Virginia Sample Letter for Debt Collection

Description

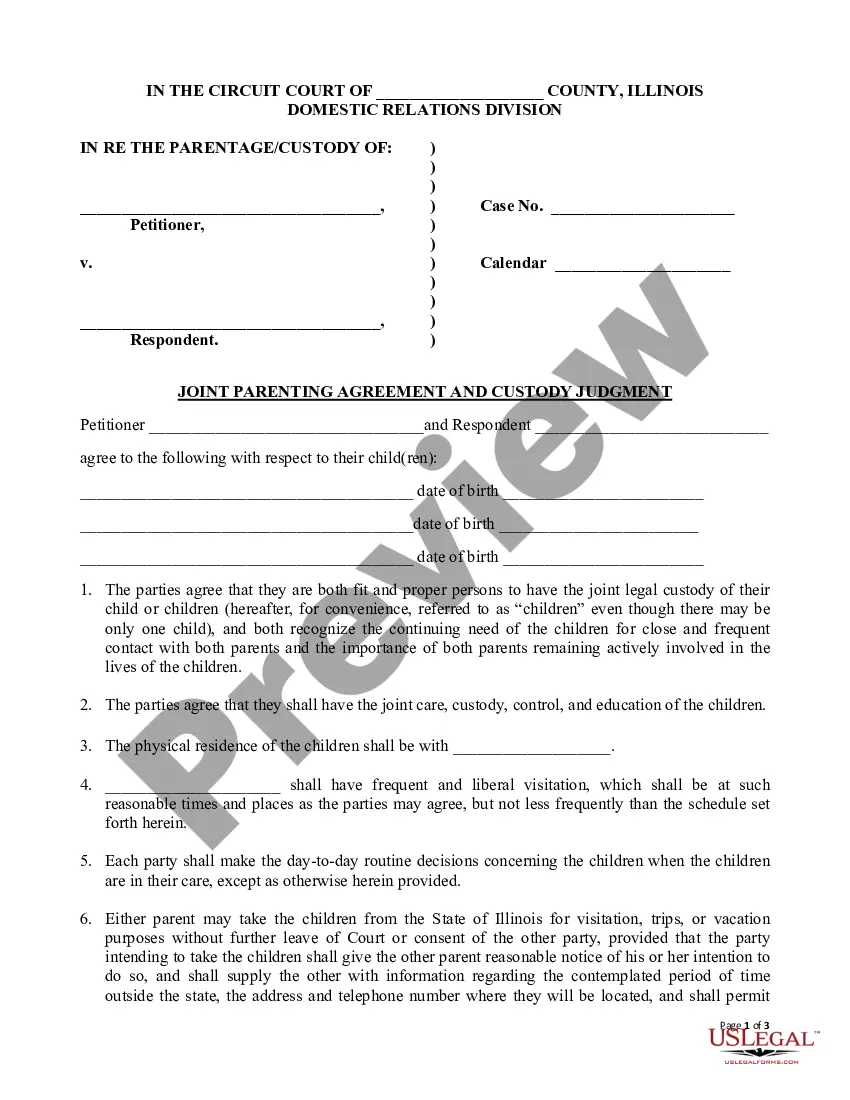

How to fill out Sample Letter For Debt Collection?

US Legal Forms - one of many biggest libraries of lawful kinds in America - gives a wide range of lawful document layouts it is possible to obtain or printing. While using site, you can get thousands of kinds for company and individual uses, sorted by classes, suggests, or keywords.You can get the most up-to-date versions of kinds such as the Virginia Sample Letter for Debt Collection within minutes.

If you currently have a registration, log in and obtain Virginia Sample Letter for Debt Collection through the US Legal Forms collection. The Down load switch can look on every single form you perspective. You have accessibility to all formerly downloaded kinds from the My Forms tab of your respective bank account.

If you want to use US Legal Forms the first time, listed here are easy guidelines to get you began:

- Be sure you have selected the right form to your area/state. Click on the Review switch to analyze the form`s articles. See the form information to ensure that you have chosen the correct form.

- If the form doesn`t suit your needs, make use of the Lookup field towards the top of the display to find the one who does.

- Should you be happy with the form, validate your decision by simply clicking the Purchase now switch. Then, opt for the pricing strategy you favor and give your qualifications to sign up for an bank account.

- Process the deal. Make use of Visa or Mastercard or PayPal bank account to perform the deal.

- Pick the file format and obtain the form on your own product.

- Make modifications. Fill up, modify and printing and indication the downloaded Virginia Sample Letter for Debt Collection.

Each web template you included with your money lacks an expiry day and is your own property eternally. So, if you want to obtain or printing another version, just proceed to the My Forms section and click on the form you want.

Get access to the Virginia Sample Letter for Debt Collection with US Legal Forms, probably the most substantial collection of lawful document layouts. Use thousands of expert and express-certain layouts that meet your business or individual requirements and needs.

Form popularity

FAQ

The final rule also provides non-exhaustive lists of factors that may be used to rebut the presumption of compliance or of a violation." This is where we get our "7-in-7" concept. You can attempt to contact a consumer about 1 debt 7 times in 7 days. And it's the "1 debt" that's key here.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

A debt collector may not harass, abuse, mislead, deceive, or be unfair to you. A federal law called the Fair Debt Collection Practices Act makes this illegal. This law does not cover business or commercial debts. This law applies to debt collectors but doesn't apply to creditors who collect their own debts.

Dear [RECIPIENT'S NAME], Despite our previous reminders, the above amount due remains unpaid. As such, we would appreciate you making this payment as soon as possible. We regret to advise that unless payment is received by [DATE] this collection will be passed over to our debt collection agency/lawyer.

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment. The new due date, whether a specific date or as soon as possible.

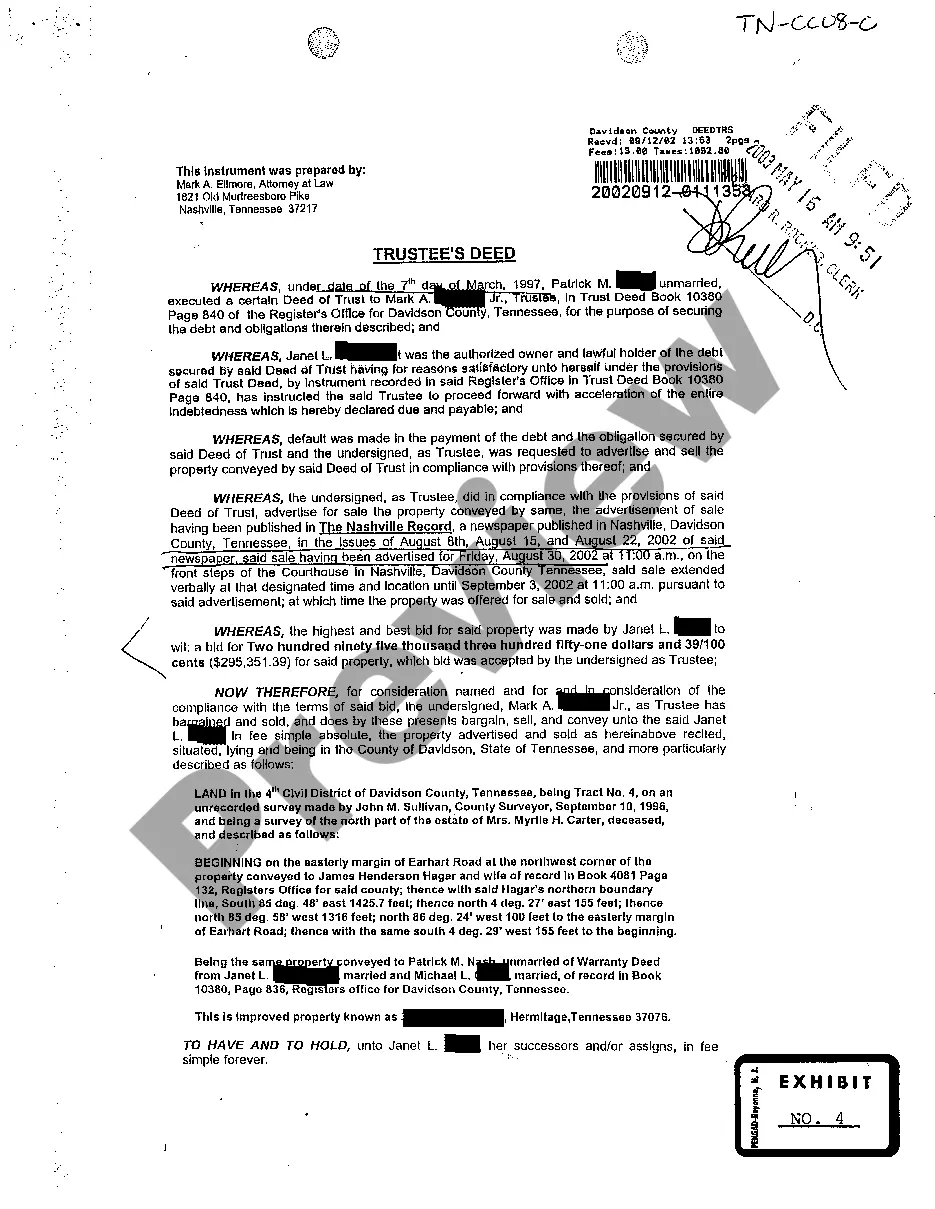

Virginia Law Prohibits Debt Collectors from Simulating Legal Documents. Virginia has a criminal statute that prohibits anyone trying to collect a debt from imitating legal process to obtain payment.

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair, or deceptive practices to collect debts from you.