Virginia Personal Financial Information Organizer

Description

How to fill out Personal Financial Information Organizer?

It is feasible to dedicate hours online looking for the legal document format that suits the state and federal requirements you desire.

US Legal Forms provides an extensive array of legal templates that are examined by experts.

You can conveniently download or print the Virginia Personal Financial Information Organizer from the platform.

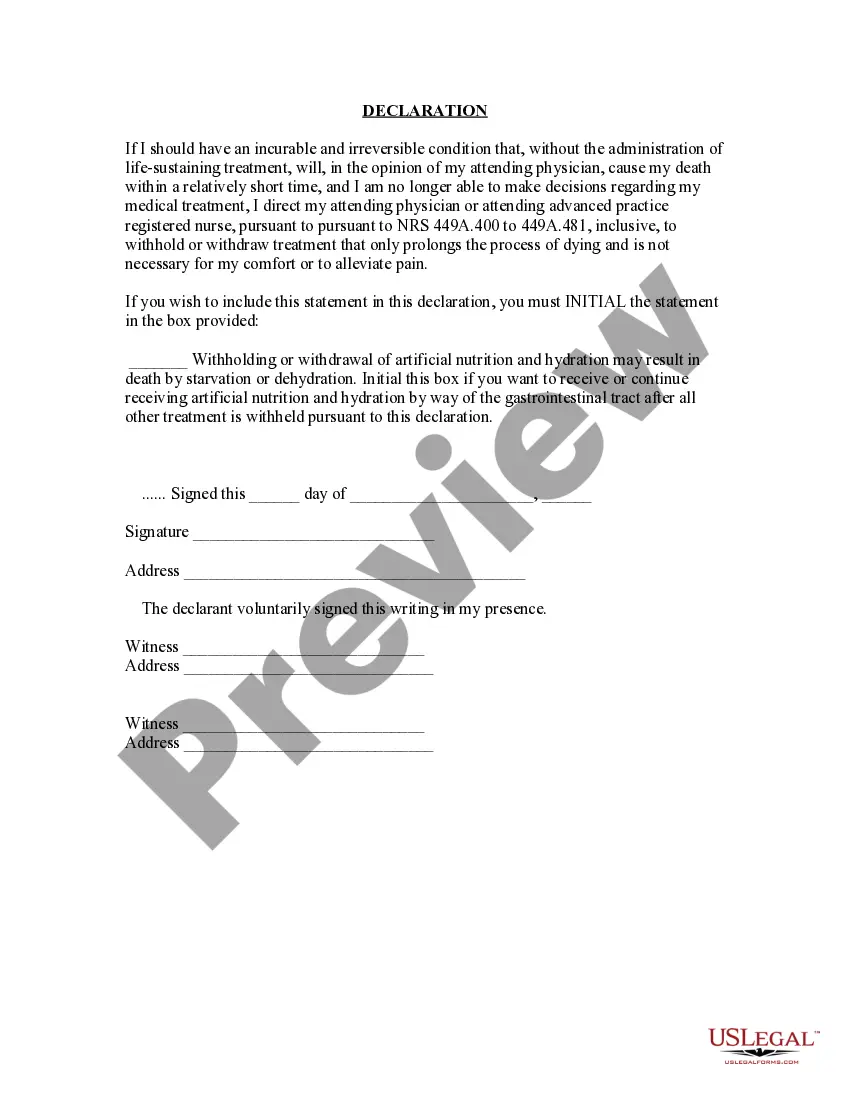

If available, utilize the Preview button to check the document format as well.

- If you possess a US Legal Forms account, you can sign in and press the Download button.

- Then, you can fill out, revise, print, or sign the Virginia Personal Financial Information Organizer.

- Every legal document format you obtain is yours permanently.

- To obtain another copy of any purchased form, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document format for the county/city of your choice.

- Review the form description to ensure you have chosen the right form.

Form popularity

FAQ

Like a financial planner, a money coach is someone who can help you with the big picture of your finances. The main difference is that money coaches look at your finances as just one part of your overall life.

Though there are several aspects to personal finance, they easily fit into one of five categories: income, spending, savings, investing and protection. These five areas are critical to shaping your personal financial planning.

Your Personal Financial Organizer is a take-action booklet intended to help you put your finances and budget in order as a first step to preparing an effective savings strategy. The sooner you start saving, the more time your money will have to work for you. Page 4. 2 YOUR PERSONAL FINANCIAL ORGANIZER.

There are many things you can use a budget binder for but these are just some of the few that we'll share:Goal setting and tracking.Paycheck tracking.Debt pay off tracking.Planning purposes.A Binder.Fun colored pens.Whiteout & paper clips.Plastic pocket dividers.More items...?

5 Main Sources of FinanceSource # 1. Commercial Banks:Source # 2. Indigenous Bankers:Source # 3. Trade Credit:Source # 4. Installment Credit:Source # 5. Advances:

Tips for Organizing Your FinancesStep 1: Ditch the Shoebox Method.Step 2: Track Your Expenses.Step 3: Establish a Bill-Paying System.Step 4: Read Your Bills and Account Statements.Step 5: Shred Old Financial Records.Step 6: Stop the Clutter at the Source.

Organize regular bills and financial statements by the month or by the account (your preference). It is usually easiest to stick with either hanging files or an expanding file. When organizing by account, be sure to arrange documents in chronological order within each file so they are easier to find later on.

An example of personal finance is knowing how to budget, balance a checkbook, obtain funds for major purchases, save for retirement, plan for taxes, purchase insurance and make investments.

Financial Planning Process: 5 Simple StepsStep One: Know Where You Stand. The first step to creating your financial plan is to understand your current financial situation.Step Two: Set Your Goals.Step Three: Plan for the Future.Step Four: Managing Money.Step Five: Review Your Plan.12-Feb-2015

Though there are several aspects to personal finance, they easily fit into one of five categories: income, spending, savings, investing and protection. These five areas are critical to shaping your personal financial planning.