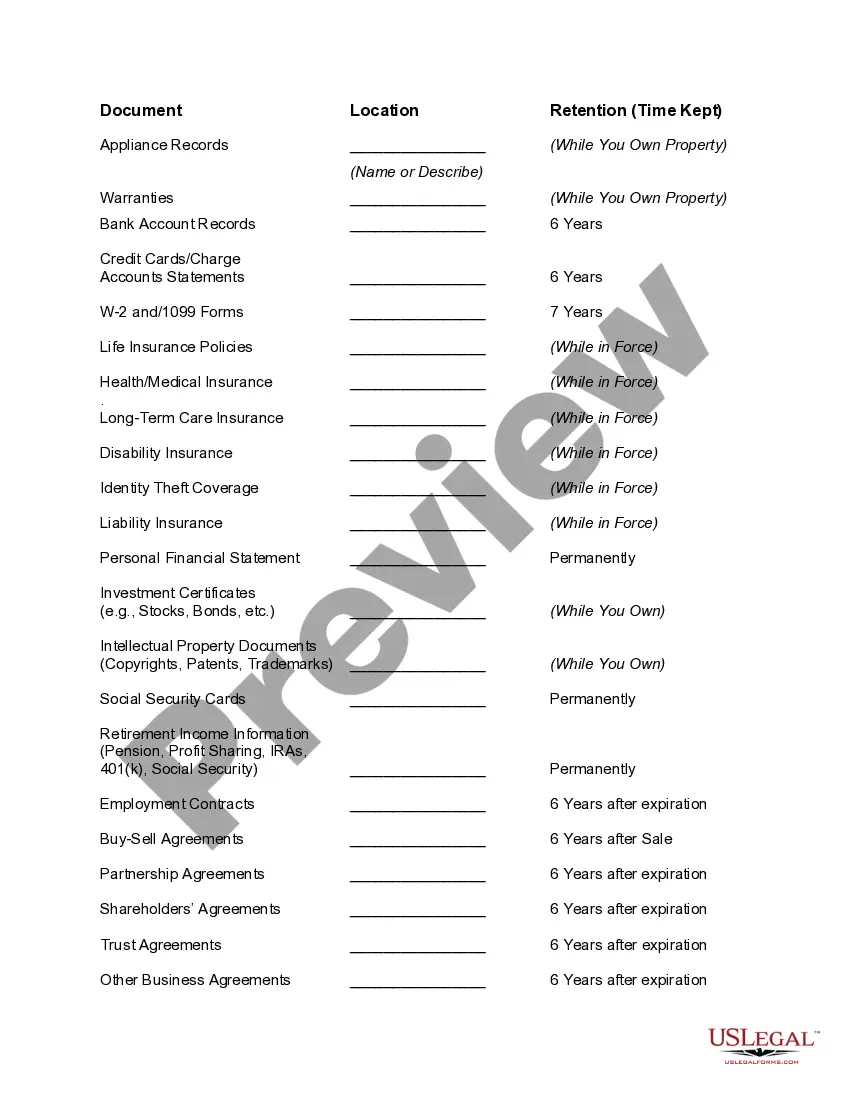

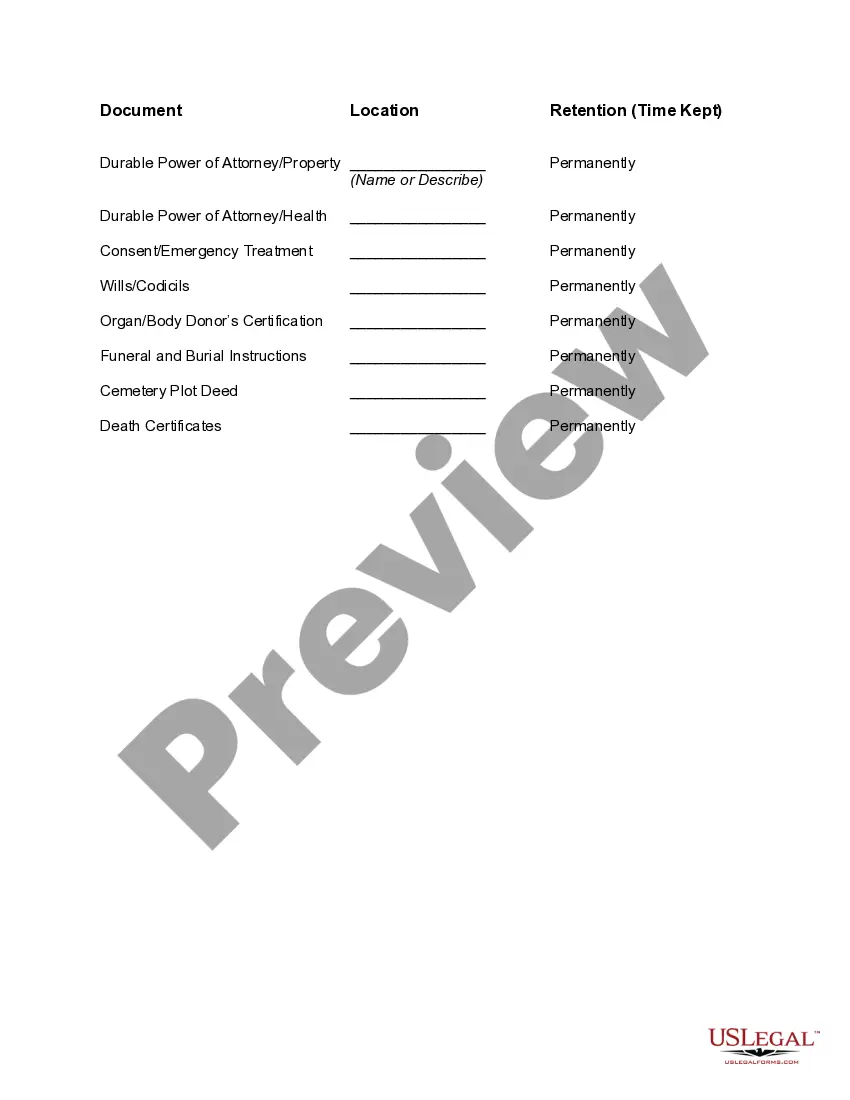

Virginia Document Organizer and Retention

Description

How to fill out Document Organizer And Retention?

You can invest hours online trying to discover the legal document format that satisfies the federal and state standards you require.

US Legal Forms offers thousands of legal forms that can be reviewed by experts.

It is easy to download or print the Virginia Document Organizer and Retention from your service.

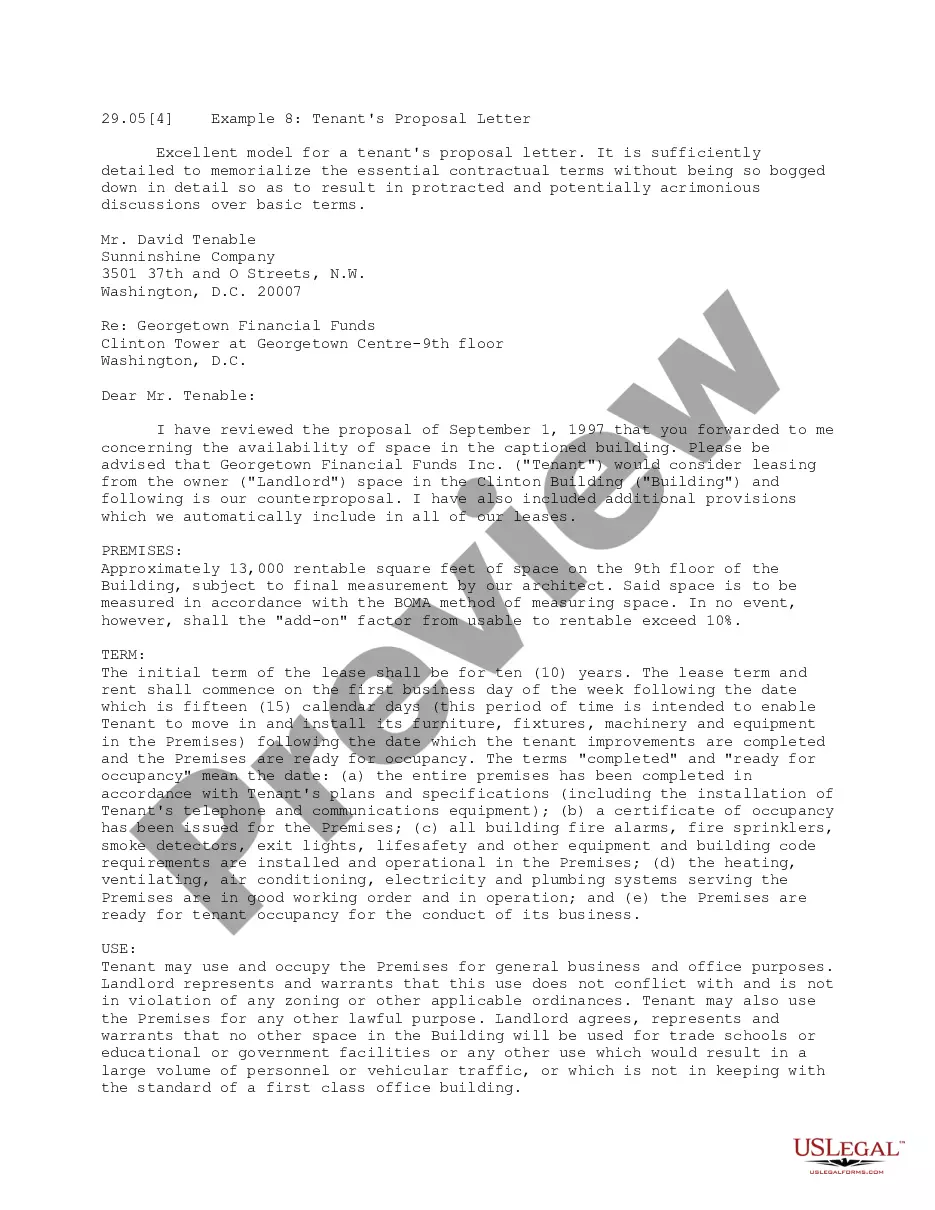

If available, utilize the Preview button to view the document format as well. If you want to find another version of the form, take advantage of the Lookup field to locate the template that fits your needs and requirements. Once you have identified the format you desire, click Buy now to continue. Select the payment plan you wish, enter your information, and register for an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to purchase the legal form. Choose the format of the document and download it to your device. Make adjustments to the document if needed. You can complete, modify, and sign and print the Virginia Document Organizer and Retention. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize expert and state-specific templates to address your business or personal requirements.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Following that, you can complete, modify, print, or sign the Virginia Document Organizer and Retention.

- Each legal document template you obtain is yours forever.

- To retrieve another copy of any acquired form, navigate to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure you have chosen the correct document format for the state/town of your choice.

- Check the form description to confirm you have selected the right form.

Form popularity

FAQ

To apply a retention label in Outlook, select the message you want to label. Then, from the options menu, choose the label you wish to apply. Utilizing a Virginia Document Organizer and Retention simplifies this process and keeps your emails organized and compliant.

A retention period (associated with a retention schedule or retention program) is an aspect of records and information management (RIM) and the records life cycle that identifies the duration of time for which the information should be maintained or "retained," irrespective of format (paper, electronic, or other).

How long should I keep employee personnel files? You should keep an employee's personnel files for six years after the employee has left your organisation. The reason for this is that up until six years has passed, the former employee may sue you for breach of contract in the county court.

According to the U.S. Department of Labor, the Fair Labor Standards Act (FLSA) requires employers to maintain records for a period of at least three years. Records to compute pay, which include time cards, work and time schedules and records of additions to or reductions from wages, must be kept for two years.

All medical records, either original or accurate reproductions, shall be preserved for a minimum of five years following discharge of the patient. 1. Records of minors shall be kept for at least five years after such minor has reached the age of 18 years.

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

Personnel records for employees separating from state service are to be retained by the separating agency for five years. (Contact the Records Management Section of the Virginia State Library and Archives concerning medical records.)

(also disposition standard), n. The length of time records should be kept in a certain location or form for administrative, legal, fiscal, historical, or other purposes.

6.2 Retention times for specific records are defined in Table 1, unless otherwise specified quality records shall be retained for 10 years. In no case shall the retention time be less than seven years after final payment on the associated contract.

All Personnel Files and Training Records: 6 years from the end of employment. Redundancy Records: 6 years. Sickness Absence Records: A minimum of 3 months but potentially up to 6 years after employment ends.