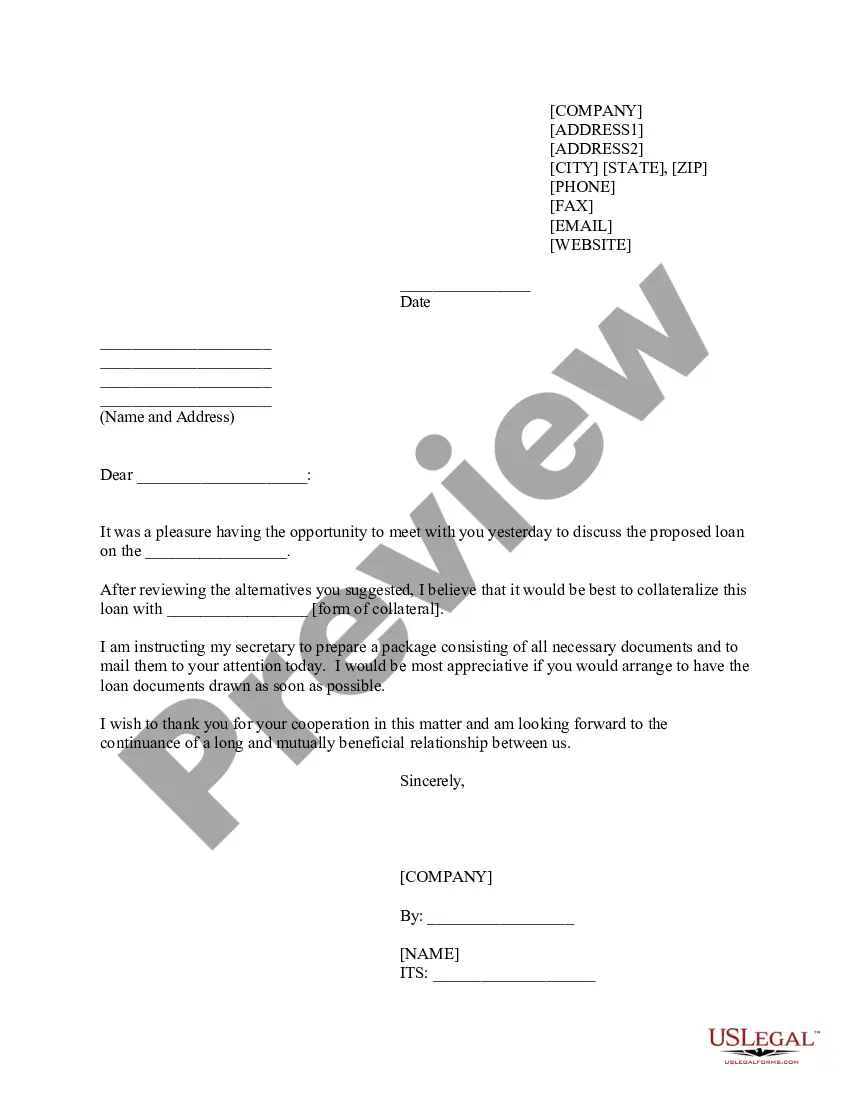

Virginia Sample Letter for Notice of Objection to Secure Claim

Description

How to fill out Sample Letter For Notice Of Objection To Secure Claim?

If you wish to complete, acquire, or produce legitimate document templates, use US Legal Forms, the largest assortment of legitimate types, which can be found on the web. Make use of the site`s simple and handy research to discover the paperwork you need. A variety of templates for business and personal purposes are categorized by groups and claims, or keywords. Use US Legal Forms to discover the Virginia Sample Letter for Notice of Objection to Secure Claim in a number of mouse clicks.

When you are presently a US Legal Forms buyer, log in to the bank account and click the Acquire button to have the Virginia Sample Letter for Notice of Objection to Secure Claim. Also you can access types you previously downloaded within the My Forms tab of your own bank account.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Ensure you have chosen the shape for your appropriate town/land.

- Step 2. Use the Review method to look over the form`s articles. Don`t overlook to read through the explanation.

- Step 3. When you are unhappy with the form, use the Search field at the top of the monitor to discover other versions of the legitimate form template.

- Step 4. Upon having discovered the shape you need, click on the Buy now button. Choose the prices program you favor and include your credentials to sign up on an bank account.

- Step 5. Process the deal. You can use your credit card or PayPal bank account to complete the deal.

- Step 6. Pick the formatting of the legitimate form and acquire it on the device.

- Step 7. Total, revise and produce or indicator the Virginia Sample Letter for Notice of Objection to Secure Claim.

Every single legitimate document template you get is your own eternally. You may have acces to every single form you downloaded in your acccount. Click the My Forms portion and decide on a form to produce or acquire again.

Contend and acquire, and produce the Virginia Sample Letter for Notice of Objection to Secure Claim with US Legal Forms. There are thousands of specialist and state-specific types you may use for your business or personal needs.

Form popularity

FAQ

You must get a court hearing on or before the return date to object to the garnishment. At the hearing, you have a chance to explain why the money can't be garnished. If the Judge agrees, the money is released to you.

Civil case appeals from the judgments of the Court must be noted in writing within ten calendar days and must be perfected within thirty calendar days from the date of the judgment by posting the bond (includes bond amount plus court costs plus attorney fees), paying the writ tax and circuit court notice fee, and ...

If a levy is placed on your property, the judgment-creditor can ask the Sheriff to take it and sell it. You then would receive a notice of sale. If a levy is placed on exempt property, you should object right away. You do this by filing a Motion to Quash Levy with the court that issued the levy.

§ 34-29. Maximum portion of disposable earnings subject to garnishment. (2) The amount by which his disposable earnings for that week exceed 40 times the federal minimum hourly wage prescribed by 29 U.S.C.

One way is by filing for bankruptcy, which will stop all garnishments and other collection efforts. The other way is by filing for an exemption, which will exempt you from garnishment but not bankruptcy.

Va. Code § 16.1-106.1. Once the appeal has been perfected by posting a required appeal bond or by payment of the costs, or after ten days have elapsed since the entry of the judgment or order when no appeal bond or costs are required to perfect the appeal, any withdrawal of the appeal must occur in Circuit Court.

Homestead exemption of $5,000, or $10,000 if the debtor is 65 years of age or older, in cash, and, in addition, real or personal property used as the principal residence of the householder or the householder's dependents not exceeding $25,000 in value (§ 34-4, Code of Virginia).

You must get a court hearing on or before the return date to object to the garnishment. At the hearing, you have a chance to explain why the money can't be garnished. If the Judge agrees, the money is released to you.